Coronavirus: 80% of Brits will spend less in Christmas 2020

Eight-in-10 Brits will reduce their Christmas spending this year amid the coronavirus pandemic, new research by uk.investing.com has found.

Some 14% of respondents said they “won’t be able to purchase anything,” at all this Christmas, in the survey 2,147 people.

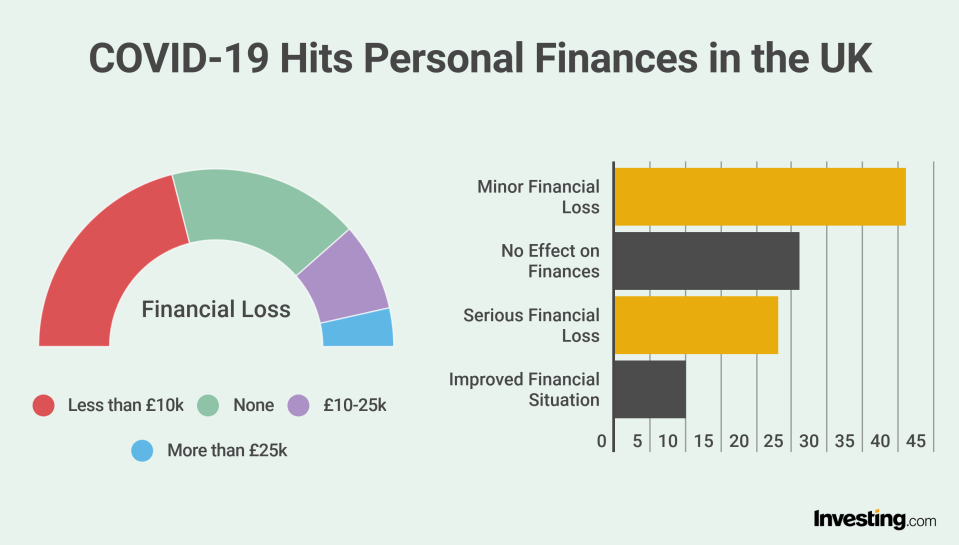

Almost two-thirds (64%) of Brits stated that the economic impact of the pandemic has resulted in some form of financial loss, with 23% describing their loss as “serious.”

While 58% said their losses amounted to less than £25,000, including 42% under £10,000, 7% of Brits were hit by a loss of more than £25,000.

As a result, 83% are spending less, including 48% who reported spending “much less.”

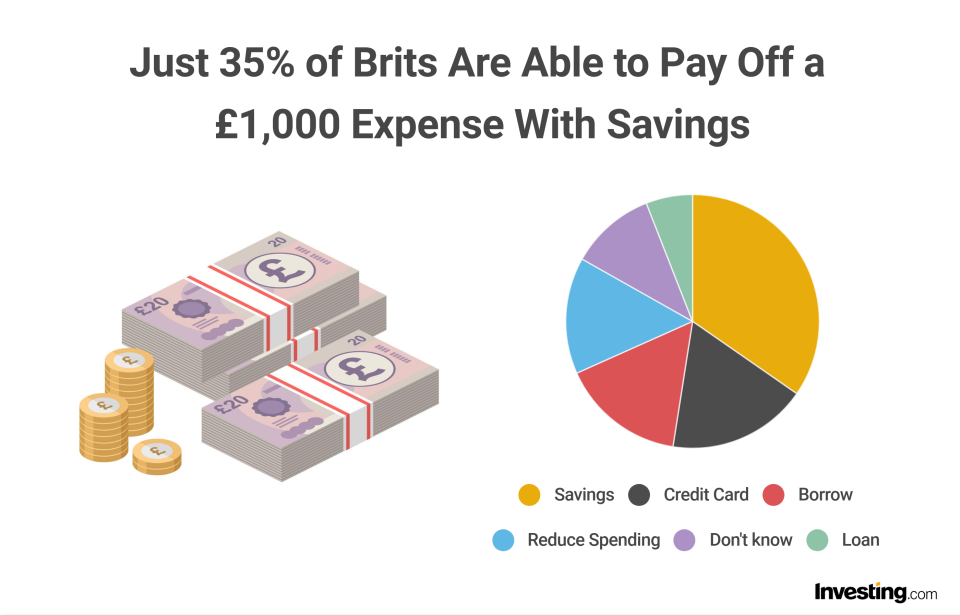

The ongoing financial instability caused by the pandemic was also reflected in Brits taking on debt rather than dipping into their savings for emergency expenses, with 18% saying they would take out a credit card and pay it off over time, 16% would borrow from friends or family, and 6% would take out a personal loan. Some 15% said they would reduce spending on other things.

Only 35% of Brits would currently pay off a £1,000 bill for an emergency from their savings, according to the survey.

This “indicates the long-term adverse impact of COVID-19 on Brits’ overall financial health, or at least their expectations of impending financial hardship,” according to the research.

Three-quarters (74%) said the financial implications of COVID-19 have made them more anxious, and 79% said they would be concerned about their finances for as long as the pandemic continues.

COVID-19-related job losses were one of the main reasons for financial instability, with UK unemployment rising at its fastest pace in more than a decade and redundancies surging to a record high between July and September. The unemployment rate reached 4.8% in the three months to September, up from 4.5% a month earlier, according to Office for National Statistics (ONS) figures.

READ MORE: Coronavirus sparks shift towards sustainable Christmas shopping

“The upcoming holiday season will likely be very different for families across the UK when compared to previous years,” said Jesse Cohen, senior analyst at uk.Investing.com.

“Not only will holiday gatherings be smaller, but the economic impact of the COVID-19 pandemic will mean that holiday shopping and spending on gifts is out of reach for many Britons this year.

“It seems evident that without additional stimulus support, the economy — and High Street retailers — will continue to struggle with the negative effects of the ongoing health crisis.”

WATCH: 10 ways to Brexit proof your finances

Yahoo Finance

Yahoo Finance