Coronavirus: UK government borrowing at highest in decades

UK government borrowing this year has hit its highest since records began in the early 1990s, as ministers ramped up spending to tackle the coronavirus crisis and tax receipts plummeted.

New official figures show the government borrowed £173.7bn ($222bn) between April and August, £146.9bn higher than a year earlier. It marked the highest since the Office for National Statistics began compiling the data in 1993.

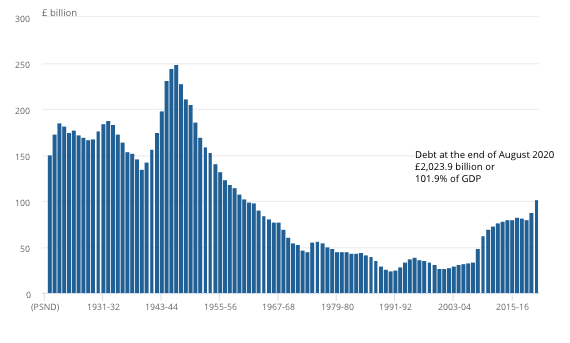

Total government debt stood at £2tn at the end of August, 1.9% bigger than the size of the entire UK economy's output and £249.5bn more than a year earlier. It marks the highest debt ratio since 1961, as GDP has also plummeted, shrinking at its steepest quarterly rate since records began earlier this year.

The government has been forced to issue new debt to cover the wide-ranging costs of the pandemic, from the furlough scheme and bailouts for rail firms to NHS preparations.

READ MORE: Rishi Sunak admits unemployment will rise despite ‘radical’ job support scheme

Borrowing has also propped up other spending with tax receipts plummeting, as many firms’ revenues have collapsed and many tax payments have also been deferred.

The Bank of England has been funding much of the government’s response by creating new money and buying up such debt, as it has significantly increased its quantitative easing (QE) programme as a result of the crisis. It has also cut interest rates to historic lows, keeping down borrowing costs.

The data published on Friday shows borrowing in August alone came in at £35.9bn ($45.82bn), the third highest in any month since records began in 1993. But it marked a lower total than expected in a Reuters poll of economists.

The Office for National Statistics (ONS) figures underline the scale of the fiscal hit taken by the government just as it rolls out further spending measures in a bid to shore up the economy.

The UK chancellor Rishi Sunak unveiled a “radical” new package of support for the UK economy on Thursday, including new income grant schemes, more business loan funds and hospitality tax cuts.

Sunak set out a string of contingency plans on Thursday to urgently safeguard jobs with both infection rates and job losses rising.

He warned there would eventually be “difficult decisions in the future” to bring public finances onto a more sustainable footing, but said the current priority had to be “throwing everything we have got at protecting people’s jobs.”

READ MORE: Coronavirus: UK government unveils ‘Winter Economy Plan’ to protect jobs and firms

Millions of workers are likely to be affected by the government’s “Winter Economy Plan,” with the new measures announced by the finance minister in parliament including:

A six-month “job support scheme” from November, with wage subsidies for workers in “viable” jobs, as long as they work and are paid as normal for at least a third of their usual hours.

New grants for self-employed workers until 30 April next year.

An extension of UK government business loan schemes, managed by banks.

Extended tax cuts for hospitality, hotels, holiday accommodation and some attractions.

Analysis by Capital Economics suggests the latest measures alone could cost around £5bn, including £3bn for the job support scheme.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, noted borrowing had picked up in August as the government paid out £4.7bn for self-employed income grants and £0.5bn for the Eat Out to Help Out scheme.

Meanwhile VAT cuts for hospitality knocked £3.7bn off tax receipts, but borrowing still came in lower than expected.

“Looking ahead, monthly borrowing will decline sharply, despite the further measures announced by the Chancellor yesterday,” added Tombs.

“The new job support scheme, which will see the state cover one-third of the wages of the regular hours that employees do not work if employers cover another third, is markedly less generous than the previous job retention scheme.”

Watch: UK online job ads at highest since March