Cineworld, IAG and housebuilder stocks rocket on COVID-19 vaccine news

WATCH: Pfizer’s Covid-19 vaccine is ‘more than 90% effective’

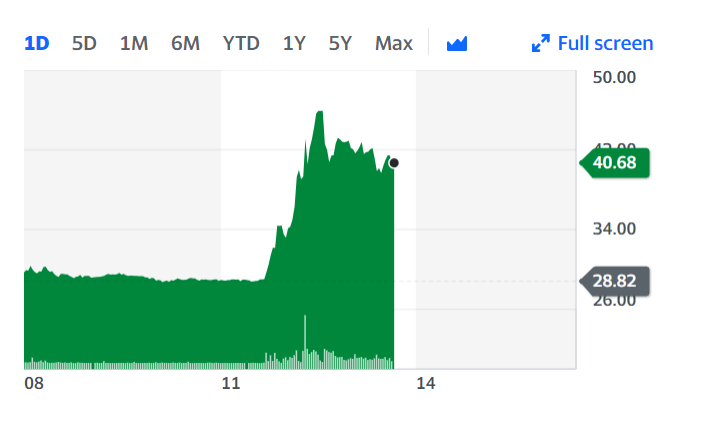

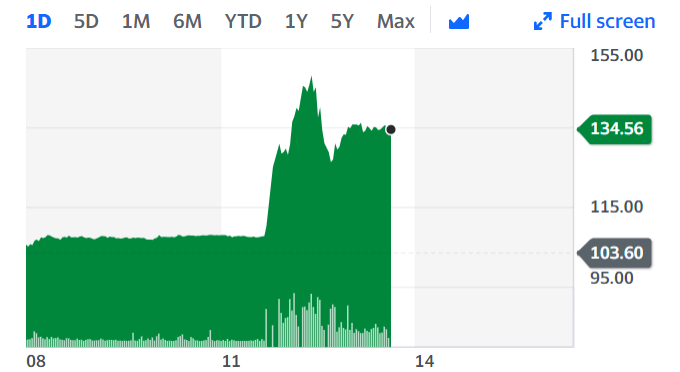

Shares of Cineworld (CINE.L) and British Airways owner International Airlines Group (IAG.L) soared amid a broader global market rally after two companies announced their vaccine candidate is more than 90% effective in preventing COVID-19 in a trial of over 43,000 participants. Housebuilder Taylor Wimpey (TW.L) also saw shares rise about 20%.

The vaccine announcement came from Germany’s BioNTech (BNTX) and its US pharma partner Pfizer (PFE) and investors welcomed fresh hopes of a coronavirus vaccine, along with the prospect of Joe Biden in the White House.

Hammerson (HMSO.L), a British property development and investment company, saw shares go up 30%.

Markets.com noted that travel stocks like IAG (up 30%) and EasyJet (EZJ.L) (up 26%) are among the best risers on the UK market, while Cineworld’s rise of 40% is “indicative of a major rotation back into stocks that have been hardest hit by the pandemic.”

WATCH: Coronavirus vaccine hopes spark global stock market surge

However, the report warned that in the case of Cineworld, Britain’s biggest cinema chain, “the 9.4% stock out on loan points to a nasty short squeeze that may exaggerate the move.”

READ MORE: Stocks rally on Pfizer vaccine 'critical milestone' and Biden victory

Stock markets rallied around the world on Monday, as investors welcomed the prospect of Joe Biden in the White House and fresh hopes of a coronavirus vaccine.

Leading European and Asian indices as well as emerging markets leapt on Monday, while Wall Street futures were also pointing to a bounce in the US later in the day. The FTSE 100 was up about 5.6% Monday afternoon.

According to Neil Wilson, chief market analyst for Markets.com: “Initial optimism is exceedingly high and could fade – we should not be jumping any guns here – but ultimately a vaccine that works effectively would be good for the economy.”

He said “the biggest gainers in a frantic session today are among those stocks worst hit by the pandemic – travel and leisure chiefly, whilst Covid winners are doing poorly. We should be careful in overreacting – but it’s clear the market is forward looking and pricing in recovery in a number of beaten-down areas next year.”

He also pointed out that certain questions still remain unanswered, such as when a vaccine will get fully rolled out.

READ MORE: Cineworld 'to shut' all cinemas in the UK and Ireland risking 5,500 jobs

Last month, Cineworld said it could close all its screens in the UK and Ireland, as soon as next week, following the news that the latest James Bond movie would be delayed until April next year.

Taylor Wimpey said earlier on Monday it expects operating profits this year to reach the top end of forecasts. Meanwhile, IAG nosedived to a €6.2bn (£5.6bn, $7.2bn) pre-tax loss for the first nine months of the year.

Yahoo Finance

Yahoo Finance