Corn and Wheat Fall Hard After WASDE Report

The USDA WASDE report showed improvements in Wheat and Corn production expected for the marketing year 2019-2020.

The USDA released the WASDE report with its recalculations about US and global grain productions. Overall, farmers will be able to have more production than previously expected in the marketing year 2019-2020.

According to the United States Department of Agriculture, more acres and higher yields in a more healthier than anticipated grains season.

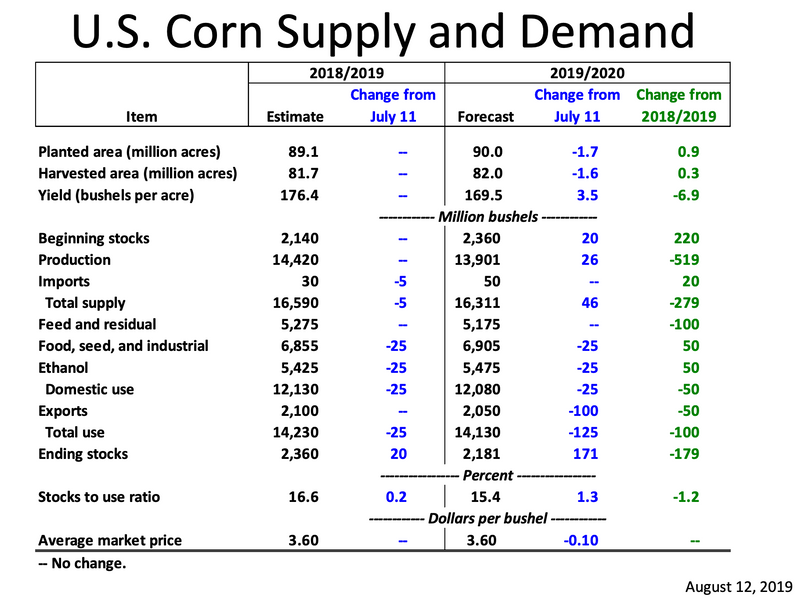

Corn production to break expectations

The WASDE report showed that corn season is healthy despite the heavy rains and extreme weather in the United States. According to the USDA, corn acreage will be 90 million acres in the US, with a yield of 169.5 bushels per acre. Well above the 87 million acres with a yield of 164.9 bushels per acre expected.

Global production will be higher also, as the WASDE report is anticipating 3.1 million tonnes more than it previously expected on July 11. The US production improved in 700,000 more tonnes.

Corn trades below 4.00 level

In that framework, corn prices collapsed on Monday with the unit falling below the 4.00 area, and it broke the August 1 minimum at 3.87 per bushel. Corn is now trading at 3.85 per bushel 6.1% lower in the day. On track to perform its worse day in six years.

Technical conditions and fundamental topics are now aligned to the downside. A better than expected corn season will put prices under pressure. The scoop is not for the downside.

Next supports are 3.80, 3.71, and 3.60. To the upside, the unit needs to close above the mentioned 3.87 to try to consolidate levels and then attempt for a recovery.

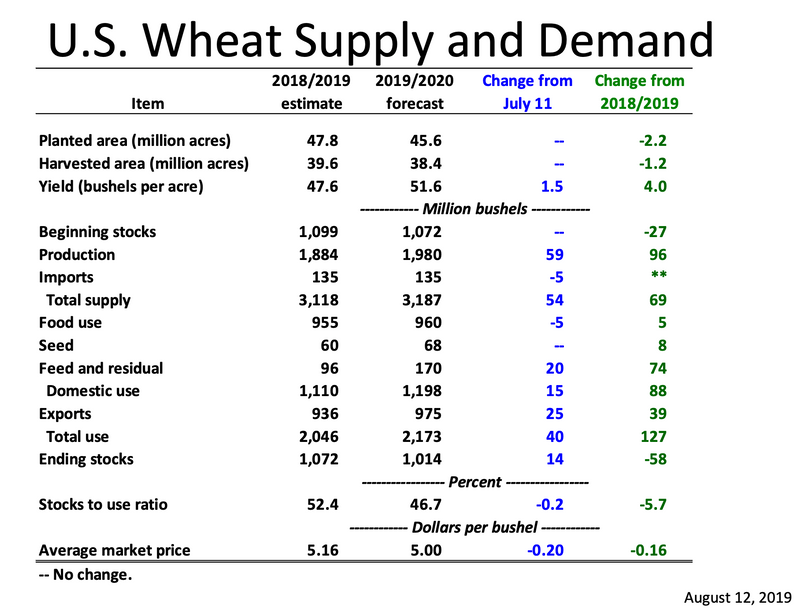

Wheat will have fewer acres but more yield

The planted area in the United States will be 45.6 million of acres according to the WASDE report, almost the same expected in the July 11 report. However, yields will be higher with a 51.5 bushels per acre in the new release, 1.5 more bushels than previously anticipated.

Wheat prices reacted to the downside after the release. The unit fell well below the 5.00 level, and it traded all the way down to 4.70. Below August 1 minimum of 4.71. Wheat is now trading 5.41% down at 4.72 per bushel.

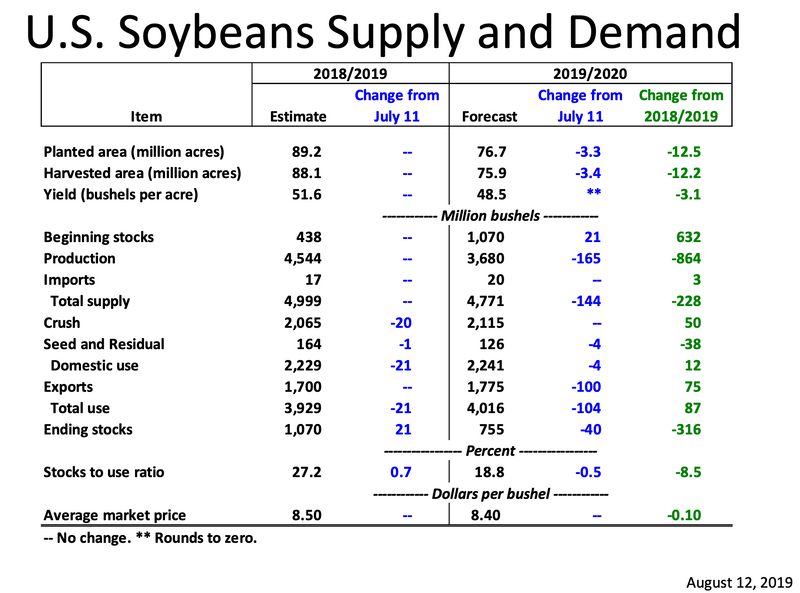

Global Soybean production down

Overall, the USDA is now expecting fewer soybean tonnes for the marketing year 2019-2020 than it previously anticipated in July.

In the United States, the planted area declined to 76.7 million acres, 3.3 million less than previously expected on July 11. Yield is also down with 48.5 bushels per acre, below 51.6 expected in July 11 report.

However, out of the United States, production of soybeans remains pretty much the same, with Brazil posting 6.0 million tonnes more than last year.

Soybean down on Monday

Soybean initially reacted down after the WASDE report, but the unit recovered losses quickly, and it is now trading above levels pre-WASDE. However, soybeans prices are trading negative on the day.

The oilseed fell to the $8.65 per bushel right after the report, and then it started recovery to current levels around 8.74, 0.57% down on Monday.

Technical conditions remain positive for the unit, but WASDE report digestion will have its say in soybean prices. To the upside, immediate resistance is at 8.82, followed by 8.95 and 9.00. To the downside, soybean buying zones are at 8.65, 8.44 and then 8.20.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance