Coronavirus: BP halves dividend as it swings to record $6.7bn loss

BP (BP.L) has halved its dividend as it swung to a record loss in the second quarter, predicting its oil and gas production will fall by at least one million barrels a day by 2030.

BP said in its second-quarter results published on Tuesday that it saw losses — on its preferred measure of underlying replacement cost — of $6.7bn (£5.1bn), compared to a profit of $2.8bn a year earlier, but broadly in line with analysts’ expectations.

BP put the losses down mainly to $6.5bn in post-tax write-offs on its oil and gas exploration assets, and pointed to lower current and expected prices, “very weak” refining margins, lower demand for fuels and lubricants, and BP’s changing strategy.

On a reported basis, it swung from a $1.8bn profit a year ago to $16.8bn of losses.

It also announced a new strategy as part of plans to reach net zero emissions, saying it would increase its annual investment in low-carbon energies tenfold within a decade, to around $5bn a year.

The oil and gas giant also said its dividend, popular with UK pension funds, will fall to $5.25 a share per quarter, marking the first cut in a decade.

BP had previously resisted cutting payouts to shareholders during the crisis, but its first cut in a decade is a sign of the severe strain on the company as the coronavirus has hammered demand and price forecasts for oil and gas.

It expects global oil demand to be up to nine million barrels of oil a day lower this year than in 2019, and said energy demand could remain weaker for a “sustained period.”

READ MORE: Shell posts £14.1bn loss as oil price crash forces write-down

Brent oil price forecasts have been revised down by 30% and Henry Hub gas prices by 16% over the next 10 years, compared to BP’s last annual report. BP assumes Brent will trade at $40 a barrel in the second half of this year, and be trading at $50 in 2025.

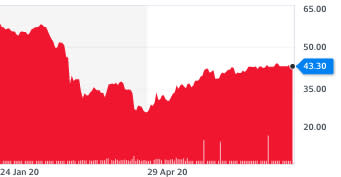

US benchmark Brent prices (BZ=F) were trading at $43.29 and West Texas Intermediate (WTI) crude (CL=F) prices were trading at $40.78 in New York at around 2.30am eastern time on Tuesday (7.30am in London).

Oil and gas production is expected to drop by 40% on last year’s levels by 2030, but BP aims to increase its net renewable generating capacity twentyfold by 2030.

The company had announced 10,000 job losses as part of a drastic cost-cutting plan in June, and predicted the coronavirus crisis would accelerate a shift towards greener energy.

“These headline results have been driven by another very challenging quarter, but also by the deliberate steps we have taken as we continue to reimagine energy and reinvent BP,” said CEO Bernard Looney.

READ MORE: BP to slash 10,000 jobs on slump in demand

"I want to acknowledge the impact the reset dividend will have on many - whether individual retail investors or large holders. However, it is a decision that we wholeheartedly believe is in the long-term interest of our stakeholders."

Shares in BP soared 7.5% on Tuesday despite the dividend cut and heavy losses, as the latter were marginally less than expected by analysts and the company’s trading income was strong.

“Even with the cut the dividend is still a quite healthy 5%,” said Michael Hewson, chief market analyst at CMC Markets UK.

“The decision to cut the dividend has been a long time coming, the only surprise it has taken a change of CEO and a huge slump in the oil price to shake the company out of its complacency.”

Last week rival Royal Dutch Shell (RDSB.L) posted $18.3bn (£14.1bn) of losses in the second quarter and record write-down in its asset values. The Anglo-Dutch company confirmed $16.8bn in post-tax impairment costs on Thursday.

But Shell’s adjusted earnings, which strip out such charges, were better than expected. It made $600m in the second quarter, down 82% year-on-year, when analysts had expected $674m losses.

The company announced earlier this year it would cut dividends for the first time since the Second World War and slash billions from planned spending to bring down costs.

Listen to the latest podcast from Yahoo Finance UK

Yahoo Finance

Yahoo Finance