This company’s punchy expansion plans are built on solid foundations

A positive first-quarter trading update last month from Whitbread (WTB) looks to reinforce the investment case for the Premier Inn-owner and restaurateur.

Market share gains, strong pricing and the long-term upside in Germany all suggest the stock is capable of delivering both capital appreciation and dividend growth over the long term, while near-term catalysts could come in the shape of asset disposals and the possible trade sale of a key rival.

The first-quarter statement noted continued strong trading, both in the UK and the fledgling German operations. Accommodation revenues rose 16% year-on-year on a like-for-like basis and food and beverage rose 10%.

Pricing power is a politically touchy subject at the moment, but firms that have it are usually highly prized by investors and right now Whitbread’s well-tended estate of rooms in its target mid-scale and economy arena is attracting custom.

As a result, revenue per available room (RevPAR) in the UK, at £64.59, is up 16% on the equivalent period a year and 40% on the pre-pandemic first-quarter of 2019.

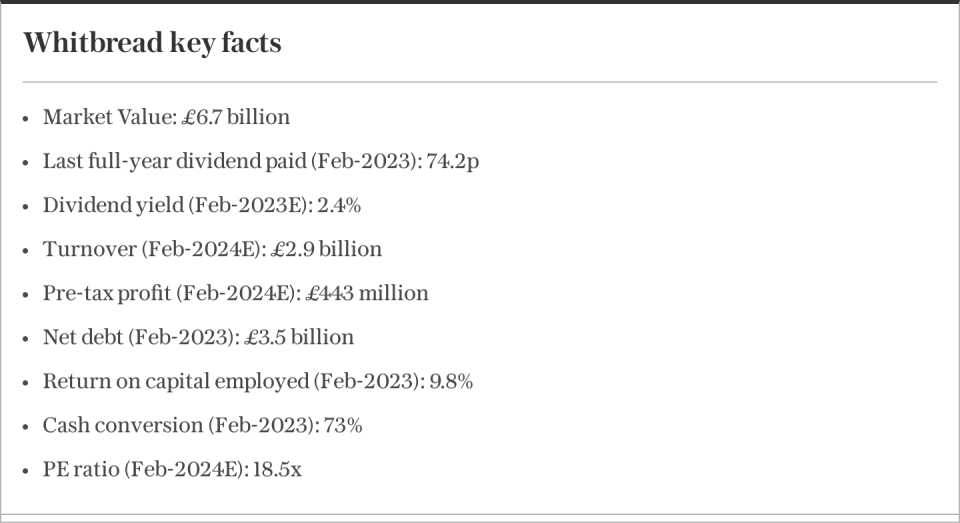

This should help the £6.7 billion cap company combat the impact of higher input costs in the form of wages, utility bills and supplies of food and drink, while the plan to add another 1,500 to 2,000 rooms to the existing UK estate of 89,000 in the year to February 2024 should help Whitbread to also take market share.

Meanwhile, the roll-out of Premier Inn in Germany continues to gain traction. A 55% surge in RevPAR, coupled with an ongoing expansion plan, mean that first-quarter sales in the country are more than double those of last year in the same three-month period. Whitbread has 18 established hotels in Germany and 38 more recently opened ones.

The firm ended its last fiscal year with 9,000 rooms and has planned to add between 1,000 and 1,500 in this current year to February 2024.

This roll-out in Germany is bringing start-up losses. After £50 million last year, chief executive Dominic Paul is currently guiding to a trading deficit of £30 million to £40 million for the current fiscal year.

While scale and improved pricing should bring long-term benefits and turn the red ink into black, the near-term losses are weighing on the overall group numbers and that in turn means the valuation attributed to the stock is a little deceptive, even if analysts continue to upgrade their overall profit forecasts for the year to February 2024 and beyond.

Whitbread’s near-19 times forward earnings multiple is a big premium to the FTSE 100, which stands on nearer 11 to 12 times for 2023, but a successful ramp-up in Germany and ongoing progress in the UK could bring that rating rattling down, all other things being equal.

Investors may also get a chance to assess Whitbread’s valuation in another context, given rumours that the rival Travelodge business could be up for sale, with its owner, the US hedge fund GoldenTree, looking to get some £1.2 billion for the business. Any transaction could provide a useful valuation benchmark for Whitbread.

It will also be interesting to see if reports of a planned sale of nearly half of the pub and restaurant estates prove accurate. Whitbread runs the Beefeater and Brewers Fayre brands, among others, and they receive little or no comment in the company’s most recent result or outlook statements.

Shareholders would be likely to welcome such a sale, as it would permit Whitbread to focus its capital allocation upon the Premier Inn operations at home and abroad and perhaps facilitate further cash returns too. The balance sheet bears relatively little financial debt and there is a pension surplus.

There are £4 billion of lease liabilities on the balance sheet, and they must not be neglected by any means, but the company is currently running a £300 million share buyback and analysts expect a healthy increase in the dividend for this fiscal year. Disposal proceeds would only serve to buttress such a solid picture.

This is not to say Whitbread is without its risks. An ongoing squeeze on consumers’ pockets in the UK and Germany from the fiendish combination of lofty inflation and higher interest rates (and thus mortgages and credit cards) could ultimately take its toll on confidence thus and spending on holidays and mini-breaks.

Even if there is no sign of it yet, the current travel boom could be a defiant farewell to the pandemic and lockdowns, a final hurrah before horns are pulled in and discretionary spending trimmed.

The next scheduled news from the FTSE 100 constituent is the first-half results statement on Wednesday 18 October.

Questor says: Whitbread looks like a long-term winner

Ticker: WTB

Share price at close: £34.01

Russ Mould is investment director at AJ Bell, the stockbroker

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 6am.

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance