What Can We Conclude About Universal's (NYSE:UVV) CEO Pay?

George Freeman has been the CEO of Universal Corporation (NYSE:UVV) since 2008, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Universal.

Check out our latest analysis for Universal

How Does Total Compensation For George Freeman Compare With Other Companies In The Industry?

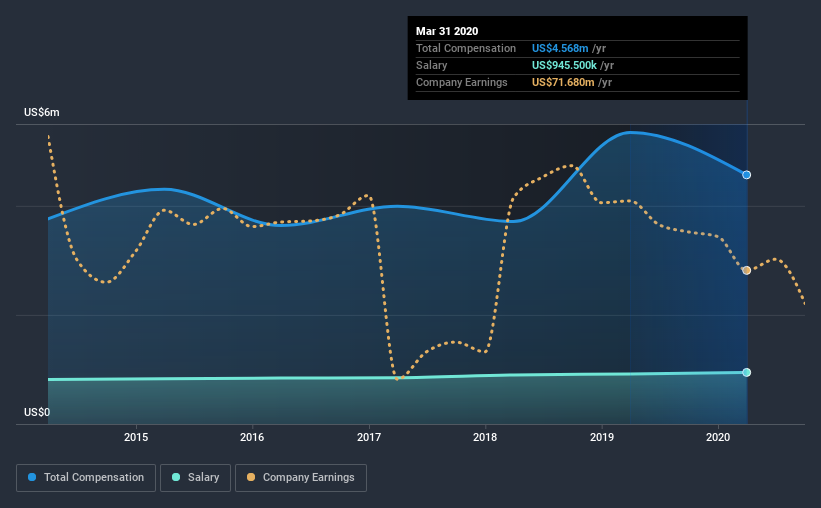

At the time of writing, our data shows that Universal Corporation has a market capitalization of US$1.3b, and reported total annual CEO compensation of US$4.6m for the year to March 2020. We note that's a decrease of 15% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$946k.

For comparison, other companies in the same industry with market capitalizations ranging between US$1.0b and US$3.2b had a median total CEO compensation of US$3.4m. Hence, we can conclude that George Freeman is remunerated higher than the industry median. Moreover, George Freeman also holds US$8.0m worth of Universal stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$946k | US$918k | 21% |

Other | US$3.6m | US$4.4m | 79% |

Total Compensation | US$4.6m | US$5.3m | 100% |

On an industry level, roughly 27% of total compensation represents salary and 73% is other remuneration. It's interesting to note that Universal allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Universal Corporation's Growth

Universal Corporation has seen its earnings per share (EPS) increase by 14% a year over the past three years. It saw its revenue drop 12% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Universal Corporation Been A Good Investment?

Universal Corporation has generated a total shareholder return of 12% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

As we touched on above, Universal Corporation is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, the EPS growth over three years is certainly impressive. Looking at the same time period, we think that the shareholder returns are respectable. While it may be worth researching further, we don't see a problem with the high CEO pay, given the good EPS growth.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 3 warning signs (and 1 which makes us a bit uncomfortable) in Universal we think you should know about.

Important note: Universal is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance