Coronavirus: More than half of Britons wary of handling cash

More than half (51%) of UK adults say that they are now much less likely to use cash as a result of the pandemic, a new study shows.

Online bank Marcus by Goldman Sachs surveyed around 8,000 people in the UK and said “its findings suggest the pandemic has significantly impacted our attitudes towards cash, leading some to ask whether the pandemic has accelerated the shift towards a cashless society.”

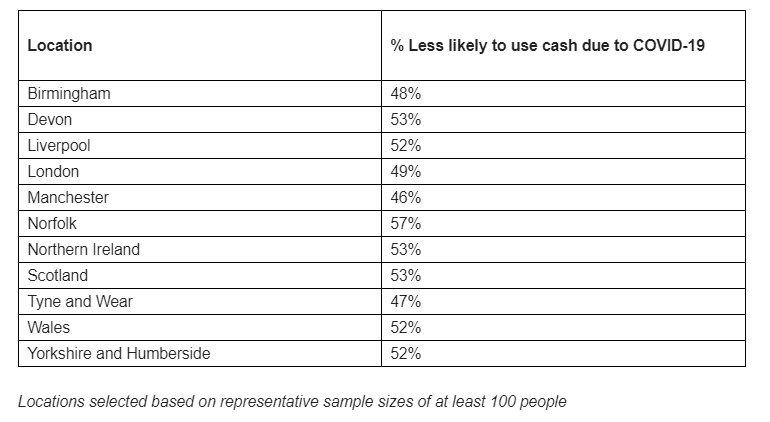

Geographically, the highest percentage (57%) of respondents likely to avoid cash was in Norfolk, while the lowest (46%) was in Manchester.

Some 32% of respondents said they are worried about hygiene when it comes to handling physical money. However, it is not just the virus that has put some off cash. Around 43% said having to go to an ATM to withdraw cash is “annoying”.

But according to Amanda Le Brocq, head of strategy at Marcus by Goldman Sachs in the UK, despite these reservations, “carrying cash is something that a significant minority of us feel is worthwhile regardless.”

“So, while our research demonstrates that many are less likely to use cash as a result of COVID-19, we may see the way we use cash change once again as society adapts to life in the pandemic. Rumours of a cashless society in the near future could well be exaggerated.”

Iona Bain, founder of the Young Money blog, had a different take on this. He said that with huge advances in fintech, plus hygiene concerns raised by COVID-19, “it’s hard to see how cash has a future.”

But he did say he wouldn’t write off cash just yet: “Many groups in society still depend on it, from small businesses to the elderly, and are keen that it survives. Plus, we instinctively grasp the value of money much more when it has a physical form.”

READ MORE: Fears grow for the end of free UK banking

The study showed that 61% agreed technology is making it easier to manage finances and 52% believed carrying cash helps them appreciate the real value of money.

The average amount of physical cash currently carried by UK adults is £36.30 ($48.2) but a quarter of respondents said they were carrying less than £5 in their wallet, according to the survey.

The report highlighted how demographic differences impact opinions on cash: Older generations are more likely to value and carry cash. For example, 41% of over 55s surveyed said they worry if they don’t have any cash on them, compared to 28% of 18-24 year olds.

Men are also more likely to carry more cash compared to women. Of those polled, men tended to hold an average of £41.89, versus £30.51 among women.

On the flip side, it was reported last month that around one in 10 people in the UK is holding more cash at home than before the coronavirus hit, according to Bank of England (BoE) analysis.

Sarah Jones, chief cashier and director of notes at the central bank, said cash was increasingly being both kept by individuals and firms as a “store of value,” as well as used for more informal person-to-person transactions.

Cash’s increased use as a store of value could explain the apparent “paradox” of growth in the number of notes in circulation both in the current crisis and in recent decades, when transactional use of cash has declined.

Jones said the trend had begun in the 1990s, but “accelerated” since COVID-19 hit.

Watch: Why can't governments just print more money?

Yahoo Finance

Yahoo Finance