Coronavirus lockdown measures protect banks and landlords more than families

The UK government’s coronavirus response has left the poorest to shoulder the most economic risk and will widen inequality across UK, according to a think tank.

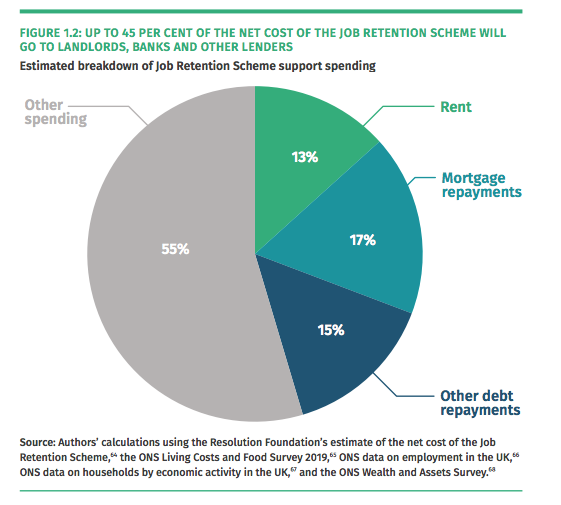

Up to 45% of the net cost of the government’s furlough scheme will be spent on rent and debt repayments to landlords, banks and other lenders, according to the Institute for Public Policy Research (IPPR).

This would come to a total of £10bn ($12bn) under a three-month shutdown, and £21bn if the lockdown and furlough scheme continued for six months, says a new paper published by IPPR on Wednesday.

Millions of people across the country are experiencing a hit to their incomes, as over 6 million workers have been furloughed on the government’s job retention scheme, and about 1.4 million people had applied for Universal Credit by mid April.

READ MORE: Just 10% of promised government-backed coronavirus loans reach businesses

The COVID-19 lockdown will widen inequality across the UK as wealthier households have the opportunity to make significant savings from reduced “discretionary” spending on holidays, hotels, restaurants and cultural and leisure activities. However, as poorer household spend less on these in the first place, they have little room to make such savings.

Most families are seeing little change in the costs of household bills for food, utilities and other essentials as well as the costs of rent, mortgages and other repayments. Even those who take advantage of rent or repayment “holidays” will eventually have to pay off their debts, with additional interest.

Households in the second highest income decile may be saving an extra £189 per week on average, where earners are able to continue working from home, according to IPPR.

At the other end of the scale, those in the second lowest income decile may be adding an average £12 a week to their existing debts, if earners are furloughed on 80% of their salary.

IPPR says this will result in poorer households shouldering most of the economic impact of the lockdown while landlords and lenders are protected.

The think tank is warning that if families come through the coronavirus crisis less able to spend because their debts are higher, it will take longer for the economy to recover.

“The long-term effects of rising indebtedness on the one hand, and a likely rebound in asset prices on the other, are likely to further widen inequalities between the working poor and the asset-owning wealthy,” IPPR said.

“Without steps to actively redress these inequalities and to ensure the risks of the crisis are fairly shared, the UK’s economic recovery is likely to be slow, uneven and unfair, worsening existing structural imbalances.”

READ MORE: UK furlough scheme extended to October with part-time work allowed

IPPR economists analysed a range of publicly available data, including from the Office for National Statistics and made calculations based on an assessment of the likely changes to household spending during lockdown, including savings in the cost of travel to work for all households.

They are calling on the government to implement short-term measures to ensure that banks, landlords and the wealthy also take their share of the burden.

These include capping interest rates on the state-backed portion of new business loans at 0% or 0.5%, considering bans on dividends and share buybacks so that government support for large businesses does not indirectly subsidise shareholders and highly-paid executives, boosting renters rights by ending “no fault” evictions, and looking at the possibility of a freeze on rent, debts and bills for some struggling households, without new debts accruing, within current legal frameworks.

Carys Roberts, IPPR’s executive director, said: “IPPR’s research finds that while millions of people across the country are seeing a hit to their incomes, the government is under-writing the income of banks and landlords without any obligation to take a similar hit. That amounts to an implicit bailout.

READ MORE: Coronavirus could create £105bn debt black hole for smaller UK firms

“We mustn’t repeat the mistakes of previous crises, by asking those least able to weather the crisis to make the greatest sacrifices. The economic risks and costs of the shutdown should be shared fairly across society.

“The government must urgently ensure that its programme of support is protecting those who need it. And as we emerge from this crisis, it will be critically important to rebuild a fairer economy, with those whose incomes have been protected contributing more.”

Yahoo Finance

Yahoo Finance