Piccadilly landlord sees value of property empire plummet by £945m

Land Securities (LAND.L), the FTSE 100 property company behind buildings like the famous Piccadilly advertising hoardings in London, has slumped to a half-year loss as the value of its buildings has dived.

The company said on Tuesday it made a pre-tax loss of £835m ($1bn) in the six months to 30 September. That compared to a loss of £147m in the same period a year earlier.

Mounting losses came as Land Securities slashed the value of its property empire by almost £1bn. The company said its property portfolio — which is mostly focused on London — was now worth £11.8bn, down £945m compared with a year earlier.

Land Securities owns office blocks, hotels, and high-quality retail space. The company said rental income was down 10% on last year.

Business has been hit hard by the COVID-19 pandemic, which has pushed many office workers to work from home and led to the intermittent closure of pubs and restaurants. International travel has also slowed to a crawl, denting business at its hotels.

Chief executive Mark Allen said the company remained “fundamentally strong” due to low levels of leverage and its high-quality assets. Allen said demand to invest in premium London office locations “remained robust”, adding that he was “optimistic about the future.”

Allen is focusing Land Securities on the London market, despite doubts about cities, and plans to invest in growing sectors and “sustainable” retail space.

Land Securities suspended its dividend in April but announced a half-year dividend of 12p per share on Tuesday. That was down almost 50% on last year.

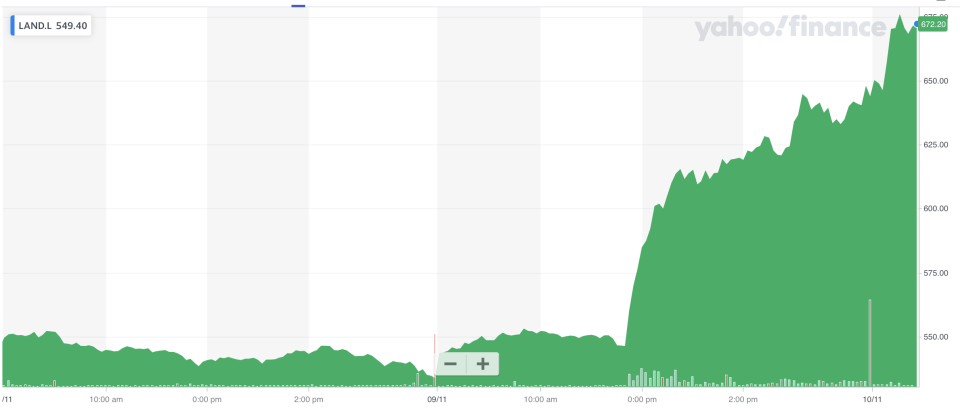

Despite the slump, the results weren’t as bad as some in the City had feared and Land Securities’ shares rose over 4% in early trade.

Watch: Why are house prices rising in a recession?

Yahoo Finance

Yahoo Finance