Coronavirus update: New York sees surge of deaths after brief respite; Trump says WHO 'really blew it'

The global coronavirus outbreak showed few signs of abating on Tuesday, as the U.S. added to its status as the world’s epicenter of new infections, while New York suffered its worst day yet of new fatalities.

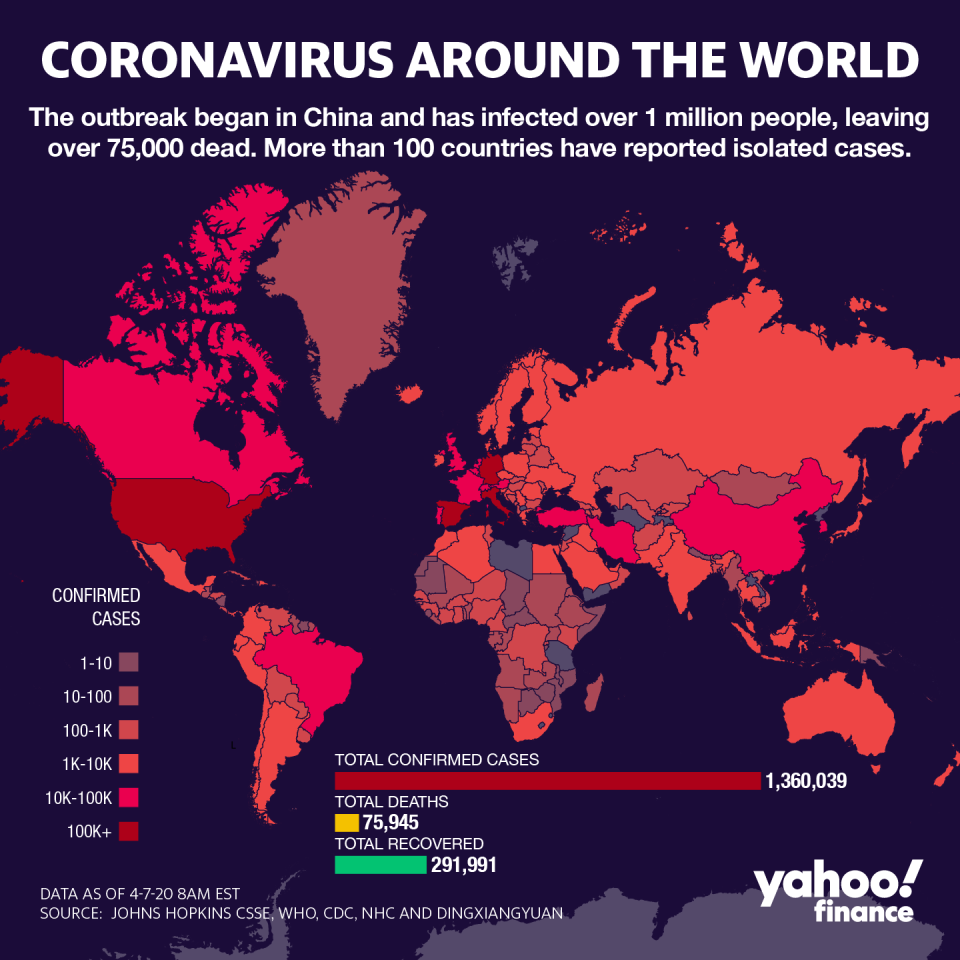

Worldwide, COVID-19 infections are creeping toward 1.5 million, according to real-time data from Johns Hopkins, with America topping the list by far with nearly 400,000 diagnosed infections. Both California and New York on Tuesday reported sharply higher cases and fatalities, underscoring how the crisis is far from over despite budding optimism over an eventual plateauing of casualties.

Cases in Europe also continued to rise, but declining rates of new infections in hotspots like Italy and Spain offered some measure of hope, even as Frace saw its death rate top 10,000. In the U.K., Prime Minister Boris Johnson remained hospitalized in intensive care as his condition worsened — the latest and highest profile victim of an outbreak that’s claimed over 80,000 lives around the world.

Separately, U.S. policymakers are debating new ways to shore up an economy that has all but certainly tumbled into a deep recession. As stocks rallied on optimism that new infections could soon peak, Treasury Secretary Steve Mnuchin was working with Congress on fresh aid to small businesses worth at least $250 billion, with the Senate poised to vote on the move as early as Thursday.

However, officials are still engaged in a furious debate about whether and when to restart economic activity. With April all but certain to feature more grim COVID-19 figures, White House economic adviser Larry Kudlow told reporters the Trump administration’s efforts to reopen the economy would be contingent upon advice from public health officials.

Yet normalcy is unlikely to occur until a vaccine is found, and mass testing can identify larger numbers of people infected by the virus. New York Gov. Andrew Cuomo acknowledged as much on Tuesday, telling reporters at his daily briefing that diagnosing the infected was a linchpin to normalizing public life.

The Empire State reported 731 deaths in a day — its worst yet after two days in which the figure appeared to be hitting a plateau. However, new hospitalizations have slowed, a critical metric amid a badly-strained health care system that’s overwhelmed the state’s medical professionals.

“It's all about testing, testing, testing,” Cuomo said. “We have done more testing than any state in the nation, but we need to do even more.”

Ezekiel Emanuel, a former health policy adviser under President Barack Obama, told Yahoo Finance’s “The Ticker” on Monday that the U.S. was “not going to get rid of this, or be past it, or return to full normalcy until that vaccine is available.”

Emanuel’s remarks echoed those of Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, who said on Monday that getting “back to normal” would entail being able to “completely protect the population” from the pathogen.

Dr. Fauci: "If 'back to normal' means acting like there never was a Coronavirus problem, I don't think that's going to happen until we do have a situation where you can completely protect the population."

Full video here: https://t.co/7Ym0v60MGM pic.twitter.com/xudXB1p6u7— CSPAN (@cspan) April 6, 2020

Trump lashes out at WHO

China on Tuesday ordered the lifting of stiff restrictions on Wuhan, the city where the coronavirus first appeared late last year. Yet in recent days, the government has faced pointed questions about its transparency in reporting new infections and deaths, with U.S. intelligence reportedly finding that Beijing understated its COVID-19 fatalities.

Meanwhile, the World Health Organization has also taken rising heat for its role in downplaying the severity of the outbreak early on. President Donald Trump, who has also sustained criticism for his handling of the crisis, lashed out at the agency for a “China-centric” approach that appeared to show favoritism toward Beijing.

The W.H.O. really blew it. For some reason, funded largely by the United States, yet very China centric. We will be giving that a good look. Fortunately I rejected their advice on keeping our borders open to China early on. Why did they give us such a faulty recommendation?

— Donald J. Trump (@realDonaldTrump) April 7, 2020

On Tuesday, Trump removed the independent watchdog meant to oversee the use of the $2 trillion stimulus package that passed last week, while the acting Navy Secretary resigned in the wake of a furor surrounding a captain who went public with a plea for help on a coronavirus-stricken air carrier.

This week is likely to pose the stiffest challenge yet to the world’s largest economy, with officials warning that the coming weeks will see a surge in new cases and deaths. Although major benchmarks have staged a comeback from a brutal sell-off, the looming first-quarter earnings season is likely to provide a stark reminder to investors over the damage wrought by the pandemic.

“We expect volatility to remain elevated until the number of COVID-19 cases peak or is contained,” said Terry Sandven, U.S. Bank Wealth Management chief equity strategist.

Next week will bring the first wave of Q1 earnings reports, Sandven noted, with earnings expected to drop by at least 5%, according to FactSet data.

“Investor focus undoubtedly will be on tone and mindset around how companies may operate during the remainder of 2020,” he added.

Javier David is an editor for Yahoo Finance. Follow him on Twitter: @TeflonGeek

Read more:

Wall Street cites Sanders as a rival to the coronavirus as a market risk

The stark reality of life under coronavirus lockdown is dawning on investors

Investors bet on Sanders after New Hampshire win as Biden plummets: Smarkets

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

Yahoo Finance

Yahoo Finance