Coronavirus update: US, global cases keep rising as pandemic fears force Fed's hand

The coronavirus continued its spread in the United States, as global officials braced for the seeming inevitable development of the disease being declared a pandemic — a fear that forced the Federal Reserve to surprise jittery investors on Tuesday with an emergency interest rate cut.

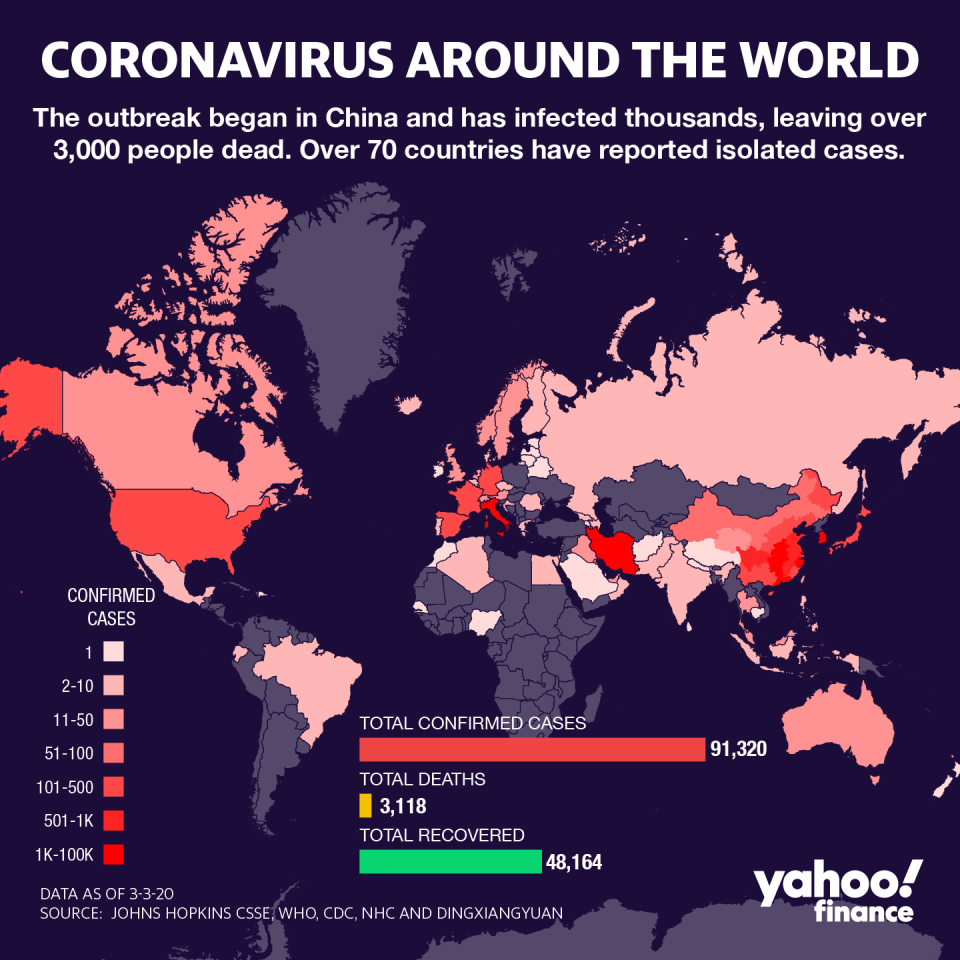

With domestic cases now topping 100 with six deaths, the world’s largest economy braced for an increased spread of the COVID-19 virus that’s infected over 91,000 globally and caused over 3,100 deaths.

Isolated cases in Washington State — where the deaths have occurred — California, Rhode Island and New York have sparked new fears about the disease’s spread, especially because a few cases involve no foreign travel.

A second case confirmed in New York State Tuesday resulted in two schools closing, just as the Federal Emergency Management Agency prepared for a potential emergency declaration from President Donald Trump.

Against that backdrop, the Federal Reserve cut interest rates by 50 basis points on Tuesday morning, a surprise move that sought to calm markets whipsawed by the virus’ growing global impact.

“It is expected after the G7 meeting that other central banks will follow the RBA and FOMC actions today. We are in a globalized economy that no longer runs in regional isolation,” Leslie Falconio, senior strategist at UBS Global Wealth Management, told Yahoo Finance.

“There is a lag from Fed cuts to the impact to the economy so we would not anticipate a reversal in 2020, unless inflation runs well above the target 2% level which is unlikely,” Falconio added.

Health and Human Services Secretary Alex Azar said that outside of China, the numbers are “not of the magnitude” of previous pandemics, according to the World Health Organization, though officials around the world are preparing for the disease to be classified as such.

The WHO has warned the disease is now a “global level” risk that is likely to worsen, but maintains it can still be contained because the spread in many countries remains very low.

Travel advisories to parts of Italy and South Korea from the U.S. have gone into effect, as well as additional screenings in both countries for outbound flights to the U.S.

The virus is overwhelmingly affecting older or vulnerable individuals, though it is possible for isolated cases that fall outside that trend, according to Anthony Fauci, director of the National Institute of Allergies and Infectious Diseases.

‘Somewhat worse’ than the financial crisis

A whipsawed market veered between gains and losses on Tuesday, then finally fell to session lows after the Fed announced its move, something that a few Wall Street economists said was a growing possibility. Markets are bracing for more easing as the virus roils the global economy, and heightens recession fears.

Powell said Tuesday that the situation remains "highly uncertain” and “remains fluid," but the decision was made to help boost household and business confidence. Meanwhile, companies continue to warn about the virus’ negative impact on their first quarter results.

The Fed's moves underscores how the disease has hammered global supply chains — and key sectors like travel and leisure, which has been hit by travel restrictions and a growing list of cancelled public events.

Amid strong pressure from President Donald Trump, Joe Brusuelas, chief economist at RSM, told Yahoo Finance Tuesday the Fed’s actions were not politically motivated.

“The Fed are the adults in the room, they are there to act in such situations,” he said. “This is not the financial crisis, this is somewhat worse.”

Cases around the globe continue to increase, with more than 70 countries reporting, including some first cases. The relentless spread of the virus has cast a shadow over the 2020 Summer Olympics in Tokyo, which raised the prospect of the event being either delayed or canceled.

The contract for the Tokyo 2020 Games calls for the events to take place within the year, giving the committee leeway to delay the games rather than outright cancel.

The power to cancel belongs to the IOC, which has reiterated its intent to continue as planned for the late summer start.

Anjalee Khemlani is a reporter at Yahoo Finance. Follow her on Twitter: @AnjKhem

Read the latest financial and business news from Yahoo Finance

Yahoo Finance

Yahoo Finance