Coronavirus: UK borrowed record £62.1bn in April to battle COVID-19 crisis

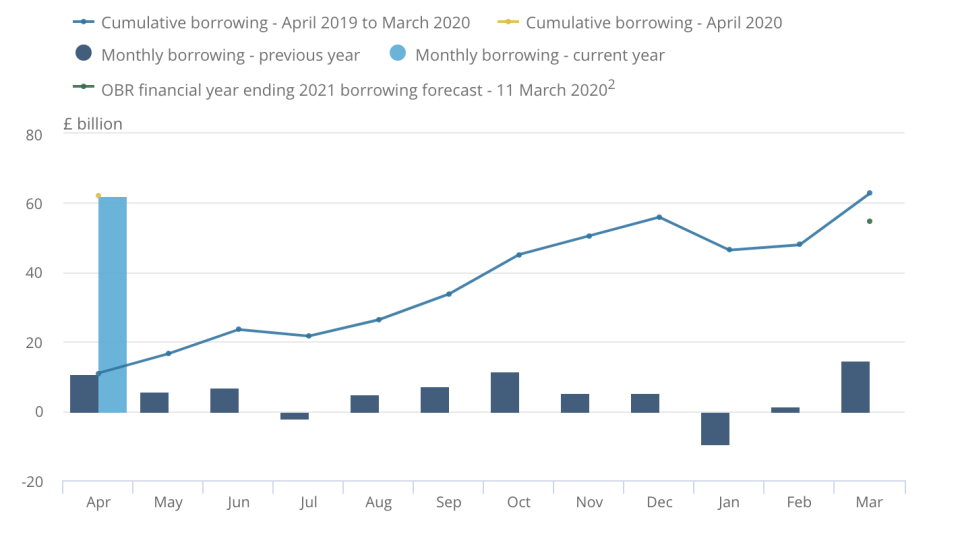

The UK government borrowed £62.1bn ($75.8bn) in April — more than it has done in any month on record — in order to help tackle the impact from the spread of coronavirus.

Data from the Office for Budget Responsibility (OBR) and the Office for National Statistics (ONS) confirmed that the coronavirus pandemic has had “unprecedented impact on borrowing,” and the amount borrowed in April 2020 was the highest in any month on record, since record keeping began in January 1993.

“The coronavirus (COVID-19) pandemic is expected to have a significant impact on the UK public sector finances. These effects will arise from both the introduction of public health measures and from new government policies to support businesses and individuals,” the ONS said in its report.

It noted that these results are just preliminary and that “the full effects of COVID-19 on the public finances will become clearer in the coming months. This means that some of the statistics included in this release, particularly those for April 2020, will be prone to larger revisions than normal, once more data become available.”

In the latest data release, the ONS also bumped up its provisional estimate of borrowing in March 2020 by £11.7bn to £14.7bn, “largely due to reductions in the previous estimate of taxes and the additional expenditure associated with the Coronavirus Job Retention scheme.”

The ONS also pointed out that the OBR estimated that borrowing in the current financial year (April 2020 to March 2021) will be £298.4bn, which is around five times the amount borrowed in the latest full financial year (April 2019 to March 2020) and almost twice as much as was borrowed in the financial year ending March 2010, at the peak of the financial crisis.

The ONS warned that “the effects of the coronavirus (COVID-19) pandemic are not fully captured in this release, meaning that estimates of national accounts-based (accrued) tax receipts, borrowing and gross domestic product (GDP) in particular are subject to greater than usual uncertainty.”

“Today’s figures highlight the extent to which the Government is digging deep to plug the growing gap in the UK’s finances,” said Tom Stevenson, investment director for personal investing at Fidelity International.

“These are extraordinary borrowing figures in extraordinary times. Fidelity’s Investor Survey, which captures UK investor sentiment since the outbreak of COVID-19, shows that a majority of investors support measures to help the UK economy cope with the coronavirus pandemic; 61% agree with the Government borrowing more than usual to fund economic support packages.

“While the Treasury’s priority is to ensure it can support households and companies here and now, there are clearly considerations about how this borrowing will be paid for at a later stage. Wells are very rarely bottomless. Our research does suggest that 40% of investors may be prepared for an increase in income taxes at some stage, but the exact steps that will be taken remain to be seen.”

Watch the latest videos from Yahoo Finance UK

Yahoo Finance

Yahoo Finance