Conglomerates Q4 Earnings Worth a Watch This Week: GE, DHR, MMM

Market sentiments have been shaky of late, with the S&P 500 declining 8.5% in the past month. The NYSE and NASDAQ also fell 3.3% and 15.3%, respectively, in the same period. Although corporate results depict top-line strength, the same has failed to impress with its margins and profitability.

Results for 12.8% of the S&P 500 companies (released till Jan 21) reflect year-over-year growth of 22.9% in earnings and 13.6% in revenues for the fourth quarter of 2021. The increments are lower than the previous two quarters. Despite improved economic activities, cost inflation and supply-chain woes are believed to have played spoilsports in the quarter.

Earnings and revenue growth projections for the majority of the 16 Zacks sectors are lower than that for the third quarter of 2021. Here we have focused on the Zacks Conglomerates sector. It is currently ranked 14 out of 16 sectors. The said sector has dipped 6.2% in the past month.

Image Source: Zacks Investment Research

Per our Earnings Trends report, earnings of the conglomerates sector are predicted to increase 3.5% in the fourth quarter of 2021, suggesting a decline from a 22.9% increase recorded in the third quarter. Then again, the sector’s revenues are projected to inch up 0.4% and margins are anticipated to grow 0.3%. Notably, the company recorded 3.9% revenue growth and a 1.9% margin expansion in the third quarter.

A number of factors are likely to have influenced multi-sector companies in the fourth quarter. A brief discussion is provided below.

Factors Impacting Conglomerates

Sound economic activities in the United States and better manufacturing and international trade activities are expected to have been beneficial for many companies in the sector. Development of infrastructure, water resources, and clean-source of energy, as well as a surge in e-commerce businesses, are anticipated to have been other tailwinds.

On the flip side, corporate activities are likely to have suffered from cost inflationary pressures and woes from supply-chain limitations, especially related to the availability of semiconductor chips. Labor, logistics and raw material-related problems are expected to have affected the sector’s players. Restricted traveling in international locations is anticipated to have been dragging for companies with exposure in the commercial aviation market. Then again, the pandemic-related measures are likely to have been affecting the players.

Three Releases to Watch for This Week

Three S&P 500 conglomerate companies are slated to release their results for the fourth quarter of 2021 this week.

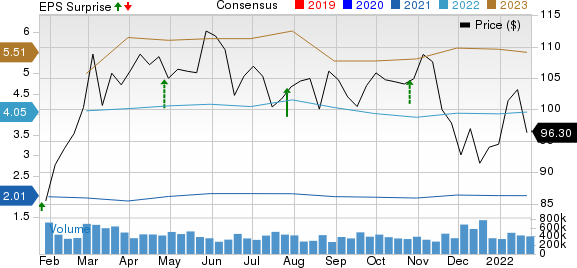

General Electric Company GE will release fourth-quarter results on Jan 25, before market open. The company reported better-than-expected results in three of the last four quarters, while posting in-line results once. It has a trailing four-quarter earnings surprise of 38.92%, on average.

General Electric Company Price, Consensus and EPS Surprise

General Electric Company price-consensus-eps-surprise-chart | General Electric Company Quote

Our proven model does not conclusively predict an earnings beat for General Electric this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of beating estimates. That is not exactly the case with General Electric. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Currently, General Electric has a Zacks Rank #4 and an Earnings ESP of -10.54%. The company is likely to have suffered from supply-chain restrictions, woes related to international operation, and weakness in the onshore wind markets in the United States and the military business. A sound digital business, buyouts, e-commerce strength, and focus on reducing debts are anticipated to have benefited. (For more information, please read: General Electric to Post Q4 Earnings: What to Expect?)

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for the company’s fourth-quarter earnings of 83 cents per share marks a 1.2% increase from the 60-day-ago figure.

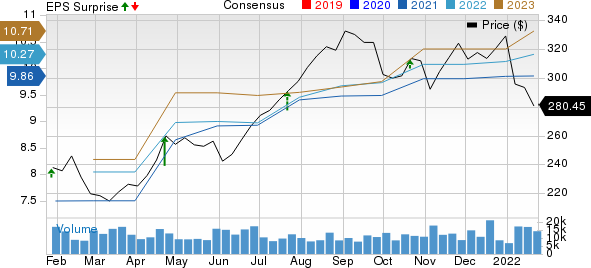

Danaher Corporation DHR will report fourth-quarter results on Jan 27, before market open. It recorded better-than-expected results in the last four quarters, the earnings surprise being 24.05%, on average.

Danaher Corporation Price, Consensus and EPS Surprise

Danaher Corporation price-consensus-eps-surprise-chart | Danaher Corporation Quote

Currently, Danaher has a Zacks Rank #2 and an Earnings ESP of -0.37%. The company is likely to have benefited from a healthy top-line performance, especially in the Diagnostics and Life Sciences segments. Supply-chain woes and cost inflation are expected to have been worrisome. (For more information, please read: Danaher to Report Q4 Earnings: What’s in the Offing?)

The Zacks Consensus Estimate for the company’s fourth-quarter earnings has been unchanged at $2.50 per share in the past 60 days.

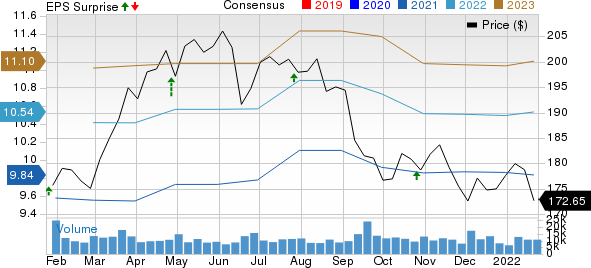

3M Company MMM is slated to release fourth-quarter results on Jan 25, before market open. In the last four quarters, the company recorded better-than-expected results. It has a trailing four-quarter earnings surprise of +14.82%, on average.

3M Company Price, Consensus and EPS Surprise

3M Company price-consensus-eps-surprise-chart | 3M Company Quote

Presently, the company has a Zacks Rank #3 and an Earnings ESP of 0.21%. It is expected to have benefited from solid product offerings, healthy demand, and solid operational execution. Personal safety, electronics, and home improvement markets are likely to have aided. Cost inflation and supply-chain restrictions are anticipated to have hurt. (For further information, please read: 3M to Report Q4 Earnings: Is a Beat in the Cards?)

In the past 60 days, the Zacks Consensus Estimate for the company’s quarterly earnings has been decreased by 1.9% to $2.03 per share.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

3M Company (MMM) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance