Compelling Reasons to Retain MarketAxess (MKTX) Stock Now

MarketAxess Holdings Inc. MKTX benefits from solid commission revenues, acquisitions and collaborations, a well-established international business and solid cash reserves.

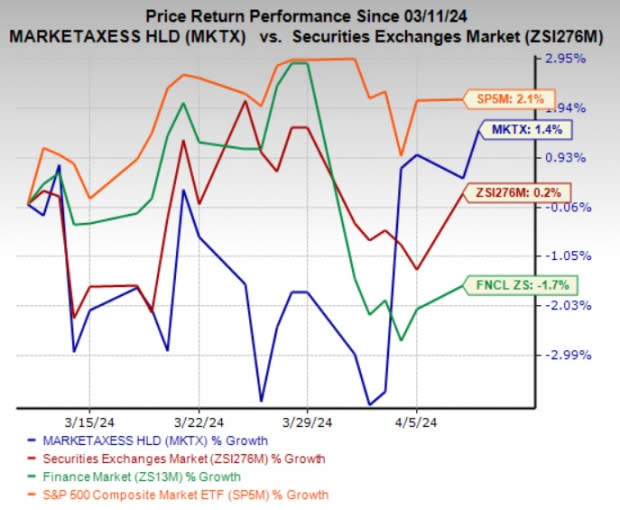

Zacks Rank & Price Performance

MarketAxess carries a Zacks Rank #3 (Hold) at present.

The stock has gained 1.4% in the past month compared with the industry’s 0.2% growth. The Finance sector declined 1.7%, while the S&P 500 composite index increased 2.1% in the same time frame.

Image Source: Zacks Investment Research

Robust Growth Prospects

The Zacks Consensus Estimate for MarketAxess’ 2024 earnings is pegged at $7.24 per share, indicating a year-over-year improvement of 5.7% from the 2023 reported figure. The consensus mark for revenues is pegged at $833.8 million, implying a year-over-year increase of 10.8% from the 2023 figure.

The consensus estimate for 2025 earnings is pegged at $8.21 per share, suggesting a year-over-year increase of 13.3% from the consensus mark of 2024. The consensus estimate for 2025 revenues is pegged at $930.4 million, implying a year-over-year improvement of 11.6% from the consensus mark of 2024.

Decent Earnings Surprise History

MKTX’s earnings beat estimates in three of the trailing four quarters and missed the mark once, the average surprise being 2.96%.

Solid Return on Equity

The return on equity for MKTX is 21.8%, which is higher than the industry average of 13.1%. This substantiates the company’s efficiency in utilizing shareholders’ funds.

Business Tailwinds

Solid trading volumes continue to drive commissions, the most significant contributor to the revenues of MarketAxess. The top line has witnessed consistent growth for more than a decade, which seems commendable. Commissions grew 3.4% year over year in 2023, while its average daily volume came in at $31.2 billion.

The leading electronic platform operator benefits from a diversified product suite comprising the U.S. High Grade, U.S. High Yield, Eurobonds, Emerging Markets and Municipal Bonds, therefore fetching a steady stream of revenues. Management keeps a keen eye on grabbing additional market share in the core credit markets. To complement, the company launched a new trading platform, X-Pro, in 2023.

MarketAxess resorts to buyouts and collaborations for strengthening its product portfolio, delving into new markets and bolstering its market reach across the fixed income markets. Its Open Trading platform enables price improvement for clients, mitigates risk in fixed-income markets and results in reduced transaction costs. In 2023, MKTX estimates that utilization of the abovementioned platform brought a price improvement of $701.9 million for its clients.

Apart from catering to its U.S. clients, MKTX also boasts an extensive international client base of more than 1,000 active firms that access its platform with the help of regulated venues in Europe, Asia and Latin America. In March 2024, it leveraged its Emerging Markets platform to support the first Casada trade carried out through the Request-for-Quote protocol, through which the company aims to enhance the available liquidity pool and offer higher trading opportunities for onshore LATAM and international investors trading in Brazilian debt instruments.

A solid financial stand is of utmost importance for pursuing uninterrupted growth-related initiatives and the financial strength of MarketAxess is substantiated by growing cash reserves and operating cash flows. As of Dec 31, 2023, its cash and cash equivalents improved 4.8% from the 2022-end level, while it generated net cash from operations worth $333.8 million in 2023.

Apart from business investments, solid cash flows enable MKTX to actively engage in share buybacks and dividend payments. Management approved a 2.8% increase in the quarterly cash dividend in January 2024.

Stocks to Consider

Some better-ranked stocks in the Finance space are Regional Management Corp. RM, Federal Agricultural Mortgage Corporation AGM and First Citizens BancShares, Inc. FCNCA. While Regional Management sports a Zacks Rank #1 (Strong Buy), Federal Agricultural Mortgage and First Citizens BancShares carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Regional Management’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 41.16%. The Zacks Consensus Estimate for RM’s 2024 earnings suggests a rise of 35.7%, while the consensus mark for revenues suggests growth of 5.7% from the corresponding year-ago figures. The consensus mark for RM’s 2024 earnings has moved 11.8% north in the past 60 days.

The bottom line of Federal Agricultural Mortgage beat estimates in each of the trailing four quarters, the average surprise being 15.24%. The Zacks Consensus Estimate for AGM’s 2024 earnings suggests an improvement of 8.6%, while the consensus mark for revenues suggests growth of 8.9% from the corresponding year-ago figures. The consensus mark for AGM’s 2024 earnings has moved 3.3% north in the past 60 days.

First Citizens BancShares’ earnings outpaced estimates in two of the last four quarters and missed the mark twice, the average surprise being 5.30%. The Zacks Consensus Estimate for FCNCA’s 2024 earnings suggests an improvement of 2%, while the consensus mark for revenues suggests growth of 1.9% from the corresponding year-ago figures. The consensus mark for FCNCA’s 2024 earnings has moved 0.7% north in the past seven days.

Shares of Regional Management and First Citizens BancShares have gained 2.4% and 6.5%, respectively, in the past month. However, the Federal Agricultural Mortgage stock has lost 1.4% in the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Citizens BancShares, Inc. (FCNCA) : Free Stock Analysis Report

MarketAxess Holdings Inc. (MKTX) : Free Stock Analysis Report

Regional Management Corp. (RM) : Free Stock Analysis Report

Federal Agricultural Mortgage Corporation (AGM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance