What Can We Conclude About Ibstock's (LON:IBST) CEO Pay?

This article will reflect on the compensation paid to Joe Hudson who has served as CEO of Ibstock plc (LON:IBST) since 2018. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Ibstock.

View our latest analysis for Ibstock

How Does Total Compensation For Joe Hudson Compare With Other Companies In The Industry?

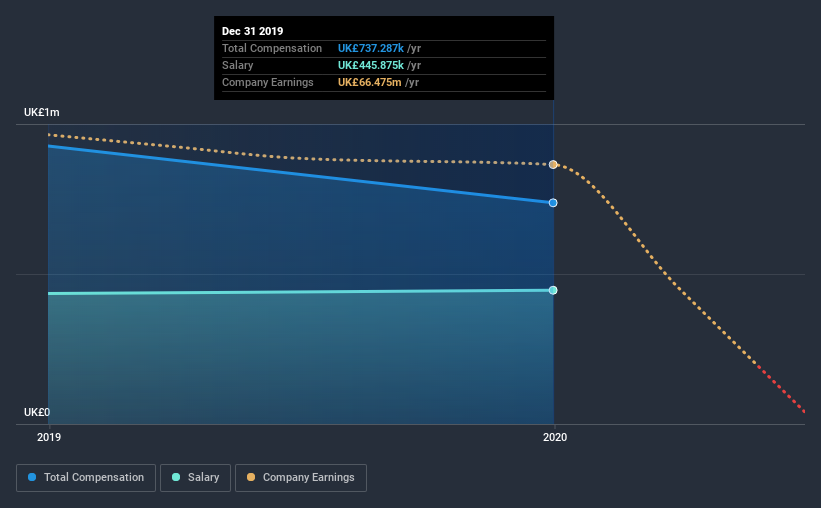

Our data indicates that Ibstock plc has a market capitalization of UK£734m, and total annual CEO compensation was reported as UK£737k for the year to December 2019. We note that's a decrease of 20% compared to last year. In particular, the salary of UK£445.9k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between UK£307m and UK£1.2b, we discovered that the median CEO total compensation of that group was UK£1.1m. Accordingly, Ibstock pays its CEO under the industry median.

Component | 2019 | 2018 | Proportion (2019) |

Salary | UK£446k | UK£435k | 60% |

Other | UK£291k | UK£492k | 40% |

Total Compensation | UK£737k | UK£927k | 100% |

On an industry level, around 40% of total compensation represents salary and 60% is other remuneration. It's interesting to note that Ibstock pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Ibstock plc's Growth Numbers

Ibstock plc has reduced its earnings per share by 35% a year over the last three years. It saw its revenue drop 16% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Ibstock plc Been A Good Investment?

With a three year total loss of 18% for the shareholders, Ibstock plc would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As we touched on above, Ibstock plc is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Over the last three years, shareholder returns have been downright disappointing, and EPSgrowth has been equally disappointing. Although we wouldn’t say CEO compensation is high, it’s tough to foresee shareholders warming up to thoughts of a bump anytime soon.

Shareholders may want to check for free if Ibstock insiders are buying or selling shares.

Important note: Ibstock is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance