Coronavirus: Barclays' profit falls 38% as it sets aside £2.1bn to cover COVID-19 losses

Barclays (BARC.L) has set aside £2.1bn ($2.6bn) to cover an expected surge in bad debts due to the coronavirus pandemic.

The bank said on Wednesday it had taken a £2.1bn credit impairment charge in the first quarter of 2020, more than double what analysts had expected and almost five times what Barclays booked for credit losses in the same quarter a year earlier.

Finance director Tushar Morzaria said £400m of the credit charge was based on loans that had already turned bad during the first quarter.

Chief executive James ‘Jes’ Staley told journalists the bank was taking a “very conservative posture” on the pandemic based on a “very harsh economic scenario”. Barclays’ modelling assumes an approximate 50% slump in UK and US GDP during the second quarter of 2020 and a surge in unemployment.

Joseph Dickerson and Aqil Taiyeb, banking analysts at Jefferies, said the provisions were “very credible and more like what we have seen at US peers than European ones”.

Read more: Barclays to donate £100m to COVID-19 charities

The provisions for lending losses came as Barclays reported a strong set of first quarter results. Group income rose 20% to £6.2bn, which was well above what analysts had expected.

Profit and revenue at Barclays’ commercial and investment bank beat forecasts. Staley said the bank’s markets business had a record quarter, as market volatility led to a surge in clients trading.

“Despite the macroeconomic downturn caused by the COVID-19 pandemic, the group’s position remains robust, reflecting our diversified business model,” Staley said in a statement.

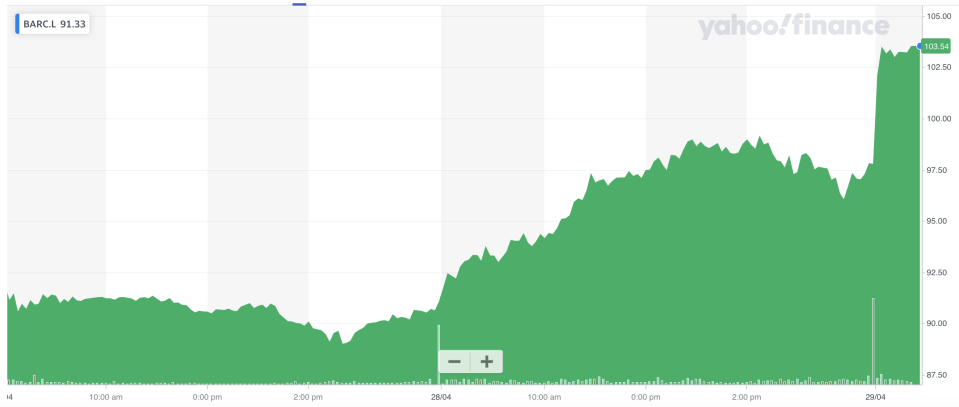

Shares in the bank jumped over 5% in London.

Pre-tax profit overall fell 38% to £913m in the first quarter, due to the higher-than-expected credit loss provision. Pre-tax profit was below what analysts had expected.

“The impact of COVID-19 came late in what was until that point a good quarter,” Staley said. “We have taken a £2.1bn credit impairment charge which reflects our initial estimates of the impact of the COVID-19 pandemic.”

Read more: Banks won't profit from COVID-19 crisis, industry group chief says

Return on tangible equity, a key measure of bank performance, fell to 5.1%. That was below analyst’s forecasts of 6.8% and well below the 9.2% recorded in the first quarter of 2019.

Barclays is targeting return on tangible equity of 10% in 2020. The bank said on Wednesday this would be “challenging” given the pandemic but “remains the right target for the group over time”.

Barclays said it lent over £737m to businesses under the government’s Coronavirus Business Interruption Loan scheme and has approved over 238,000 mortgage and loan payment holidays. More than six million Barclays customers and clients are now paying no fees on their personal overdraft or business bank accounts.

“An event like the COVID-19 pandemic makes everyone focus on what’s really important right now,” Staley said. “For us, that means running the bank safely and soundly, helping our customers and clients through the difficulties they face, supporting the UK economy and the communities where we live and work, and taking care of our colleagues around the world.”

Read more: Barclays waiving overdraft fees until end of April

Staley said he was “incredibly proud” of staff for working through this disruptive period.

“Operationally, it has been extraordinarily challenging to deliver services under very tough conditions and constraints, and those challenges look set to remain in the near term,” he said.

“Despite all the challenges we face as a consequence of COVID-19, I am confident Barclays will emerge from this pandemic, well placed to continue to serve our customers and clients, the communities and economies in which we operate, and our shareholders.”

Barclays provisions for credit losses come a day after HSBC (HSBA.L) set aside $3bn to cover expected bad debts linked to the coronavirus pandemic. Deutsche Bank (DBK.DE) and Credit Suisse (CS) have in recent weeks also set aside around €500m each to cover an expected spike in loan losses.

Yahoo Finance

Yahoo Finance