Could the tax code be used to take on China? Joe Biden and others think so

The debate over China during the campaign has usually involved little more than name calling. The Trump campaign calls its opponent “Beijing Biden,” while Joe Biden’s allies say that the president “got conned” by the Chinese during the last four years.

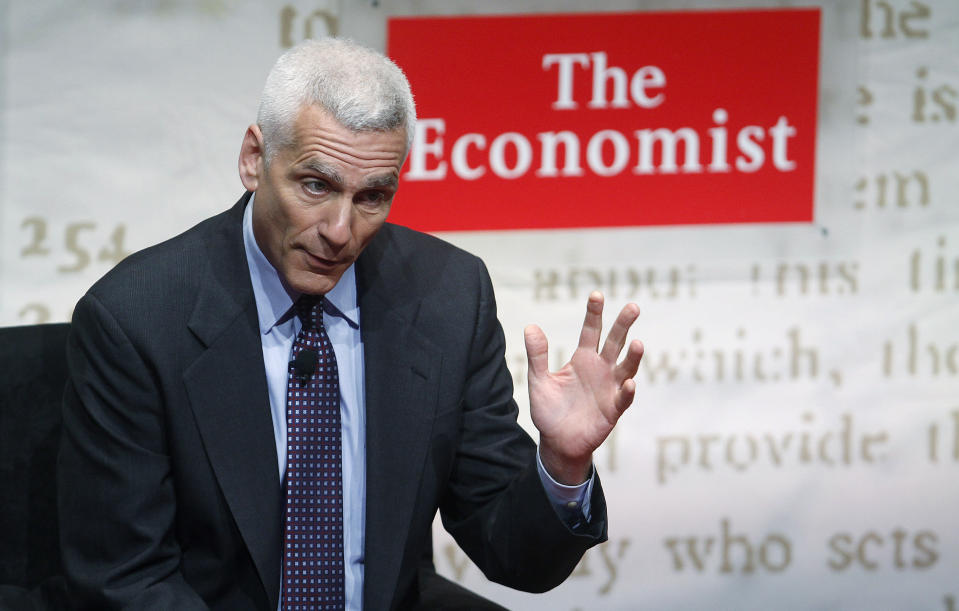

But in a recent interview with Yahoo Finance, one of Biden’s top economic advisors laid out a bit more detail about how a President Biden might approach the issue. Jared Bernstein, who was chief economist to Biden in the White House under President Obama and currently advises his 2020 campaign, described the candidate’s three-part plan for dealing with China.

He also talked about the need to “get the tax policy right to stop incentivizing offshoring,” adding that “this is key” to take on China. It’s an idea that could find bipartisan support in the years ahead. Sen. Lindsey Graham, one of President Trump’s staunchest allies on Capitol Hill, recently introduced a bill that includes a similar idea for tax credits for manufacturers.

Trump’s campaign has also signaled support for the idea in broad terms. Their second-term agenda includes “Tax Credits for Companies that Bring Back Jobs from China.” Some experts have also suggested there might not be that much difference between a Biden and Trump approach to China.

The still-to-be-answered question is: if tax reforms can make their way through Washington in the years ahead, how big of an impact might they have on the bipartisan effort to decouple the U.S. with China and on the deficit?

Garrett Watson, a senior policy analyst at the Tax Foundation, is optimistic that “there might be opportunities to think bigger,” to reform the tax code in the years ahead. But, in an interview with Yahoo Finance, he cautioned that “it's unlikely to completely change the state of the game as it relates to investment in China.”

‘This has been kind of under-reported and under-appreciated’

Bernstein said Biden’s approach would be a big shift after Trump’s 2017 tax cuts which, he argues, “seriously incentivized corporations to go offshore.”

“I think this has been kind of under-reported and under-appreciated,” he said in an interview with Yahoo Finance.

Economists have wrestled in recent years with the question of whether Trump’s 2017 tax cuts encouraged or discouraged outsourcing. The tax law undoubtedly transformed how the tax code applies to multinational corporations. It cut tax burdens on companies for both their national and foreign earnings by slashing the overall corporate tax rate from 35% to 21%. The law also changed the rules to implement what’s known as a territorial tax system. That means, in essence, that corporations could save money if they had a subsidiary in a country with a lower corporate tax rate than the U.S.

Some have argued that the law’s changes “opened the floodgates” for outsourcing. Other studies found that the law produces – on net – a slight incentive to make investments inside the United States but more could be done.

Bernstein also said that government procurement can play a role. The government buys “$600 billion in goods every year,” and Biden would change the rules for purchasing to “onshore those supply chains.”

Carrots and sticks

Biden’s plan offers some details of how he might approach the issue. The campaign promises a manufacturing communities tax credit as an inducement for companies to open factories in the U.S. Biden would also repeal the 2017 Trump tax cuts on income earned overseas and implement clawback provisions as a disincentive for companies with supply chains abroad.

Republican proposals have focused on the carrot side of things. For example, Sen. Graham (R-SC) says his tax credit idea for medical manufacturers “will help revitalize an industry and bring it back to the United States.”

It’s far from a done deal that bipartisan negotiators could find common ground. “There's probably going to be a lot of disagreement about how to do that and what makes sense,” Watson said about what to watch for if Washington tries to tackle the issue in 2021.

The other question is how much the proposals would impact the budget. The national debt is at record levels and both Biden and Trump have made a series of promises that would likely run the debt even higher.

New tax credits could pull even more money out of the U.S. Treasury, while tax penalties could bring more money in. Watson’s group, in an analysis of Biden’s tax plan, mentioned the provisions but didn’t analyze the cost of his proposals “due to the lack of detailed information.”

“We don't have enough details,” Watson said. But he did predict that “it's unlikely to be significant” in its impact on the overall deficit “relative to other tax proposals in [Biden’s] plan.”

If provisions end up being narrowly targeted at specific industries, Watson said, “that of course is going to have a much lower revenue amount than a more generalized credit.”

Ben Werschkul is a producer for Yahoo Finance in Washington, DC.

Read more:

How Biden would undo the Trump tax cuts

Here’s why Biden may be good for ‘the investing climate’

Biden's tax plan: Eyes on the 1% and corporations like Amazon

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance