Cooper Tire's (CTB) Q4 Earnings, Revenues Miss Estimates

Cooper Tire & Rubber Co. CTB posted adjusted earnings of 50 cents per share in the fourth quarter of 2017, missing the Zacks Consensus Estimate of 62 cents.

Cooper Tire registered net sales of $757 million, missing the Zacks Consensus Estimate of $770 million in comparison with the year-ago revenues of $784 million.

Operating profit was $47 million in the fourth quarter of 2017, down 55.4% from the year-ago quarter.

Segment Details

Americas Tire Operations registered a 7.1% decrease in net sales to $645 million. Operating profit in this segment declined 47.8% to $61 million while operating margin decreased from 16.8% to 9.4%.

International Tire Operations registered a 30.5% rise in revenues to $162 million. Operating profit came in at $6 million, increasing from $1 million in the year-ago quarter. Operating margin rose to 3.7% from 1.1% in the year-ago quarter.

Financial Position

Cooper Tire had cash and cash equivalents of $371.7 million as of Dec 31, 2017, down from $504.4 million as of Dec 31, 2016. Capital expenditures increased to $54 million in the fourth quarter of 2017 from $49 million in the year-ago quarter.

Share Repurchases

In February 2017, Cooper Tire increased the share repurchase amount by $300 million and extended it til December 2019. During the fourth quarter of 2017, the company spent $20.7 million on repurchasing 576,242 shares at a price of $35.87 per share. Since August 2014 through Dec 31, 2017, Cooper Tire has brought back a total of 14.8 million shares at an average price of $34.42 per share.

Outlook

Cooper Tire expects operating margin for full-year 2018 to be at the low end of 9-11%. For 2018, capital expenditures are still expected between $215 and $235 million. The effective tax rate for the year is expected to be 23-26%.

Cooper Tire currently has a Zacks Rank #2 (Buy).

Some better-ranked companies in the auto space are General Motors Company GM, Daimler AG DDAIF and Lear Corp. LEA. While General Motors sports a Zacks Rank #1 (Strong Buy), both Daimler and Lear carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

General Motors has an expected long-term growth rate of 8.4%.

Daimler has an expected long-term growth rate of 5%.

Lear has an expected long-term growth rate of 7.1%.

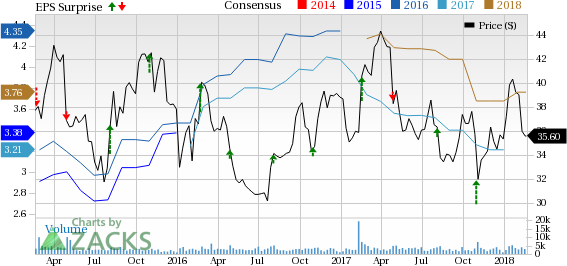

Cooper Tire & Rubber Company Price, Consensus and EPS Surprise

Cooper Tire & Rubber Company Price, Consensus and EPS Surprise | Cooper Tire & Rubber Company Quote

Can Hackers Put Money INTO Your Portfolio?

Earlier this month, credit bureau Equifax announced a massive data breach affecting 2 out of every 3 Americans. The cybersecurity industry is expanding quickly in response to this and similar events. But some stocks are better investments than others.

Zacks has just released Cybersecurity! An Investor’s Guide to help Zacks.com readers make the most of the $170 billion per year investment opportunity created by hackers and other threats. It reveals 4 stocks worth looking into right away.

Download the new report now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Motors Company (GM) : Free Stock Analysis Report

Daimler AG (DDAIF) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Cooper Tire & Rubber Company (CTB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance