Coronavirus: England goes into second lockdown for one month

England is going into a second lockdown for one-month and the government will extend the furlough scheme to help protect jobs.

UK prime minister Boris Johnson, who was accompanied England's chief medical officer Professor Chris Whitty and the government's chief scientific adviser Sir Patrick Vallance, said at a press conference on Saturday, non-essential shops and hospitality will have to close, and travel will be under new restrictions, from Thursday and until 2 December. Schools and colleges will be allowed to stay open.

Johnson confirmed that the government will extend the furlough scheme to help protect jobs.

“We are going to extend the furlough system through November. We will extend further until December,” said Johnson.

“Christmas is going to be different this year, perhaps very different, but it’s my sincere hope and belief that by taking tough action, we can allow families across the country to be together.”

“We’re not going back to the full scale lockdown of March and April, the measures that I’ve outlined are far less primitive and less restrictive. Though, I’m afraid, from Thursday, the basic message is the same: Stay at home, protect the NHS, and save lives.”

On Saturday, the total number of coronavirus cases since the pandemic began hit 1,011,660.

“Across virtually the entire country now, there is a significant rate of increase,” warned Whitty. “Data from the Office National Statistics, which is the official data, shows that the prevalence of this disease has been going up, extremely rapidly over the last few weeks.”

“We now have around, 50,000, new cases a day, and that is rising.”

Watch: More than 1 million coronavirus cases in UK confirmed

Whitty added: “If we do nothing, the inevitable result will means these numbers will go up and they will eventually exceed the peak that we saw in spring of this year.

“We now have several hospitals with more inpatients with COVID than we had during the peak in the spring.”

Vallance also said that projection models show deaths will increase over the next six weeks, if nothing is done.

The announcement comes closely after the BBC reported seeing documents that show the UK was on course for a much higher death toll than during the first wave.

A study from Imperial College London and Ipsos Mori earlier revealed that the government’s efforts to curb the pandemic in England have not succeeded in reducing the spread of COVID-19, with infection rates doubling every nine days and an estimated 960,000 people carrying the virus in England on any one day.

The UK has been teetering on the edge of a full scale national lockdown for sometime as a growing number of regions fall into Tier 3 restrictions.

Scotland's new tiered system of restrictions will come into force at 06:00 on Monday while Wales remains under a 17-day "firebreak" lockdown until 9 November. Northern Ireland closed pubs and restaurants for four weeks and schools were also closed for two weeks.

How will it affect the economy?

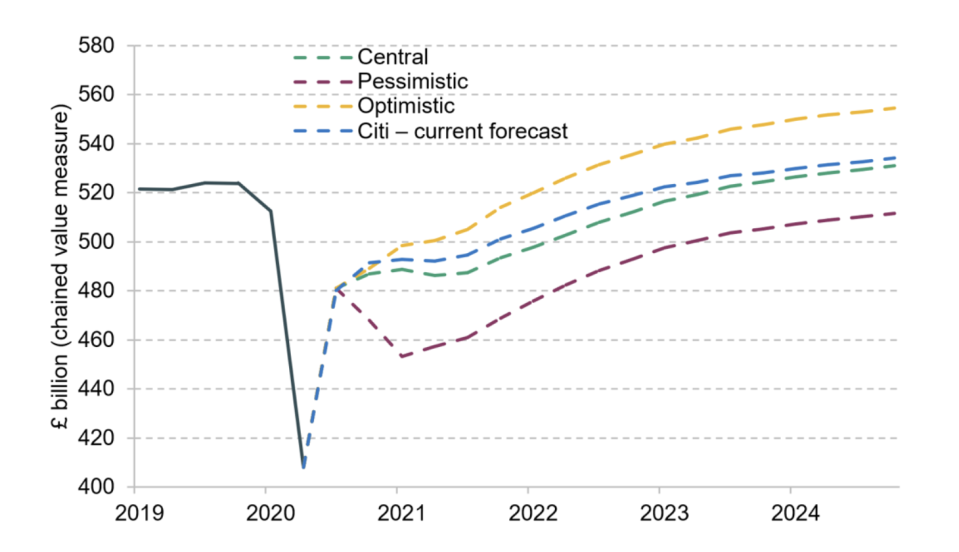

Prior to Saturday’s announcement, the Institute for Fiscal Studies (IFS) pointed out in a report published in October that “lockdown measures implemented in response to COVID-19 slashed nearly two decades of growth from the UK economy in March and April of this year.”

This has also resulted in huge job losses despite the implementation of the furlough scheme — where the government would pay for up to a certain percentage of employees wages as long as the company did not lay off that person.

In the UK, the unemployment rate surged to its highest level in over three years. Latest figures from the Office for National Statistics (ONS) show the unemployment rate grew to 4.5% in the three months to August, compared with 4.1% in the previous quarter.

Meanwhile, the Centre for Economic and Business Research (CEBR) said in a report last month UK employers are expected to slash 1.5 million jobs by Christmas.

The IFS said that while the economy has “rebounded strongly... we think this momentum is unlikely to last.”

At the end of October, purchasing managers’ index (PMI) data revealed how the UK economy is already losing steam as the resurgence of the coronavirus and rising restrictions hobble firms’ efforts to recover from the crisis.

READ MORE: Germany sets aside €10bn to compensate firms for November lockdown losses

Both the dominant services sector, which makes up around four-fifths of the economy from cafes to banks, and manufacturing saw growth slow this month.

“Households have a key role to play in the recovery: firm balance sheets are weakened by the outbreak and the external picture remains complicated by Brexit and by other countries’ experiences of the pandemic.

“Lingering virus unease and broader uncertainty seem set to weigh on demand in the second half of 2020. With these effects concentrated in labour-intensive sectors, substantial increases in unemployment risk propagating the economic downturn – especially given the dialling down of policy support. We expect output in 2020 Q4 to remain more than 6% below 2019 Q4 levels – a larger drop than the peak-to-trough fall during the financial crisis.”

With a second lockdown on the cards for the UK, it’s likely to have a greater impact and analysts will be releasing their revised forecasts over the coming month.

Prepare for a market rally

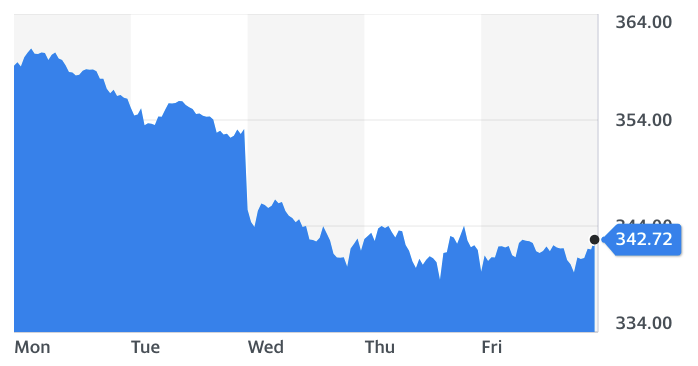

Markets have taken a beating this week as a number of Europe’s largest economies, such as Germany and France, placed its nations under tighter restrictions amid a second-wave of the COVID-19 pandemic.

The Europe-wide Stoxx 600 index (^STOXX) tumbled 5.6% this week.

The DAX (^GDAXI) lost 8.6% since trading began on Monday in Frankfurt. In Paris, the CAC 40 (^FCHI) lost 6.4% in the week.

READ MORE: The week the COVID-19 second wave hit stock markets

In the past month the FTSE 100 (^FTSE) — the leading benchmark for UK stocks — has slumped by more than 3% to below 5,600 points. It shed more than 4% this week alone.

Chancellor of Europe’s largest economy Germany warned that the country faces four long, hard winter months.

“We have to act, and act now,” chancellor Angela Merkel said announcing the lockdown on Thursday. “The curve must be flattened again.

“We are now at a point where, on average nationally, we no longer know where 75% of infections come from.”

However, the German government announced on the same day that it would spend up to €10bn (£9bn, $11.7bn) to compensate companies for lost revenue for four weeks.

Companies with up to 50 employees will receive up to 75% of revenue, based on what they made in the same month in 2019. Larger businesses will be compensated for up to 70% of their monthly revenue.

Three days ago, French President Emmanuel Macron announced a second national lockdown until at least the end of November, as daily deaths in France hit its highest level since April.

Next week will likely see a stock rally as investors assess how the lockdown will impact businesses and spending.

WATCH: What is a recession?

Yahoo Finance

Yahoo Finance