Constellation Brands (STZ) Tops Q4 Earnings & Sales Estimates

Constellation Brands Inc. STZ has delivered stellar fourth-quarter fiscal 2020 results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate. With this, the company has reported earnings and sales beat for nine consecutive quarters. Results have been primarily aided by strength in the beer business and gains in the wine & spirits segment.

Driven by the robust results, shares of the company rose 2.1% in the pre-market trading session. In the past three months, shares of the Zacks Rank #4 (Sell) company have lost 31.1% compared with the industry’s 36.2% decline.

Q4 Highlights

Constellation Brands posted fiscal fourth-quarter comparable earnings of $2.06 per share, which increased 12% year over year and beat the Zacks Consensus Estimate of $1.62. The reported figure included Canopy Growth CGC equity loss of 12 cents. Excluding impacts of Canopy Growth, the company posted earnings of $2.18 per share, which grew 15% from the year-ago quarter.

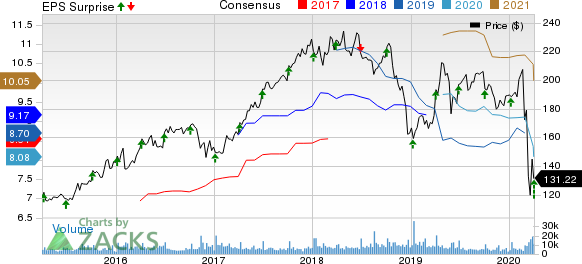

Constellation Brands Inc Price, Consensus and EPS Surprise

Constellation Brands Inc price-consensus-eps-surprise-chart | Constellation Brands Inc Quote

Net sales improved about 6% to $1,902.9 million and surpassed the Zacks Consensus Estimate of $1,839 million.

At the company’s beer business, sales improved 8.9% to $1,187.5 million, driven by a 7.2% rise in shipment volume and 10.8% overall depletion growth. Import beer depletion growth was 11.4%. Solid portfolio depletions and market share gains mainly stemmed from continued strength in the Modelo and Corona Brand Families. Notably, depletions for the Modelo Brand Family increased more than 18% along with 5% growth for the Corona Brand Family.

Sales at the wine and spirits segment rose 1.2% to $715.4 million in the fiscal fourth quarter. Further, organic net sales for the segment improved 3.7%. While the segment witnessed a 1.4% decline in shipment volume and a 0.6% fall in depletions, organic shipment volume rose 1.4%.

Margins

Adjusted gross profit grew 8% year over year to $971.7 million. Also, the adjusted gross profit margin expanded 110 basis points (bps) to 51.1%.

Constellation Brands' comparable operating income rose 2% to $598.7 million, while comparable operating margin improved nearly 110 bps to 31.5%.

Further, the operating margin at the beer segment contracted 120 bps to 39.3%, owing to increased marketing and SG&A expenses, offset by gains from favorable pricing and cost of goods sold. However, the wine and spirits segment’s operating margin expanded 120 bps to 28.9% on mix benefits and lower marketing and SG&A expenses.

Financial Position

Constellation Brands ended fiscal 2020 with cash and cash equivalents of $81.4 million. As of Feb 29, 2020, it had $11,210.8 million in long-term debt (excluding current maturities) along with total shareholders’ equity (excluding non-controlling interest) of $12,131.8 million.

In fiscal 2020, Constellation Brands generated operating cash flow of $2.6 billion and adjusted free cash flow of $1.8 billion.

On Apr 2, 2020, the company announced a quarterly dividend of 75 cents per share for Class A and 68 cents for Class B stock. The dividend is payable May 19 to its shareholders of record as of May 5.

Fiscal 2021 Outlook

Driven by the potential impacts of the coronavirus outbreak in the United States, the company states that it is not able to provide earnings per share guidance for fiscal 2021. However, it outlined some business expectations for fiscal 2021, before accounting the impacts of the COVID-19 outbreak.

For fiscal 2021, Constellation Brands estimates 7-8% net sales growth for the beer segment, including the effects of the Ballast Point divestiture. Organic net sales are anticipated to increase 8-10%, with operating margin of 39.5-40%.

Net sales and operating income for the wine and spirits business are estimated to decline 30-35%. Depletions for the retained Power Brand portfolio, after the divestiture transactions, are expected to increase 2-4%.

Further, the company expects interest expenses of $385-$395 million. Further, it anticipates tax rate of 18% and weighted average diluted shares outstanding of 195 million. The company expects no share repurchases in fiscal 2021. It expects to generate operating cash flow of $2.3-$2.5 billion for fiscal 2021.

2 Stocks to Consider From the Beverage Industry

Reeds, Inc. REED has an impressive long-term earnings growth rate of 20% and a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

National Beverage Corp. FIZZ, which currently carries a Zacks Rank #2, has delivered a positive earnings surprise of 2.9% in the trailing four quarters, on average.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Constellation Brands Inc (STZ) : Free Stock Analysis Report

National Beverage Corp. (FIZZ) : Free Stock Analysis Report

Reeds, Inc. (REED) : Free Stock Analysis Report

Canopy Growth Corporation (CGC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance