Costco earnings, inflation data — What you need to know in markets on Thursday

Markets bounced back on Wednesday.

After an ugly start to the holiday-shortened week markets rebounded on Wednesday as each of the major U.S. indexes gained more than 0.8% while bond yields moved higher after a volatile Tuesday that saw the 10-year yield fall sharply.

In the end, the Dow gained 306 points, or 1.2%, the S&P 500 added 34 points, or 1.2%, and the tech-heavy Nasdaq added 65 points, or 0.89%. The small cap Russell 2000, meanwhile, outperformed all of the major indexes and added 1.5% to close at an all-time high.

The 10-year Treasury yield, meanwhile, settled around 2.85%.

On Thursday, the economics schedule will be a bit lighter than Wednesday — which saw labor market and growth data disappoint — though we will get the latest reading on “core” PCE, the Fed’s preferred inflation reading, which is expected to rise 1.8% over the prior year in April.

We’ll also get manufacturing data from the midwest and the weekly report on initial jobless claims out Thursday morning.

And on the earnings front, notable companies expected to report Thursday include Costco (COST), Dollar General (DG), Dollar Tree (DLTR), Lululemon (LULU), Ulta Beauty (ULTA), VMWare (VMW), and American Eagle (AEO).

American companies will hire just about anyone it seems

The U.S. economy is starved for good workers.

On Wednesday, Walmart (WMT) announced a new education program for associates the company said will cost employees about $1 per day. The company also said that anyone can wear jeans to work now. These moves also come after the company has already raised its starting wage to $11 an hour.

And Walmart’s latest effort to hire and retain talent comes on the same day the Federal Reserve’s latest Beige Book report showed that wages keep going up and standards keep going down amid a lack of employees able to fill openings across the country.

“Labor market conditions remained tight across the country, and contacts continued to report difficulty filling positions across skill levels,” the report said.

“Shortages of qualified workers were reported in various specialized trades and occupations, including truck drivers, sales personnel, carpenters, electricians, painters, and information technology professionals. Many firms responded to talent shortages by increasing wages as well as the generosity of their compensation packages.”

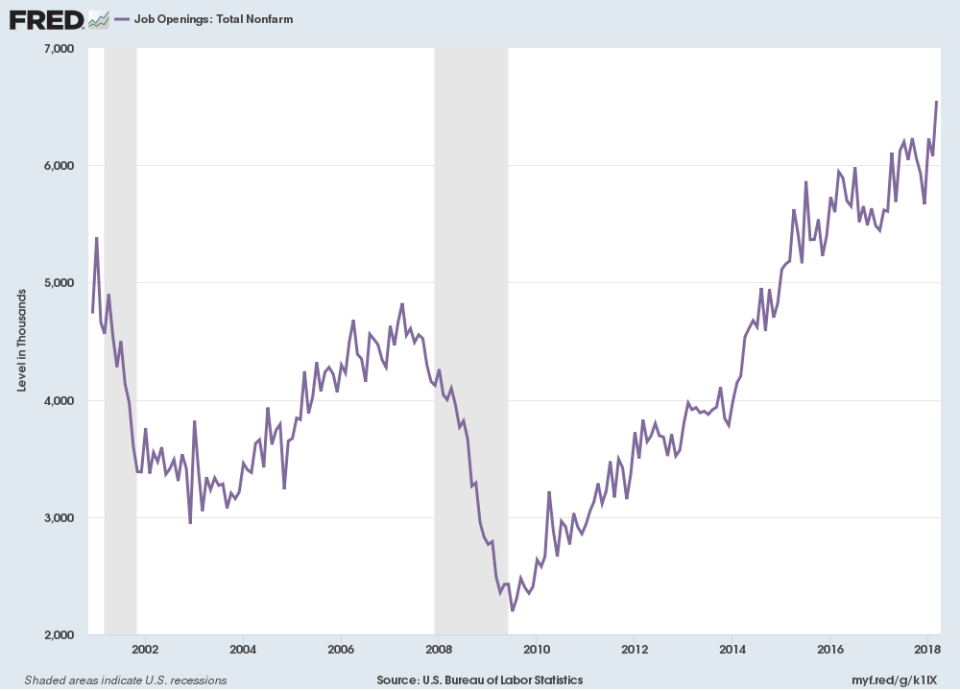

In March, we’d note, the number of jobs open in the U.S. hit a record 6.55 million.

Business contacts in the Philadelphia Fed’s region said, “Staffing firms continued to report steady demand for temporary workers and direct hires in several local labor markets, with increased wage pressures in the tightest markets. According to one contact, clients are hiring faster now compared with a few years ago when they were indecisive about whether to hire and whom.”

In the St. Louis Fed’s region, contacts reporting slackening standards when it comes to passing drug tests and criminal backgrounds. “Contacts in Missouri and Arkansas also reported difficulties filling skilled technical and engineering positions,” the report said. “Some local employers have begun relaxing drug-testing standards and reducing restrictions on hiring convicted felons in order to alleviate labor shortages.”

And in Dallas, employees that had retired are being coaxed back into the workforce to meet short-term employment needs.

“Labor market tightness continued across a wide range of industries and skill levels, with some contacts saying difficulty finding workers was constraining growth to some extent,” according to the Dallas Fed.

“One staffing services contact noted that some firms were rehiring former retired employees on a part-time basis to meet their staffing needs. In Houston, shortages of painters, tile setters, carpet layers (workers at the backend of the home construction cycle) were noted, a departure from earlier in the year when mostly sheet rock/drywall installers were in short supply.”

So, what about wages? In April, average hourly earnings rose 2.6% over the prior year and in May economists expect wages rose by the same amount. This is more than the current rate of inflation but low considering the level of unemployment in the economy.

Economists have argued that more holistic measures of what it costs to employ someone like the employment cost index — which takes into account benefits as well as wages — shows that worker pay is increasing more rapidly than these figures would indicate.

And some Beige Book commentary backs up this idea that when looking at how companies are increasing their investment in employees it goes beyond just wages.

In the Atlanta region, “Contacts also noted that geographic mobility was a major challenge, as workers’ willingness to relocate for a position remained more challenging than in the past.” Offering a moving bonus or help offsetting the costs of moving would certainly move the needle on overall employee costs.

“Overall, contacts [in the Atlanta region] expressed that recruiting and retention efforts were much more aggressive and creative than they were a year ago,” the report said.

And these “creative” methods saw companies basically throw the kitchen sink at employees. “Firms reporting mild [wage] pressure typically responded by offering nondirect wage benefits, like increased vacation time, flexible scheduling, and marketing a positive culture to both existing and potential workers,” the report said.

Of course, wage increases do work, too.

“In cases where wage pressures were described as ‘acute,’ if firms were still not able to meet demand with their existing labor supply after implementing nonwage benefits, they typically raised wages, often considerably,” the report said.

See? Economics works!

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance