Consumers enjoy falling prices amid warning they will not last

Consumers enjoyed another month of falling shop prices in April amid warnings that international supply issues and rising food and oil costs mean they are unlikely to last.

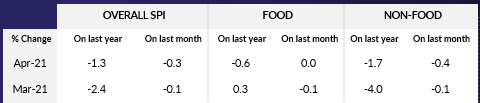

Prices fell by 1.3% in April compared with a year earlier, a slower decline than the 2.4% decrease seen in March and above the 12 and six-month average decreases of 1.8% and 2% respectively, according to the BRC-Nielsen Shop Price Index.

A decline in food prices compared with April last year was the result of fewer promotions during the first lockdown, when retailers tried to deter shoppers from stockpiling.

Food prices fell by 0.6%, down from a rise of 0.3% in March – the first time that food prices have been deflationary since January 2017.

Fresh food prices fell for the fifth consecutive month in April and accelerated to 1.5% in April from a decline of 0.8% in March.

Non-food deflation slowed significantly to 1.7% compared to a decline of 4% in March – the slowest rate of decline since January 2020 and above the 12 and six-month average drops of 3.4%.

Deflation continued as retailers discounted goods, particularly last season’s stock as they made way for the latest products ahead of re-opening.

However, some products, such as furniture, saw prices generally rise due to the combination of high demand and disruption to global supply chains.

British Retail Consortium chief executive Helen Dickinson said: “Falling prices are unlikely to last. In the months ahead retailers will have to battle the cost pressures from Brexit red-tape, rising shipping costs due to international supply issues, as well as increasing global food and oil prices.

“As these costs filter through, retailers may be left with no option but to pass on some of these costs to consumers. The Government can help to relieve this pressure by ensuring that the new checks and documentation requirements this autumn avoid adding further friction to the import of goods.”

Mike Watkins, head of retailer and business insight at NielsenIQ, said: “With the economy reopening we will start to see a rebalancing of consumer spend and it’s good news that there is still shop price deflation.

“Looking ahead, with many households uncertain about their personal finances, if external cost pressures start to feed through then shoppers may become more price sensitive over the next few months, as lifestyles are adapted to a new normal.”

Yahoo Finance

Yahoo Finance