Coronavirus: UK households take on more debt after months of repayments

UK households borrowed more through credit cards and overdrafts than they paid off for the first time in four months in July.

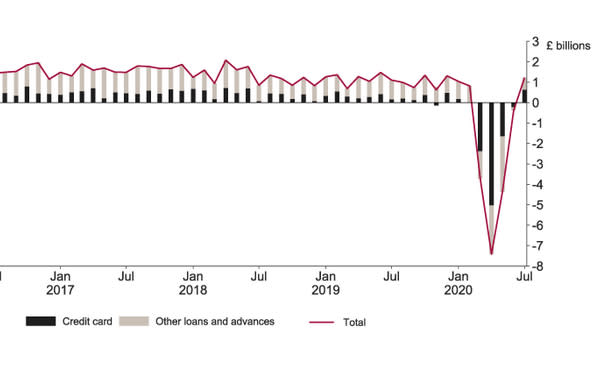

Lender survey data from the Bank of England showed on Tuesday showed that net consumer borrowing returned to “around its pre-COVID level” in July with households borrowing an additional £1.2bn ($1.6bn). That’s higher than the £1.1bn monthly average for the 18 months up to February this year.

Analysts said UK households showed a “return of big ticket purchases” and more normal spending habits after the coronavirus lockdown and recession reined in household borrowing earlier this year.

“Recovering consumer credit suggests that households’ appetite for big ticket purchases is returning,” said Andrew Wishart, UK economist at Capital Economics.

READ MORE: UK mortgage approvals soar 66% as stamp duty slashed

He described it as an “encouraging” sign for the UK’s wider recovery, with the much of the economy heavily reliant on consumer spending, despite campaigners’ concerns over household debt levels.

Pablo Shah, senior economist at the Centre for Economic and Business Research (CEBR), said it showed “some semblance of normality.”

He noted non-essential shops re-opened their doors in June and the hospitality sector re-opened in July in much of the UK after lockdown, which had “drastically curtailed” household spending opportunities.

Shah said lockdown may have built up a degree of pent-up demand for spending, and noted: “Looking towards the end of the year, borrowing is likely to come under renewed pressure, as the termination of the furlough scheme will likely be accompanied by a jump in unemployment.”

Gross borrowing and repayments also remain lower than pre-pandemic levels.

“Net repayments of £15.9bn between March and June meant that consumer credit shrank by 3.6% year-on-year in July. With the exception of June 2020, this is the sharpest pace of contraction on record,” noted Shah.

The concern over savings

When it comes to personal finances, analysts warn that Britons could be getting back into bad habits.

“When we threw open the doors in July, it blew the dust off our wallets, and loosened the purse strings,” said Sarah Coles, personal finance analyst, Hargreaves Lansdown.

“We didn’t go completely crazy: we still borrowed slightly less than before the crisis and saved slightly more because we’re still fairly nervous about getting out and about, and worried about what the future holds. However, we left many of our most stringent lockdown savings habits behind.

“However, there are some new habits we can’t afford to live without. We need to stay on top of our borrowing. Debt repayments took a hit during the crisis, and they’re still well below pre-crisis levels. If you are running up expensive debts, you need to get on top of your borrowing, draw up a budget, and work out how you’re going start paying things off. Don’t wait for debts to become problem debts before you make a plan to deal with them.”

As Britons have taken on more debt, savings are suffering. According to the BOE data on Tuesday, while savings did increase by £7bn in July, this is still well below from £11.7bn in June, and an average of £19.1bn between March and May.

“We also need a plan for our savings. New savings were always going to drop off after lockdown, but we still need them to be working as hard as possible. At the moment, the vast majority of new savings are going into easy access accounts – and rates on those accounts continue to fall,” said Coles.

“We should all have 3-6 months’ worth of savings in an easy access account, but we need to ensure our money is working as hard as possible.”

Yahoo Finance

Yahoo Finance