Coronavirus: UK household finances under intense strain as lockdown hurts economy

New data released on Monday suggest a worrying turn for household finances, as COVID-19 continues to wreak havoc on the economy.

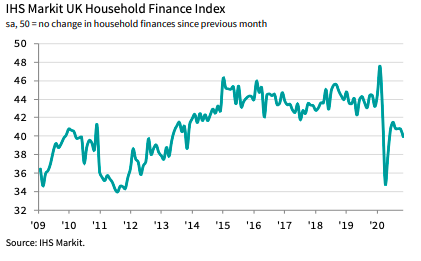

The IHS Markit UK Household Finance index’s reading of overall perceptions of financial wellbeing dipped to a six-month low of 40 in November, signalling a more intense strain on the household finances amid a second lockdown in England and ongoing restrictions across the rest of the UK.

Any reading below 50 signals a deterioration.

The outlook remained negative in November, with UK households on average expecting their financial situation to worsen in 12 months’ time. However, the level of pessimism was the weakest since March.

November data also highlighted the quickest drop in the amount of cash UK households have available to spend since May, with the rate of decline sharp overall.

There was also further evidence that households have turned to savings to finance some of their purchases and help mitigate falling incomes, as the level of household savings fell rapidly and at the quickest rate for seven years, IHS Markit said.

Demand for unsecured credit, such as credit cards, overdrafts and unsecured loans, increased for the fourth month in a row.

While cash availability looked shaky, job security perceptions recovered further from April's survey low, with UK households the least pessimistic since March. That said, the index measuring job security was noticeably below the 50.0 mark and remained historically subdued.

READ MORE: Women across the UK to save £46m a year once tampon tax is scrapped

"Incomes from employment declined at the fastest pace since July, which may have been driven by renewed use of furlough due to business closures in the hospitality and retail sectors,” said Lewis Cooper, economist at IHS Markit.

Cooper noted that the furlough scheme extension to March 2021 has helped improve job security prospects, as employment concerns were the least widespread for eight months.

"Nonetheless, the latest data paint a worrying picture for household finances across the UK, with no sign yet of a recovery from the blow caused by the pandemic,” he said.

“The easing of lockdown measures will likely elevate some of the strain we saw in November, but until the economic recovery becomes more sustainable it is unlikely households will see much improvement in their financial situation."

Watch: What is the budget deficit and why does it matter?

Yahoo Finance

Yahoo Finance