Coronavirus hit on roaming charges hurts Vodafone

Vodafone Group’s (VOD) revenue for the first half of its 2021 financial year was down 2.3% year-on-year to €21.4bn ($25.4bn, £19.2bn) as the coronavirus pandemic impacted the money it makes from roaming as well as handset sales.

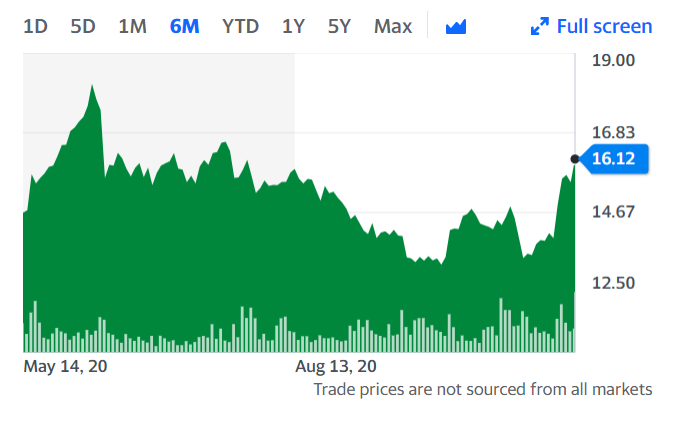

But the company’s share price ticked up roughly 4% Monday morning, helping to boost the FTSE 0.6%, as Nick Read, group CEO, touted “increased confidence” in the company’s full year outlook.

The mobile operator said a “good underlying momentum” and the benefit from the acquisition of Liberty Global’s assets in Germany and Central and Eastern Europe was offset by lower revenue from roaming, handset sales, foreign exchange headwinds and the disposal of Vodafone New Zealand.

Read explained that “COVID-19 and the reduction in roaming revenues, through the significant reduction in international travel, is currently obscuring our underlying commercial progress.”

However, he said the H1 results “underline increased confidence in our full year outlook. We are reporting a resilient first half performance and we continue to see good commercial momentum across the group.”

“The results demonstrate the success of our strategic priorities to date, namely increasing customer loyalty, growing our fixed broadband base, driving digitisation to simplify the company and capture significant cost savings, and deliver 5G efficiently through network sharing,” he added.

The group made a profit of €1.6bn in H1, up from a loss of €1.9m in H1 2020. It reaffirmed full-year 2021 free cash flow guidance of at least €5bn and said adjusted EBITDA is expected to be between €14.4bn to €14.6bn.

Vodafone launched 5G in 127 cities across nine European markets. It said it its mobile contract customer loyalty improved year-on-year for an eighth successive quarter.

READ MORE: Vodafone plans IPO of 'Europe's biggest tower business'

In response to the trading conditions related to the pandemic, the company said it accelerated a series of cost saving activities, resulting in a €300m net reduction in its Europe and common functions operating expenditure.

The group said in a statement it is “firmly on track to deliver our original three-year target of at least €1.2bn of net savings from operating expenses in Europe and Group common functions, having reached €1.1bn of savings between FY19 and H1 FY21.”

“We have extended our ambition to at least another €1bn of savings over the next three years. This focus on efficiency, delivered through standardisation and integration of our technology support operations, has enabled our adjusted EBITDA margin to be resilient during the pandemic and remain broadly stable at 32.8%,” it added.

Earlier, the company had said it is planning to float its new mobile phone mast business Vantage Towers on the stock market in Frankfurt early next year. It has now said it is on track with these plans.

Michael Hewson, chief market analyst at CMC Markets UK, said of the results: “The main focus for investors going forward is the need to address the company’s cash flow issues, and invest in 5G over the next few years, and to that end the main focus is next year's potential IPO of the company’s Vantage Towers business.”

Watch: What is the budget deficit and why does it matter?

Yahoo Finance

Yahoo Finance