Comstock Resources (CRK) Drops 28.5% Post Q1 Earnings Report

Shares of Comstock Resources, Inc. CRK have declined more than 28% since first-quarter 2020 earnings announcement on May 6. Although the bottom line came ahead of the Zacks Consensus Estimate, investors are displeased with the company’s borrowing base reducedfrom $1.575 billion to $1.4 billion due to lower oil and natural gas price.

Let’s delve deeper.

Comstock delivered first-quarter 2020 adjusted net income per share of 12 cents, beating the consensus estimate of 6 cents. This outperformance is attributable to strong production. However, the figure declined 45.5% from the year-ago adjusted net income per share of 22 cents due to weak commodity price realizations.

Further, total revenues of $226 million came below the Zacks Consensus Estimate of $243 million. The top line, however, soared 78% year over year.

Production & Realized Prices

Production of oil and natural gas averaged 125.5 billion cubic feet equivalent (Bcfe), up 230.2% from the year-ago level, attributable to the Covey Park acquisition and strong returns from the company’s successful Haynesville shale drilling program. Natural gas output accounted for 97.8% of the company’s total production compared with 87.2% in the year-earlier quarter, primarily owing to the Covey Park buyout.

On third-quarter 2019 earnings call, management announced its takeover of a privately-held company with Haynesville shale properties. The transaction was carried out on Nov 1, 2019. Located in DeSoto Parish, LA, the acquired acreage consists of 3,000 net acres alongside 12.7 net future drilling locations. Per the terms of the all-stock deal, Comstock issued 4,500,000 shares of common stock. According to the company, the purchased oil and gas reserves are anticipated to own a capacity worth 89 Bcfe.

The average realized crude oil price in the quarter under review was $41.01 per barrel, down 9.55% from the year-ago realization of $45.34. The average realized natural gas price was $1.69 per thousand cubic feet compared with $2.72 in the same period last year.

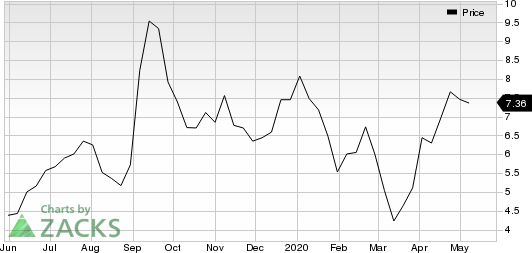

Comstock Resources, Inc. Price

Comstock Resources, Inc. price | Comstock Resources, Inc. Quote

Expenses

Total operating expenses in the first quarter summed $181.86 million, higher than the year-ago figure of $73.66 million, primarily due to increased lease operating and gathering & transportation expenses. Notably, the company’s lease operating costs rose to $28.7 million from $14.8 million a year ago. Moreover, Comstock’s gathering and transportation expenses ascended to $28.4 million. Depreciation and amortization expenses also climbed to $110.4 million.

Cash Flow, EBITDAX & Balance Sheet

Comstock’s operating cash flow was $156 million, surging 120.3% from the year-ago number of $70.8 million. Earnings before interest, taxes, depreciation, amortization and exploration (or EBITDAX) also soared handsomely. The metric skyrocketed 108% year over year to $201.6 million from $96.9 million a year ago.

As of Mar 31, the company had $15.5 million as cash and cash equivalents. Its long-term debt of $2507.3 million translated to a total debt to total capital of 68.1%.

Guidance

For 2020, Comstock forecasts capex of $412 million with its main focus on Haynesville shale.

Despite the reduced rig count and volatility in the natural gas prices, the company anticipates generating significant free cash flow in the $150-$200 million range in 2020.k

Zacks Rank & Performance of Other Energy Players

Comstock has a Zacks Rank #2 (Buy). Among other players in the energy sector that already reported first-quarter earnings, the bottom-line results of Cheniere Energy Inc. LNG, Murphy USA Inc. MUSA and Williams Companies Inc. WMB beat the respective Zacks Consensus Estimate by 204.3%, 4.3% and 4%. While Cheniere Energy and Williams Companies carry the same Zacks Rank as Comstock, Murphy sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comstock Resources, Inc. (CRK) : Free Stock Analysis Report

Williams Companies, Inc. The (WMB) : Free Stock Analysis Report

Cheniere Energy, Inc. (LNG) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance