Should You Be Concerned About Highlands Natural Resources plc’s (LON:HNR) Investors?

I am going to take a deep dive into Highlands Natural Resources plc’s (LSE:HNR) most recent ownership structure, not a frequent subject of discussion among individual investors. Ownership structure of a company has been found to affect share performance over time. Since the effect of an active institutional investor with a similar ownership as a passive pension-fund can be vastly different on a company’s corporate governance and accountability of shareholders, investors should take a closer look at HNR’s shareholder registry.

See our latest analysis for Highlands Natural Resources

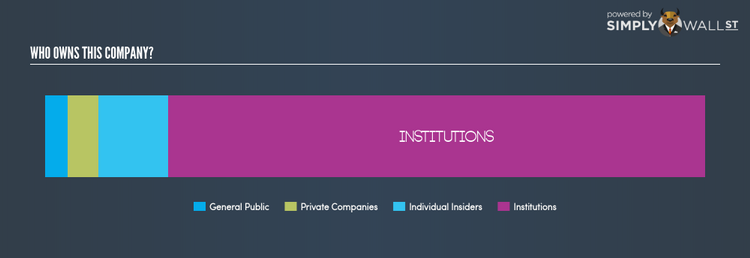

Institutional Ownership

With an institutional ownership of 81.24%, HNR can face volatile stock price movements if institutions execute block trades on the open market, more so, when there are relatively small amounts of shares available on the market to trade However, as not all institutions are alike, such high volatility events, especially in the short-term, have been more frequently linked to active market participants like hedge funds. For HNR shareholders, the potential of this type of share price volatility shouldn’t be as concerning as hedge fund ownership is is not significant,indicating few chances of such sudden price moves. While that hardly seems concerning, I will explore further into HNR’s ownership type to find out how it can affect the company’s investment profile.

Insider Ownership

I find insiders are another important group of stakeholders, who are directly involved in making key decisions related to the use of capital. In essence, insider ownership is more about the alignment of shareholders’ interests with the management. HNR insiders hold a significant stake of 10.56% in the company. This level of insider ownership has been found to have a negative impact on companies with consistently low PE ratios (underperformers), while it has been positive in the case of high PE ratio firms (outperformers). Another aspect of insider ownership is to learn about their recent transactions. Insiders buying company shares can be a positive indicator of future performance, but a selling decision can simply be driven by personal financial needs.

General Public Ownership

The general public, with 3.48% stake, is a relatively minor group of shareholders in HNR. This size of ownership may not be enough to sway a policy decision in their favour, but they can still make a collective impact on company policies if it aligns with other large shareholders.

Private Company Ownership

Another important group of owners for potential investors in HNR are private companies that hold a stake of 4.71% in HNR. These are companies that are mainly invested due to their strategic interests or are incentivized by reaping capital gains on investments their shareholdings. However, an ownership of this size may be relatively insignificant, meaning that these shareholders may not have the potential to influence HNR’s business strategy. Thus, investors not need worry too much about the consequences of these holdings.

Next Steps:

The company’s high institutional ownership makes margin of safety a very important consideration to existing investors since long bull and bear trends often emerge when these big-ticket investors see a change in long-term potential of the company. This is to avoid getting trapped in a sustained sell-off that is often observed in stocks with this level of institutional participation. However, ownership structure should not be the only determining factor when you’re building an investment thesis for HNR. Rather, you should be examining fundamental factors such as the intrinsic valuation, which is a key driver of Highlands Natural Resources’s share price. I urge you to complete your research by taking a look at the following:

Financial Health: Is HNR’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance