Costco (COST) Triumphs on Business Model and Pricing Strength

Costco Wholesale Corporation COST, an esteemed player in the retail discount space, has showcased a decent performance in the stock market. Fueled by its strategic, operational initiatives, such as the customer-centric business, a robust membership program and a commitment to delivering value-driven products, the company's stock has outpaced the Zacks Retail-Discount industry.

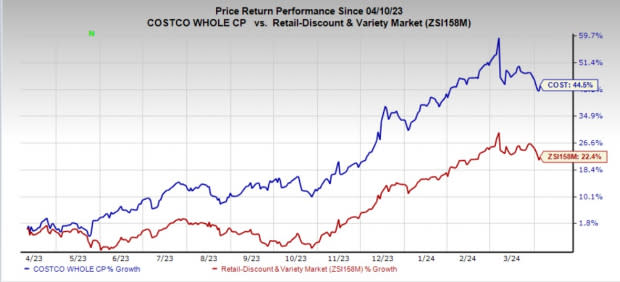

As a consumer defensive stock, Costco has weathered market volatility admirably. Over the past year, shares of this Zacks Rank #3 (Hold) company have surged approximately 44.5% compared with the industry's 22.4% rise.

A Leading Warehouse Retailer

Headquartered in Issaquah, WA, Costco remains a dominant force in the warehouse retail sector, boasting a wide array of high-quality merchandise. Its unique membership-based business model and pricing strength differentiate it from traditional competitors. Discount stores have become the preferred choice for low-to-middle-income consumers for their everyday needs, propelling Costco's sales performance.

In the second quarter of fiscal 2024, Costco's net sales grew by 5.7% year over year to reach $57,331 million, with comparable sales climbing 5.6% year over year — a significant acceleration from the preceding quarter's 3.8% increase. We anticipate 4.6% growth in comparable sales for fiscal 2024.

Image Source: Zacks Investment Research

Impressive Membership Growth

Costco's total paid membership continues to rise, driven by its expanding customer base and high renewal rates. Membership fees surged by 8.2% to $1,111 million in the second quarter of fiscal 2024, with the company boasting 73.4 million paid household members by the quarter's end.

We project Costco's total paid membership to reach approximately 76 million by the end of fiscal 2024, marking a 7% increase from fiscal 2023. Additionally, we estimate a 4% uptick in net sales and a 4.9% rise in total membership fees for fiscal 2024, translating to estimated 4% revenue growth for the fiscal year.

Market Penetration

Through strategic market analysis and tailored offerings, Costco has successfully expanded its presence, both domestically and internationally. The company has been steadily opening new club locations while operating e-commerce sites across various countries, including the United States, Canada, the U.K., Mexico, Korea, Taiwan, Japan and Australia.

In fiscal 2023, Costco opened 23 net new units, with plans to open 30 units, including two relocations, in fiscal 2024. With the ramp-up in new warehouse openings, we anticipate a boost in membership fees.

Wrapping Up

Costco's promising future is underpinned by its favorable product mix, steady store traffic, pricing power and robust liquidity position. Emphasizing a strategy focused on offering products at discounted prices, Costco has successfully attracted customers seeking both value and convenience.

3 Stocks Looking Red Hot

Here, we have highlighted three better-ranked stocks, namely Sprouts Farmers Market SFM, Vital Farms VITL and Grocery Outlet GO.

Sprouts Farmers is engaged in the retailing of fresh, natural and organic food products. It currently sports a Zacks Rank #1 (Strong Buy). SFM has a trailing four-quarter earnings surprise of 10%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Sprouts Farmers’ current financial-year sales and earnings suggests growth of 6.7% and nearly 3.9%, respectively, from the year-ago reported numbers.

Vital Farms offers a range of produced pasture-raised foods. It currently has a Zacks Rank #2 (Buy). VITL has a trailing four-quarter earnings surprise of 155.4%, on average.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings calls for growth of 18.6% and nearly 35.6%, respectively, from the year-ago reported numbers.

Grocery Outlet, the extreme value retailer of quality, name-brand consumables and fresh products, currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Grocery Outlet’s current financial-year sales and earnings implies growth of 9.6% and 10.3%, respectively, from the year-ago reported numbers. GO has a trailing four-quarter earnings surprise of 17%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance