Computershare Leads Trio of Premier Australian Dividend Stocks

Amid fluctuating market conditions, Australian shares experienced a downturn, influenced by global economic factors and shifts in investor expectations regarding interest rate movements. This backdrop sets the stage for an exploration of dividend stocks, where stability and consistent returns become particularly appealing in uncertain times.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Computershare (ASX:CPU) | 3.00% | ★★★★★☆ |

Korvest (ASX:KOV) | 6.74% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.70% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.06% | ★★★★★☆ |

Joyce (ASX:JYC) | 8.07% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.61% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.40% | ★★★★★☆ |

Fortescue (ASX:FMG) | 8.23% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.36% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.18% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Computershare (ASX:CPU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Computershare Limited, operating in issuer services, employee share plans, voucher services, business communications, utilities technology, and mortgage and property rental sectors, has a market capitalization of A$15.58 billion.

Operations: Computershare Limited generates revenue through various segments, including issuer services with A$1.19 billion, communication services and utilities at A$330.42 million, employee share plans and voucher services contributing A$406.20 million, and mortgage services along with property rental services amounting to A$566.33 million.

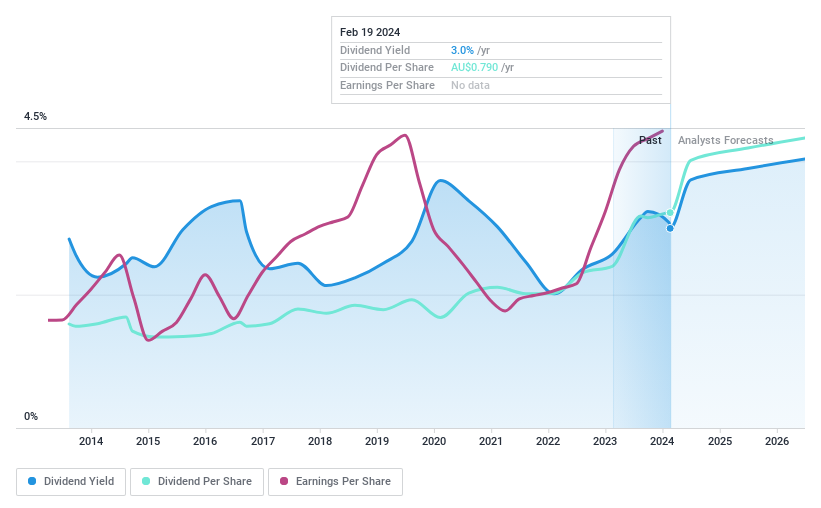

Dividend Yield: 3%

Computershare's recent appointment of Gerrard Schmid to its board underscores a strategic move towards enhancing governance and expertise, particularly in financial technology. The company announced an interim dividend of A$0.40 per share, reflecting a commitment to shareholder returns despite a challenging environment. Financial performance for H1 2024 shows resilience with sales reaching US$1.38 billion and net income at US$105.22 million, alongside earnings growth of 37.2% over the past year. However, Computershare faces challenges with a high level of debt but maintains dividend sustainability through a reasonable payout ratio (68.9%) and cash flows (Cash Payout Ratio 44.9%). Despite its dividends being lower than the top Australian dividend payers, Computershare has shown consistent dividend reliability and stability over the past decade, positioning it as an attractive option for investors seeking steady returns amidst uncertainty.

Delve into the full analysis dividend report here for a deeper understanding of Computershare.

Our valuation report here indicates Computershare may be undervalued.

New Hope (ASX:NHC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Corporation Limited is a company engaged in the exploration, development, production, and processing of coal, along with oil and gas properties, boasting a market capitalization of approximately A$3.96 billion.

Operations: New Hope Corporation Limited generates its revenue primarily from coal mining activities in New South Wales and Queensland, totaling approximately A$1.93 billion.

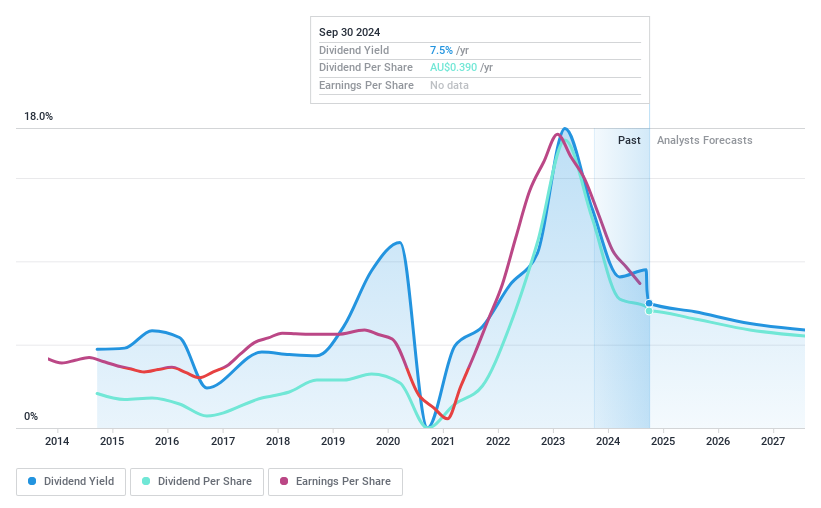

Dividend Yield: 9.2%

New Hope Corporation Limited's recent financials reveal a downturn, with sales and net income significantly reduced from the previous year, indicating potential challenges ahead. Despite this, the company has maintained its dividend attractiveness with a high yield of 9.23%, ranking it in the top tier of Australian dividend payers. However, concerns arise from its high cash payout ratio (90.2%) and forecasted earnings decline (12.9% per year over the next three years), questioning the sustainability of future dividends. Additionally, while trading at a considerable discount to fair value suggests good relative value, inconsistent dividend reliability and coverage by cash flows highlight risks for dividend-focused investors.

Navigate through the intricacies of New Hope with our comprehensive dividend report here.

Upon reviewing our latest valuation report, New Hope's share price might be too pessimistic.

Lycopodium (ASX:LYL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lycopodium Limited, operating in the resources, infrastructure, and industrial processes sectors, offers engineering and project delivery services with a market capitalization of A$466.95 million.

Operations: Lycopodium Limited generates revenue primarily from the process industries sector, amounting to A$11.85 million.

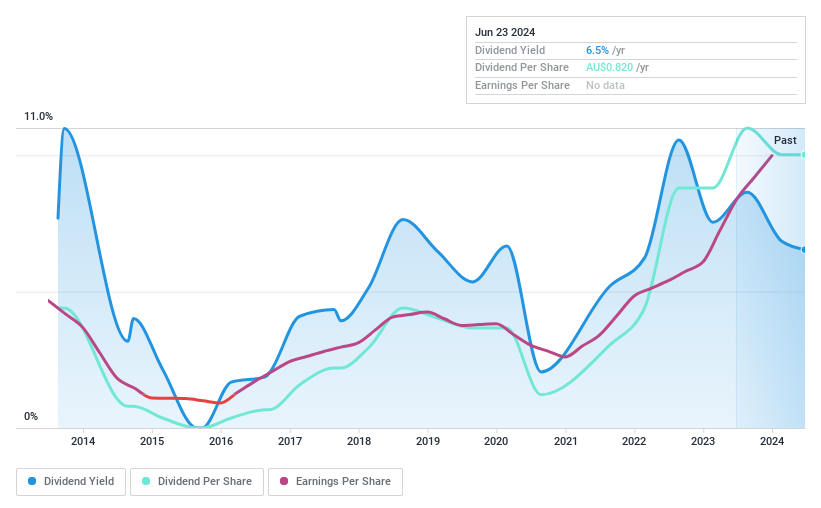

Dividend Yield: 7.1%

Lycopodium's recent performance and dividend metrics present a nuanced picture for investors. While the company boasts a notable dividend yield of 7.09%, positioning it above the Australian market average, concerns linger regarding its sustainability due to a high cash payout ratio of 244.7%. Despite earnings growth of 79.9% over the past year and reaffirmation of strong revenue guidance for 2024 at around A$345 million with an NPAT between A$46 million to A$50 million, volatility in dividend payments over the past decade and significant insider selling in the last three months may raise caution flags. Additionally, Lycopodium's trading at a discount suggests perceived value but juxtaposes against challenges in reliable dividend coverage by cash flows.

Make It Happen

Investigate our full lineup of 46 Top Dividend Stocks right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance