Could the Cash ISA be scrapped?

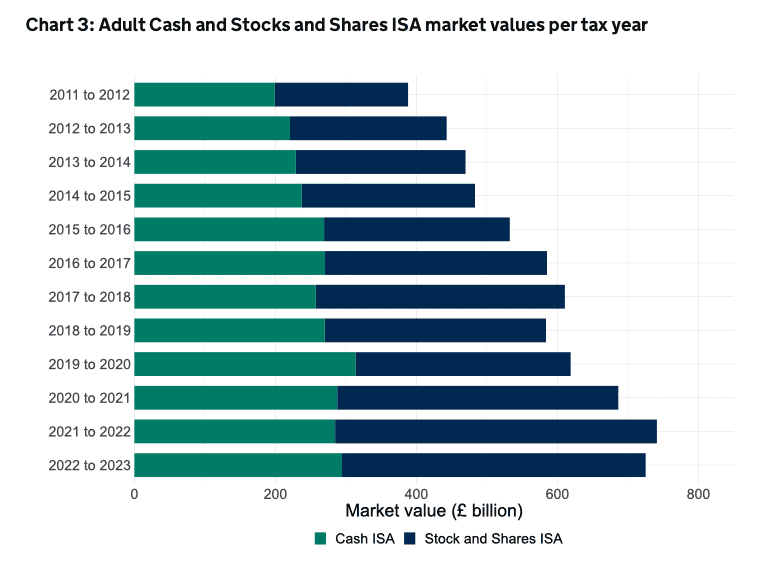

Cash ISAs are popular financial products. According to the UK government, Britons had around £290bn stashed in them at the end of the 2022/23 tax year.

But could this ISA ever be scrapped in the future? Potentially, I believe. I wouldn’t be surprised to see it ditched at some point. Because the way I see it, scrapping it could give both the wealth of the nation and the UK stock market a major boost in the long run. Of course, nobody has suggested it will happen and that’s just my opinion.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Let’s get Britain investing

In my view, scrapping the Cash ISA would have multiple benefits. First, it would most likely push a lot more Britons into Stocks and Shares ISAs – which are far more powerful investment vehicles. This could encourage people to learn more about investing in stocks and funds.

In the long run, investing in these kinds of assets is a much more effective way to build wealth than simply saving. Unfortunately though, a lot of people across Britain today still don’t understand how investing works or the benefits of it (partly because their money is in — albeit safe — Cash ISAs).

More wealth for everyone

Secondly, it could result in significantly more wealth for Britons in the long run. Imagine if UK savers with time on their side put their capital into a global tracker fund such as the iShares Core MSCI World UCITS ETF (LSE: SWDA) within a Stocks and Shares ISA and held it there for 10 years.

Over the last decade, this ETF has generated returns of 9.7% per year ignoring currency movements (a strengthening pound can weaken returns). That’s far higher than Cash ISAs have paid out (for most of the last decade Cash ISAs were paying 1%).

Past returns aren’t an indicator of future performance, of course (the stock market can be volatile at times and this ETF has experienced plenty of turbulence over the last decade). But let’s say that this product – which provides exposure to amazing companies such as Apple, Amazon, and Nvidia – was able to deliver the same kind of return over the next decade.

In this scenario, those with money allocated to it would most likely end up far wealthier than if they had kept their money in cash savings. Invest £20,000 and obtain a return of 9.7% per year and it would result in over £50,000 after a decade. Keep £20,000 in a Cash ISA offering 4%, however, and yet would end in less than £30,000 after 10 years. So, scrapping the product could potentially give the wealth of the nation a major boost.

Support for UK shares

Finally, it could even give the UK stock market – which has underperformed global markets over the last decade – some support. Let’s say a third of that £290bn went into UK shares. This could give the market a real shot in the arm. Today, the FTSE 250 index (home to many domestically-focused businesses) only has a market cap of £330bn. If nearly £100bn was to come into this index, it could shoot up.

Long-term benefits

Of course, scrapping the Cash ISA wouldn’t suit everybody. There are plenty of people with lower risk profiles who like to keep their money in cash savings products (you can keep cash in a Stocks and Shares ISA).

But I believe that people would adapt to the situation over time if it was scrapped. And in the long run, I think the benefits would far outweigh the disadvantages.

The post Could the Cash ISA be scrapped? appeared first on The Motley Fool UK.

More reading

Ed Sheldon has positions in Amazon, Apple, and Nvidia. The Motley Fool UK has recommended Amazon, Apple, and Nvidia. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024