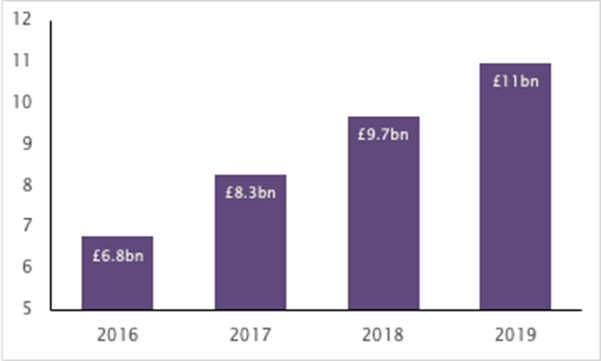

Sales at UK’s top online-only retailers hit record £11bn in 2019

Sales at the UK’s top 20 online-only retailers including Asos (ASC.L) and Farfetch (FTCH) reached a record high of £11bn ($14bn) in 2019, research by law firm RPC showed.

The figure was up 13% from £9.7bn in 2018. The growth was largely driven by the success of fashion retailers, which increased their revenues by 22% to reach £6.5bn in 2019.

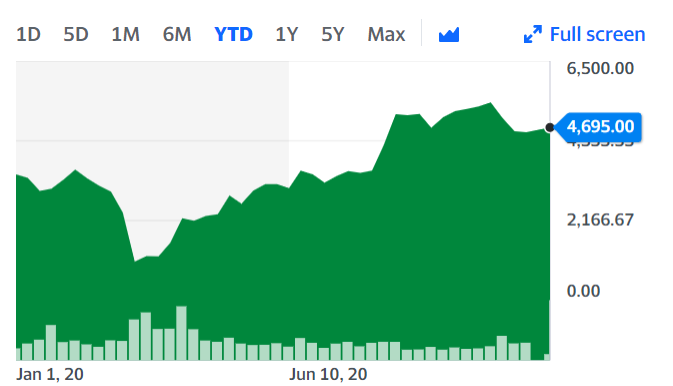

Sales are likely to rise further in 2020, with the coronavirus pandemic accelerating the move to online shopping.

Asos reported full-year sales (to 31 August 2020) were up 39% on the prior year, the report said. Meanwhile in its Q2 2020 results, Farfetch said digital platform gross merchandise value was an all-time high of £503m and revenue was up 74% year-over-year to £282m.

Fast fashion retailer Boohoo said it expects its revenue for 2020 to grow 25%, with its shares reaching a record high value during lockdown. The company acquired high-street brands Warehouse and Oasis, which entered into administration as a result of the pandemic.

Brick-and-mortar shops, already under threat from online shopping, have taken a massive hit during the pandemic, having been shut for months in the summer during the first lockdown. They will be shut once again for all of November due to new restrictions, in the lead-up to the holiday period.

RPC said another advantage online retailers have is the amount of hard data they can gather from social media interactions, website browsing and sales, which means they can respond to consumer trends in a more speedy and focussed way.

READ MORE: Marks & Spencer falls to its first loss in almost 100 years

Jeremy Drew, co-head of retail at RPC says: “Whilst you can’t beat the theatre and social element of high street shopping, online retailers have the edge in personalising the experience and convenience.”

He added that “ever slicker algorithms” allow them to make tailored suggestions and help consumers navigate huge stock ranges.

Another advantage online retailers have is they can sign up to work with buy-now, pay-later platforms such as Klarna, to lower the barrier to making sales. Some 200 new retailers signed up to the platform each day in H1 2020.

“Online retailers have been investing in experiential technology, such as augmented and virtual reality as well as live streaming of fashion events and product drops, to help replicate the experience of shopping, but from the comfort of home. With ever more people likely to gravitate to shopping online in the future, brands will struggle to remain competitive if they do not continue innovating effectively,” Drew said.

WATCH: What is inflation?

Yahoo Finance

Yahoo Finance