Could the Bank of England still cut rates in June after poor inflation figures?

Today was supposed to be the day that inflation reached the two per cent target, bringing an end to the UK’s struggle with inflation over the past couple of years.

It has not quite gone to plan.

Inflation fell to 2.3 per cent in April, down from 3.2 per cent in March. That’s quite a big fall, but it was not as big as expected. City forecasters and the Bank of England had expected it to fall to 2.1 per cent.

Although Rishi Sunak jumped on the airwaves to proclaim inflation was “back to normal”, markets seemed less convinced.

The FTSE 100 shed 0.6 per cent in early trade while traders drastically reduced bets on a June rate cut. Markets are now pricing in the chance of a June rate cut at just 12 per cent, down from 50 per cent at the start of the week.

Even August now seems less likely with traders not fully pricing in a rate cut until November.

But still, it seems a little excessive that a 0.2 percentage point overshoot is enough to push back interest rate cuts and knock the FTSE 100 off its record-breaking streak. After all, inflation was above 11 per cent in October 2022.

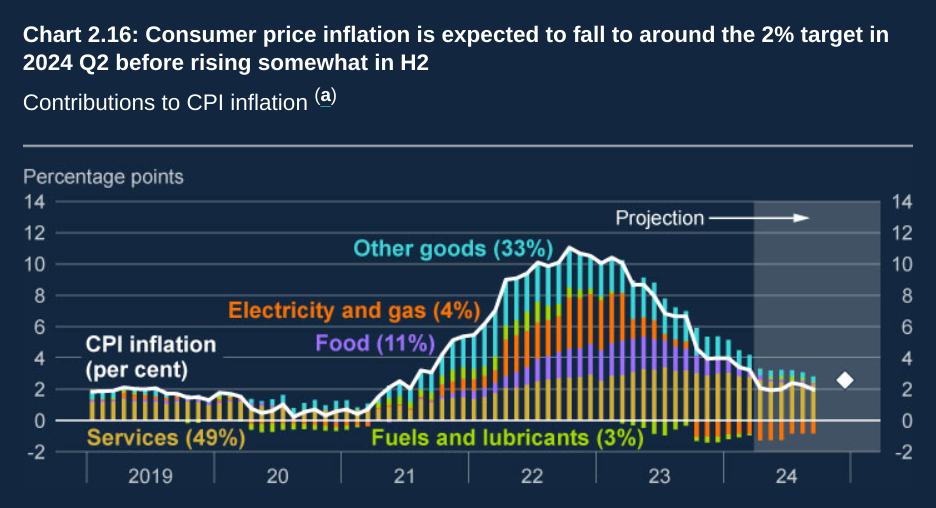

To understand the market reaction you have to break down the headline figure. The fall in inflation was largely driven by lower energy prices and easing food costs, as has been the case for a number of months.

It’s hard to argue inflation is on a quick path sustainably back to target when services inflation is barely declining

Rob Wood, Pantheon Macroeconomics

Gas prices fell by 37.5 per cent on the year while electricity prices fell by 21.0 per cent. Food inflation meanwhile came in at its lowest level since November 2021, rising 2.9 per cent.

The initial surge in inflation back in 2022 was largely prompted by higher commodities prices following the Russian invasion of Ukraine. As these shocks have unwound and commodity prices have stabilised, the headline rate has fallen closer to target.

However, indicators of domestic price pressures still remain relatively high. Which brings us to services inflation.

Services inflation is such an important part of the inflation basket for the Bank because the UK’s economy is so geared towards services. Interest rates almost exclusively affect the domestic economy, so the Bank thinks developments in the services sector provides a good gauge for how domestic price pressures are developing in response to higher interest rates.

The latest figures are not good. Services inflation only fell to 5.9 per cent in April from 6.0 per cent in March, well ahead of the 5.5 per cent expected by the Bank of England.

The figures showed that inflation for restaurants and hotels actually accelerated in April, climbing to 6.0 per cent. Cultural services inflation, which includes things like concerts and cinemas, rose from 5.4 per cent to 8.3 per cent.

Rob Wood, chief UK economist at Pantheon Macroeconomics described this morning’s services print as a “shocker”.

“It’s hard to argue inflation is on a quick path sustainably back to target when services inflation is barely declining,” he said.

This overshoot on services inflation is the aspect of this morning’s figures which most concerns economists. Many think that a June interest rate cut is now essentially off the table.

“Given the importance attached to this series as a measure of inflation persistence, the scale of the overshoot will likely make it much harder for the Monetary Policy Committee (MPC) to cut in June,” Peter Arnold, EY UK Chief Economist, said.

Core inflation also came in well ahead of expectations at 3.9 per cent. While this was down from 4.2 per cent in March, it was ahead of the 3.6 per cent expected by economists.

What the figures essentially show therefore, is that the UK is still suffering from lingering price pressures.

And remember, the Bank of England’s latest forecasts – out earlier this month – predicted that inflation will pick back up again later in the year.

The downward drag on inflation from energy is at its strongest now. As energy prices fall more slowly in the months to come, the headline rate of inflation is likely to rise again.

The Bank forecast that inflation would rise back up to 2.6 per cent later this year. Its fair to assume that after today’s figures inflation might approach 3.0 per cent by the end.

Back to normal? Not yet.

Yahoo Finance

Yahoo Finance