The coronavirus crisis has brought the EU’s failings into sharp relief

Europe is being ravaged by the coronavirus pandemic. There have been more than 10,000 deaths in Italy. In the grimmest of league tables, Spain comes second. Normal life has been suspended across the continent and the hit to the economy is immense. France’s output is running at two-thirds of what it was last year. Germany has abandoned fiscal rectitude and – along with the rest – adopted a “whatever it takes” approach.

Border controls have been erected to stop the flow of people even though this contravenes one of the founding principles of the single market. Rules on state aid to struggling companies have been relaxed. The European Central Bank has embarked on a gigantic asset purchase scheme in an attempt to flood the eurozone economy with cheap money.

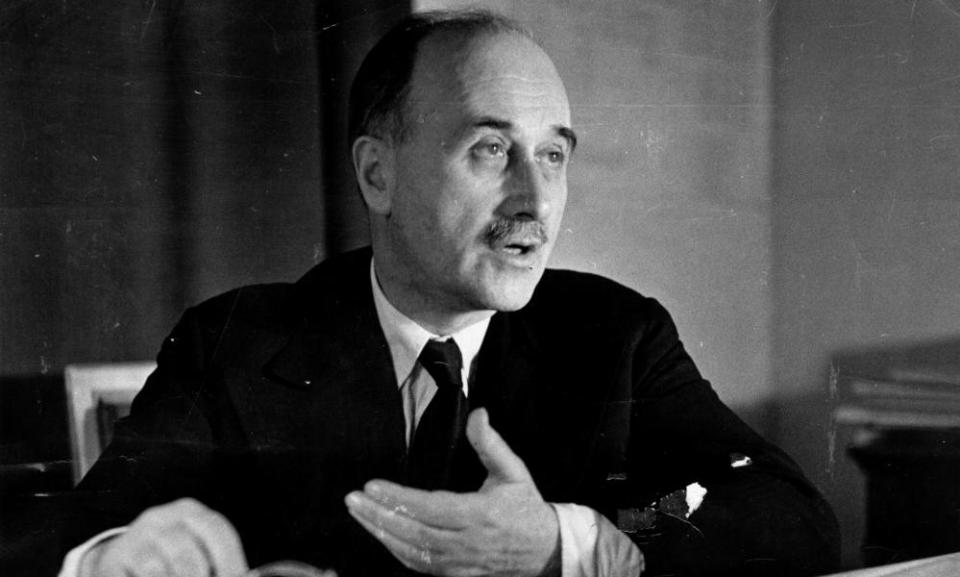

Jean Monnet, the driving force behind the creation of what was to become the European Union in the 1950s, said that Europe would be forged in crises, and Covid-19 clearly meets that criterion. The twin health-economic emergency is by far the worst crisis Europe has had to face since the signing of the Treaty of Rome in 1957: worse than the oil shock of the mid-1970s, worse than the banking meltdown of 2008.

That, though, was not the end of Monnet’s observation. He went on to say that the sort of Europe that would be forged would depend on the “solutions adopted for those crises”. And, in that respect, the signs have not been good.

If ever there was a time for the EU to act as one, for the richer countries to show solidarity with those less fortunate, then this is it. Yet when Italy pleaded for fellow countries to send it medical equipment such as masks, France and Germany not only failed to respond, they placed export bans (since lifted) on the export of the kit Italian hospitals were crying out for. In the end it was left to China to show EU how to respond to a country in dire need.

Another problem for Italy is that because of its slow growth and high levels of public debt it has to pay a higher rate of interest on the money the government borrows than is the case for Germany and, when the hospitals in the cities of Lombardy started to fill up with Covid-19 cases, this gap – or spread – started to widen. It was therefore deeply unhelpful for Christine Lagarde, the president of the ECB, to say that it was not the job of her institution to “close bond spreads”.

Lagarde, to her credit, quickly recanted and the ECB is now doing its utmost to help Italy and the wider eurozone economy. But the crisis has highlighted the weaknesses of the eurozone: the lack of coordination between monetary policy run by the ECB from Frankfurt and fiscal policy under the control of member states; the lack of a sizeable, single budget; the absence of financial tools that would make a collective approach easier.

Last week’s virtual meeting of EU leaders was supposed to come up with a joint approach to the crisis but was instead a complete car crash. One group of countries – including Italy, Spain and France – wanted the creation of corona bonds, which would be issued collectively by all eurozone countries.

The thinking behind a corona bond is simple. By pooling risk, hard-pressed countries such as Italy and Spain would benefit from the reputation for financial probity of countries like Germany and the Netherlands. Of the money raised, the lion’s share would go to the countries at greatest need and at lower rates of interest than they would have to pay if they were issuing their own national bonds.

Yet even in these quite exceptional circumstances, corona bonds proved to be a non-starter. Germany thought Italy should ask for assistance through the European Stability Mechanism, where the money comes with strings attached. Mark Rutte, the Dutch prime minister, said under no circumstances would he agree to common bonds. For Germany, the Netherlands and a number of other northern European eurozone members, it is a question of moral hazard: the countries that are running big budget deficits will never change their ways if they think they can always borrow on the cheap.

The Italians and the Spanish also dug their heels in, preferring for the meeting to end with no agreement rather than accept the stigma of conditionality. So, in time-honoured fashion, the can was kicked down the road, with eurozone finance ministers given a couple of weeks to come up with something.

One possible solution would be to get round the moral hazard problem by making the corona bonds a one-off solution to a quite exceptional crisis. If, as is possible, the emergency is relatively short-lived, the Germans and the Dutch ought to be able to support the idea of corona bonds are for 2020 only.

There is little doubt which side Monnet would be backing. This is not just about providing a lifeline to Italy, important though that is. Nor is it simply about avoiding the meltdown of already shaky Italian banks, which would have ripple effects across the eurozone. It is about political legitimacy and whether the EU goes forward or backwards.

Italy’s prime minister, Giuseppe Conte, said at the weekend: “If Europe does not rise to this unprecedented challenge, the whole European structure loses its raison d’être to the people. We are at a critical point in European history.”

That just about sums things up. The message being sent out is that Europe is a project for the good times and that when the going gets tough people can only really rely on their own government and the nation state.

Yahoo Finance

Yahoo Finance