Could Plug Power, Inc. Be a Millionaire-Maker Stock?

The future of renewable energy is very bright. Solar and wind are becoming competitive with fossil fuels as cheap producers of electricity. Battery costs are falling sharply, potentially changing the calculus on the necessity to maintain "baseload" power plants. At the same time, cheaper wind and solar will make production of hydrogen cheaper, helping bridge the gap for what has been a bit of a "holy grail" of renewable fuel for transportation and remote power generation.

And with well over a decade in the business of making fuel cells, Plug Power Inc. (NASDAQ: PLUG) has grown its sales from less than $20 million per year in 2005 to over $100 million the past 12 months. But over that same period, its stock price has fallen 96% as the company has issued new shares to keep afloat, washing investors out in the process.

Image source: Getty Images.

Are we on the cusp of seeing fuel cells finally emerge as a major force in renewable energy and transportation? Could this result in Plug Power finally reaching its potential and investors riding the company to riches? While it's not out of the realm of possibility, the company has been a terrible investment so far. Until management can demonstrate it can operate within its own cash flows, that seems set to remain the case.

Revenue growth hasn't added any value so far

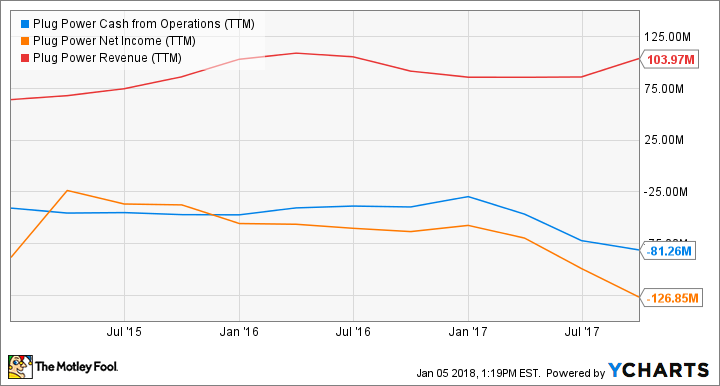

Over the past year, Plug Power's sales are up 21% and has increased 62% since the beginning of 2015. But over that same period, the company's GAAP earnings and cash flows have worsened:

PLUG Cash from Operations (TTM) data by YCharts

A big part of the problem is poor execution. As much as the company has grown sales with agreements with big customers including Amazon.com and Wal-Mart, which use the company's equipment to power forklifts in its distribution centers, it has failed to run that incremental revenue into profits. As a matter of fact, "operational efficiencies" are driving gross margins down. Management had forecast adjusted gross margin between 8% and 12% in 2017 but now expects a range of 5% to 6%.

The big problem here is that manufacturers should gain operating leverage from higher volume, since fixed costs are spread over more products sold. Plug Power hasn't seen that happens so far.

More equity destroyed, balance sheet has worsened

To add insult to injury, the company sold more stock over the period to raise cash, increasing the share count -- and diluting existing investors -- by 27%. This isn't a new thing for Plug Power or its investors, who have seen the company issue stock on a regular basis just about every year since going public. Over the past five years the company's share count has more than tripled, in part because the company has been forced to raise cash to fund the business. The company has also added about $40 million in debt over the past year.

For years the company has steadily burned through its cash and diluted investors. That situation hasn't changed in recent years, even as sales have improved:

PLUG Shares Outstanding data by YCharts

At the table shows, Plug Power raised a lot of cash in 2014 after selling a lot of equity, but it has steadily burned through that cash even as it has had to issue even more stock.

Until Plug Power shows it can change, don't expect it to change

Hydrogen fuel cells are far more viable today than at any point in history, and it's likely that their use will only grow from here, especially as hydrogen production costs fall and the infrastructure improves. At the same time, there will be opportunities for investors to do well.

And eventually Plug Power could become one of the companies to profit. However, so far the company has only proved adept at destroying shareholder value, not making millionaires. Until management demonstrates it can meaningfully improve cash flows and turn the growth in demand for its products into better operating results, it remains a stock investors should probably avoid.

More From The Motley Fool

Jason Hall has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance