What will the consequences of the new Brexit white paper be for the UK economy?

The government has produced a white paper on the future trade arrangements it wants with the European Union after the transition ends in 2021.

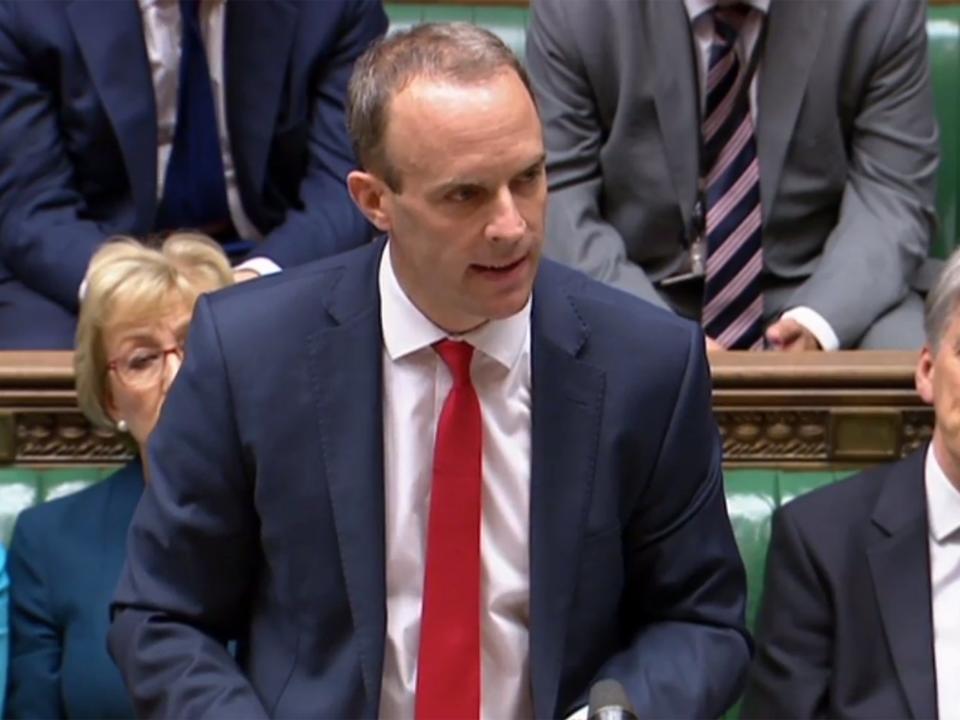

The document, presented in the House of Commons on Thursday by the new Brexit secretary Dominic Raab, fleshes out last week’s controversial Chequers document, which led to the resignations of cabinet members David Davis and Boris Johnson.

It’s far from clear whether the EU side will accept the plan.

But, if they did, what would the economic implications be for the UK?

What is in it?

From an economic perspective there are five major elements.

First, there is a proposal for a “common rulebook” for UK-EU goods trade to remove the need for time-consuming standards checks on products and industrial components when they cross the border. The UK also proposes to stay in the EU’s VAT regime for the similar reasons.

Second, there is a commitment to stay in the EU agencies that authorise things like chemicals, aviation and medicines – with the UK contributing to their running costs.

Third, there is a proposal of a “facilitated customs agreement”. This is a complex plan designed to let the UK remain in the EU customs union, while simultaneously forging its own new goods trade deals with other countries. The UK would collect tariffs on goods on behalf of the EU on goods bound for the continent that come through Britain. But it could also, supposedly, apply lower tariffs if certain goods were to stay in the UK, in some instances by rebating importing firms later.

Fourth, the document proposes “new arrangements” for digital and financial services trade between the UK and the EU.

Finally, it suggests a “new framework” for UK-EU immigration to replace the current freedom of movement for workers across the EU.

What will this do to the economy?

Some have suggested that it proposes a “soft Brexit”.

Under the white paper plan, manufacturers would still likely face some new frictions. But it will be far preferable from their perspective to severe customs delays entailed in leaving the VAT area and the regulatory coordination elements of the single market.

But the white paper plans is still very far from economically painless for the UK.

The document seeks to present exit from the single market for services as a benefit for the UK. But financial services are clear that the inevitable loss of the pan-EU “passport” to operate is damaging. The City of London Corporation described the document as “a real blow”.

As Jonathan Portes of King’s College London has argued in The Independent, the Chequers framework, in the government’s own previous modelling, comes somewhere between an European Economic Area-scenario and a Free Trade Agreement-scenario. That implies a cost of 3 per cent of GDP over 15 years. That’s equivalent to around £60bn in today’s money, or £2,300 per household.

And on immigration if the new “framework” delivers on the government’s pledge to “reduce net immigration” that’s also something likely to hold back UK productivity growth in the long term.

But will the Europeans agree in any case?

A giant, pendulous question mark hangs over this.

Will the EU be happy to waive through the vastly complicated and entirely hypothetical Downing Street customs proposal, even though it risks compromising the EU customs union if it fails?

Will they accept the end of free movement of labour into the UK? Or will they regard this as a cherry-picking exercise – the UK attempting to get the benefits of the regulatory single market without the responsibilities?

The EU might very well refuse and demand a commitment closer to EEA membership terms for the UK and a bog-standard customs union agreement in return for smoothing the Brexit economic impact.

Theresa May, already destabilised by this week’s resignations and backbench Conservative Party dissent, could easily find herself unable to deliver that.

With the clock rapidly ticking down to Brexit in March 2019, that could bring the prospect of an economically disastrous “no deal” scenario surging back into play.

Yahoo Finance

Yahoo Finance