How Contrarian investors cashed in on the hidden appeal of Waterman

A takeover bid for the engineering consultancy Waterman saw the price of its shares leap today. At 140p-per-share, the agreed cash deal with Japan’s CTI Engineering represented an 85% premium on Waterman’s previous price.

While the deal is yet to be sealed (and there is always a risk it may fail), this development ought to be of interest to onlooking investors. That’s because it comes against the recent run of play for Waterman, whose shares have been generally out of favour and drifting for several months. It begs the question of whether this turn of events could have been predicted...

Since last summer, the market mood has been very much ‘risk on’ towards profitable, growing, small-caps like Waterman. Yet this micro-cap - valued at just £23 million before today’s price rise - failed to ride that wave despite having some appealing features.

Of course, it’s very easy to look for all the plus points after the unpredictable arrival of a takeover bid. But the fact is that for more than a year prior to last autumn, Waterman had one of the strongest combinations of high quality, appealing value and positive momentum in the market.

It was only when its momentum began to weaken last October that it slipped from what we call a Super Stock into classic Contrarian territory. It was still high quality and attractively valued - it was just that the market had got nervous about it.

A high quality micro cap on the cheap

Our small-cap specialists Graham and Paul have both written extensively about Waterman in the past. Overall, they’ve been upbeat about it. But part of the challenge in assessing this business is that it operates in a highly cyclical industry. Plus its small size makes it vulnerable to setbacks. This was arguably part of the reason why it has generally always looked cheap at first sight. Its sensitivity to problems means the market has been wary of bidding it too high.

In terms of balance sheet health, over the past 18 months Waterman has consistently scored well against the nine-point Piotroski F-Score - our ‘go to’ litmus test of financial improvement. And this has really underpinned its strong Quality Rank (the Quality component of Stockopedia’s StockRank).

Waterman is undeniably a low margin business. But importantly, the trends have been positive in recent years with operating margins and its return on capital employed both growing consistently. So there were signs of a more resilient and efficient business emerging here.

Another point is that Waterman has been paying - and substantially growing - its dividends to shareholders since 2012. It’s currently on a forecast yield of 6.1%.

How the market fell out of love with Waterman

From April 2015 to September 2016, Waterman’s business quality, its ‘cheapness’ and its positive price and earnings momentum planted it firmly in Super Stock territory, with a StockRank over 95. You can find out more about the StockRanks here.

But in October 2016, the momentum started to unravel when it undershot earnings expectations and analysts cut their forecasts. Together with the uncertainty of the EU referendum result, its price strength against the market turned negative. This was compounded in February when its interim results missed forecasts again.

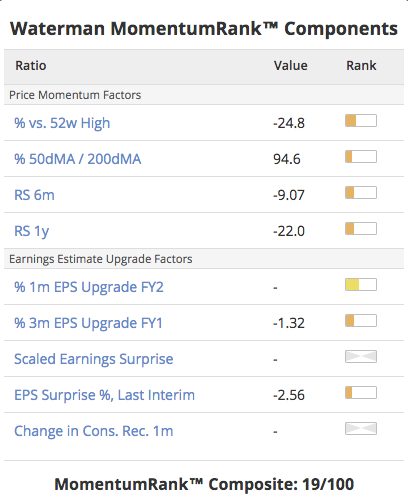

You can see from the Momentum Rank breakdown that Waterman’s momentum has been under pressure across the board.

Despite this decline in momentum, Waterman was falling from a position of strength. Its investment profile had changed but it was still reasonably well placed - and this is what investors really needed to know.

Last week Stockopedia released a new set of stock Classifications, which confirmed the profile of Waterman as a Contrarian play. Its high Quality and Value Ranks combined with a low Momentum Rank placed it in the realms of stocks that appeal to value investors who are prepared to wait for value to ‘out’.

In this case, the catalyst has been an M&A deal. For others, the market will take longer to push prices higher, while some will fail to recover. But even without a takeover, the two-factor exposure behind Contrarians means that they are statistically better placed, on average, to perform well over time. As you can see from this chart, they are one of the four winning investment styles.

With Waterman, we’ve seen how the transition from Super Stock to Contrarian can happen. Arguably, the company’s small size and almost non-existent research coverage meant that the market really hasn’t understood it that well. That meant its momentum was very susceptible when sentiment wobbled.

The good news for its Contrarian investors is that there appears to be a foreign suitor out there that also sees the value (assuming the deal goes through, which it may not). It was a similar story last year with Avesco - another Contrarian stock that went on to attract a premium price takeover. It’ll be interesting to see if we get any more.

If you’re interested in hunting for Contrarians like Waterman, you can get started in the StockRanks portal. From the menu, you can opt to select any investment style, market cap bracket, sector and RiskRating.

Read More about Waterman on Stockopedia

Discuss Waterman on Stockopedia

Yahoo Finance

Yahoo Finance