Coronavirus update: Markets rally, but infections creep closer to 100K amid spike in cases outside China

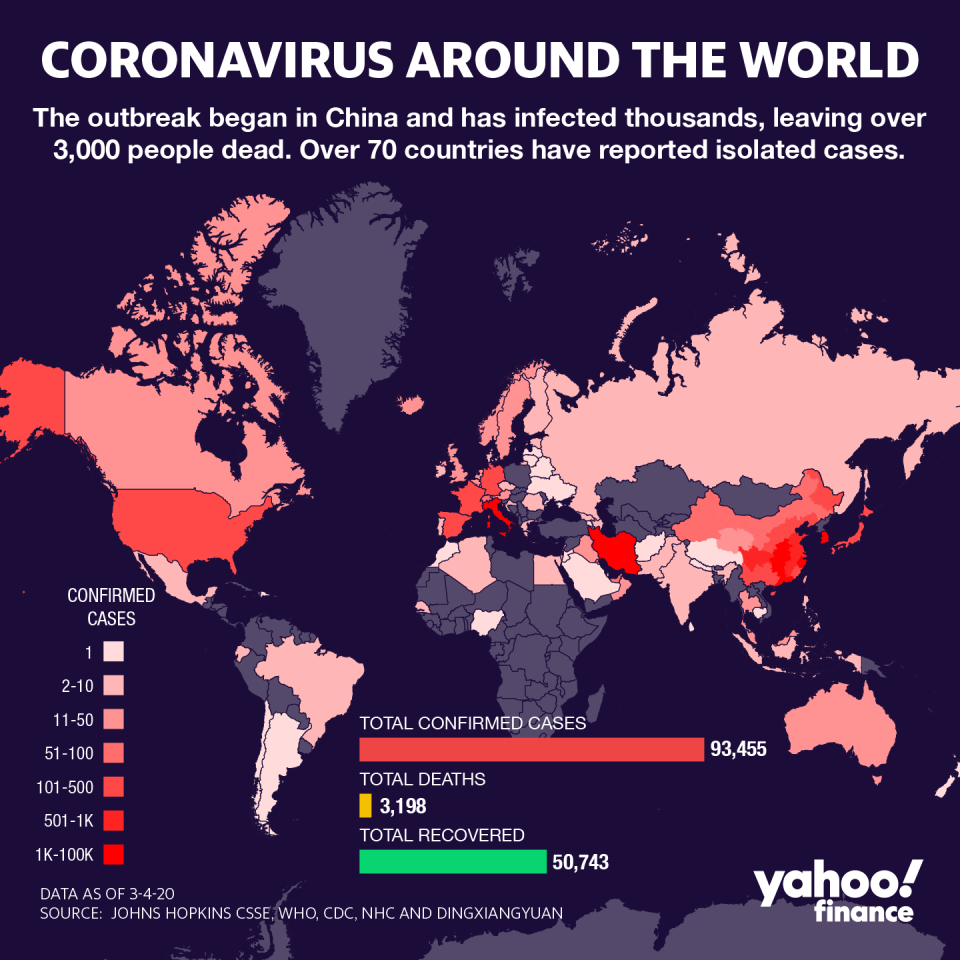

The global coronavirus outbreak has shown no signs of slowing down, with the worldwide total of infections topping 94,000 and claiming over 3,200 lives — as Italy, South Korea and the United States fight a seemingly losing battle to contain the disease’s spread.

On Wednesday, the U.S. reported its 11th death as caseloads grew in California and New York. In Europe, Italy’s infected numbers jumped above 3,000 on 100 deaths — forcing the government to shutter all of its schools. And Iraq, which shares a border with hard-hit Iran, also joined the dozens of countries affected by COVID-19 with its first confirmed case of the virus.

Beaten-down markets staged a brisk rally, even after the Federal Reserve’s shock emergency rate cut on the previous day prompted traders to sell. The International Monetary Fund slashed its outlook for global growth as it announced a $50 billion emergency coronavirus program.

“We are determined to provide the necessary support to mitigate the impact, especially on the most vulnerable people and countries,” IMF Managing Director Kristalina Georgieva, said in a statement. “We have called upon the IMF to use all its available financing instruments to help member countries in need.”

Fears are growing more acute that the outbreak is on a fast track to being declared a pandemic. According to the World Health Organization — which hasn’t yet labeled the outbreak a the death rate globally has risen to 3.4%, outpacing the flu’s 1% mortality rate.

The race for pharmaceutical companies to find a vaccine is also underway, though an immediate breakthrough is not seen as likely. Meanwhile, Congress is likely to vote on a roughly $8 billion emergency response package this week, including more than $800 million for the National Institutes of Health (NIH) and about $2.2 billion for the Centers for Disease Control, of which a portion would be distributed to local governments.

And rallying markets belied the growing number of companies hit with global supply chain worries that are downwardly revising their outlooks. Among hard-hit airlines, Lufthansa and United (UAL) announced deep cuts to their schedule amid slowing demand.

‘Just the tip of the iceberg’

Canada’s central bank joined the Fed in reducing interest rates by 50 basis points Wednesday, after the U.S. central bank surprised markets with a cut of its own on Tuesday. China could soon follow suit.

Although Wall Street reversed Tuesday’s deep sell-off, the market’s upbeat tone was due in part to investors cheering the results of ‘Super Tuesday’s’ Democratic primaries.

Underneath the rally, travel and leisure companies are being battered by fears of a global downturn, as the disease’s spread and curtailed travel to major countries has undermined demand. In fact, the International Air Transport Association (IATA) released a report showing that January traffic was the slowest growth in a decade.

“January was just the tip of the iceberg in terms of the traffic impacts we are seeing owing to the COVID-19 outbreak, given that major travel restrictions in China did not begin until 23 January,” Alexandre de Juniac, IATA's Director General and CEO, said in a statement.

Pharmaceutical companies were back in focus Wednesday as they push forward in efforts to produce a treatment or vaccine in response to the virus. Vir Biotechnology (VIR) partnered with Alnylam to work on a treatment, the two announced. Vir is already working with a Chinese biotech to manufacture a product, when available.

Meanwhile, diagnostics came under the spotlight as a relaxation of FDA policy surrounding diagnostic tests, as the CDC faces intensifying pressure from its faulty kits. Yet the current costs of diagnostic tests are unknown, with the CDC deploying kits to public health departments around the country.

At least two industry giants, Labcorp and Quest Diagnostics (DGX), are expected to announce efforts for their tests, amid a growing need to “get in the game” as the pathogen spreads rapidly.

In China, new infections have fallen sharply — yet the economic toll remains heavy with travel to and from the country sharply curtailed, and business activity still sluggishly restarting. A new report suggests the world’s second-largest economy is at risk of losing business to foreign competitors if the virus is not contained by the end of the month.

Anjalee Khemlani is a reporter at Yahoo Finance. Follow her on Twitter: @AnjKhem

Read the latest financial and business news from Yahoo Finance

Yahoo Finance

Yahoo Finance