Coronavirus: EasyJet sells and leases back planes to raise £305.7m to survive

EasyJet (EZJ.L) has sold and leased back nine Airbus planes in a bid to shore up its finances, raising $398.6m (£305.7m) in cash to help it survive the coronavirus crisis.

The airline left the door open to more similar deals in a statement to investors on Tuesday, noting it still had 152 fully-owned aircraft and calling the sale-and-leaseback market “robust.”

The deals with two companies underline the challenge facing airlines with demand for air travel worldwide taking a hammering from the pandemic. EasyJet had already raised more than £2.4bn in cash since COVID-19 hit.

It said in its most recent trading update that passenger numbers had halved in the year to 30 September, and EasyJet expects a full-year loss for the first time in its history.

This month, the International Air Transport Association (IATA) said passenger demand has plummeted and 2020 is expected to see passenger numbers down at least 70% compared to 2019 for travel to/from/within Europe. IATA says that only 340 million travellers in the region are expected to fly in 2020 compared to close to 1.2 billion that flew last year.

READ MORE: HSBC plans ‘conservative’ dividend after better-than-expected quarter

The resurgence of the virus and government restrictions in Europe have dashed airlines’ hopes of a gradual recovery, with EasyJet customer numbers peaking in August before tailing off “significantly” in September.

“Customer demand was materially affected by changes in government travel guidance and quarantine rules. Customers are booking at a very late stage and visibility remains limited,” its last update said.

The crisis has seen EasyJet seek to cut staff numbers by up to 30%, but it said it had avoided compulsory redundancies by “greatly increased seasonal and flexible working patterns.”

WATCH: EasyJet warns first ever loss could top $1bn

Its CEO Johan Lundgren said at the time: "Based on current travel restrictions we expect to fly c.25% of planned capacity for Q1 2021 but we retain the flexibility to ramp up capacity quickly when we see demand return and early booking levels for summer '21 are in line with previous years.

"Aviation continues to face the most severe threat in its history and the UK Government urgently needs to step up with a bespoke package of measures to ensure airlines are able to support economic recovery when it comes.”

READ MORE: EasyJet slashes up to 4,500 staff in ‘kneejerk’ job cuts

The sale-and-leaseback deals for Airbus 320 family aircraft have a term of almost 10 years, and are with Wilmington Trust SP Services (Dublin) Limited and Sky High 112 Leasing Company Limited. They will cost EasyJet £15m in additional interest charges and depreciation over the term of the leases.

“Following high levels of demand from the operating lease marketplace, easyJet is pleased to confirm that it has engaged with a number of operating lessors to raise further liquidity, which will be used to further strengthen easyJet's financial position,” the latest statement said.

Watch: Delta Air Lines CEO: "We’ve never seen anything close to managing through the challenges of the pandemic"

“EasyJet will continue to review its liquidity position on a regular basis and will continue to assess further funding options, including those that exist in the robust sale and leaseback market.

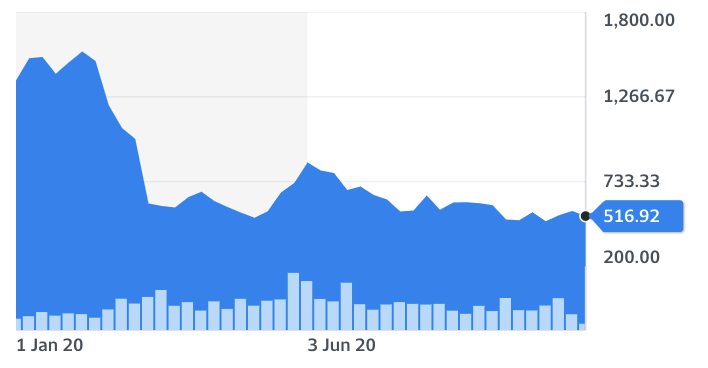

EasyJet shares shot 1.4% higher as markets opened on Tuesday, before losing some ground to trade 0.6% higher at around 8.30am in the UK. It follows heavy declines of 5.3% on Monday as rising infection rates and restrictions weighed on vulnerable stocks including airlines:

Yahoo Finance

Yahoo Finance