'I couldn't file my tax return... my wife was seeing aliens'

If you’re likely to miss the tax self-assessment deadline later this month, you’d better come up with a few better excuses than these…

The taxman has published some of the worst – or perhaps best – reasons for failing to file on time.

Among the most “wildly optimistic” excuses was the man who claimed: “I couldn’t file my return on time as my wife has been seeing aliens and won’t let me enter the house.”

MORE: How was Christmas for you? 10,000 people filed self-assessment tax forms

Other reasons submitted but ultimately rejected included the forms being upstairs in the house and the person suffering from vertigo so he or she was unable to fetch it.

HMRC also sees a raft of frankly ridiculous attempts to claim expenses, such as seeking to claw back 250 days-worth of sausage and chips meals at £4.50 a time.

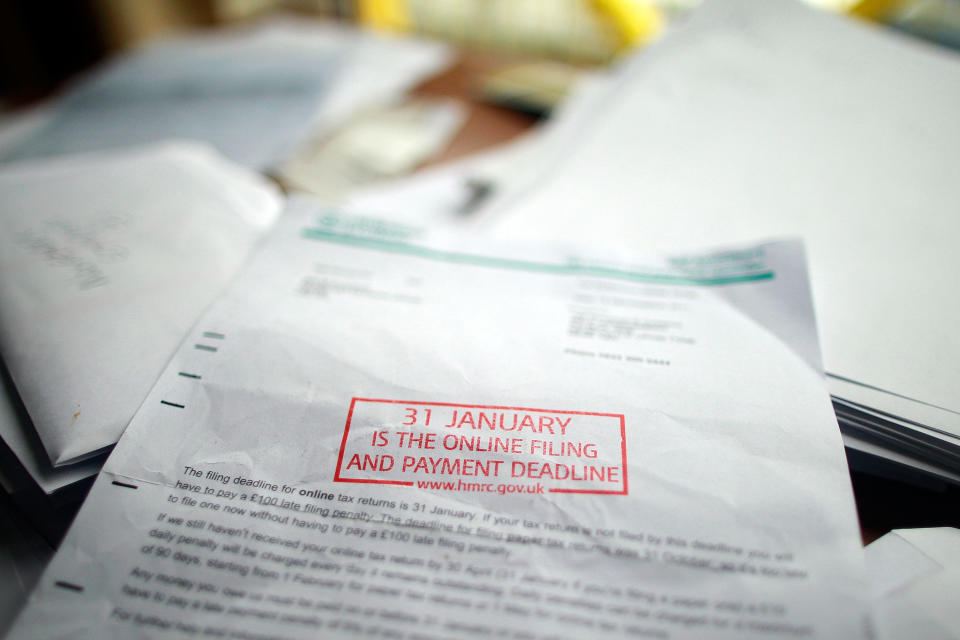

The deadline for this year’s returns, which can now only be filed online as the paper deadline passed in October last year, is January 31.

Last year, nearly 33,000 people filed within the hour before the deadline, but another 840,000 missed the cut-off point – incurring an automatic £100 fine.

With the explosion in the gig economy, some 11 million people are now required to fill in a self-assessment form or get their accountant to do it for them.

Those who fail to complete the forms within three months will see a penalty of £10 per day, up to a maximum of £900.

Angela MacDonald, HMRC director general of customer services, said: “Each year we’re making it easier and more intuitive for our customers to complete their tax return.

“But each year we still come across some questionable excuses, whether that’s blaming a busy touring schedule or seeing aliens.

MORE: ‘Shockingly lethargic’ pension reforms risk creating lost generation of gig workers

“We also receive absurd expense claims from vet fees for a rabbit to room service at a hotel. It is unfair to make honest taxpayers pick up the bill for other people’s spurious claims, so HMRC will only accept sincere claims such as legitimate expenses for a job.

“However, help will always be provided for those who have a genuine excuse for not submitting their return on time.”

Top 5 excuses:

I couldn’t file my return on time as my wife has been seeing aliens and won’t let me enter the house.

I’ve been far too busy touring the country with my one-man play.

My ex-wife left my tax return upstairs, but I suffer from vertigo and can’t go upstairs to retrieve it.

My business doesn’t really do anything.

I spilt coffee on it.

Top 5 spurious expenses claims:

A three-piece suite for my partner to sit on when I’m doing my accounts.

Birthday drinks at a Glasgow nightclub.

Vet fees for a rabbit.

Hotel room service – for candles and prosecco.

£4.50 for sausage and chips meal expenses for 250 days.

Yahoo Finance

Yahoo Finance