Crane Co (CR) Q1 2024 Earnings: Aligns with Analyst Projections and Raises Full-Year Guidance

Earnings Per Share (EPS): Reported EPS of $1.12 for Q1 2024, slightly below the estimated $1.13.

Revenue: Achieved $565 million in Q1 2024, surpassing estimates of $546.39 million.

Net Income: Recorded at $64.8 million, falling short of the estimated $65.10 million.

Annual EPS Guidance: Raised to $4.75-$5.05 from the previous range of $4.55-$4.85.

Acquisition: Announced the acquisition of CryoWorks, Inc. for approximately $61 million, expected to close by April 30, 2024.

Dividend: Declared a regular quarterly dividend of $0.205 per share for Q2 2024.

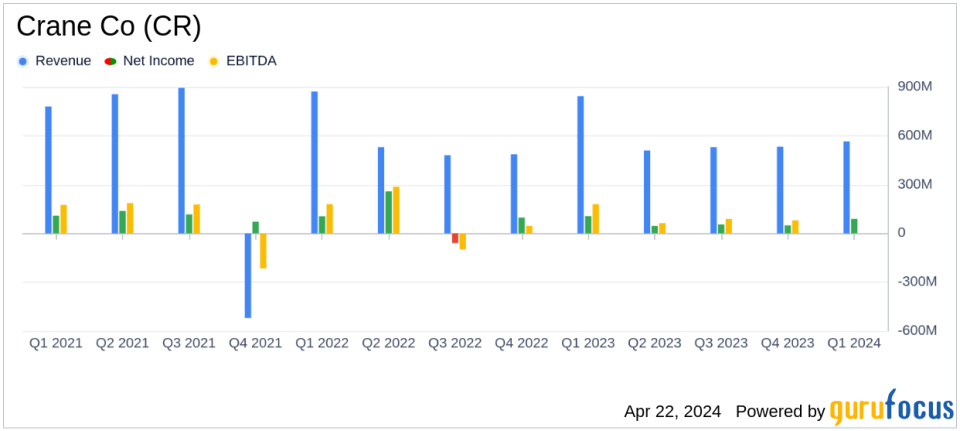

On April 22, 2024, Crane Co (NYSE:CR) disclosed its first quarter financial results for 2024, demonstrating a consistent performance that aligns closely with analyst expectations. The company reported earnings per share (EPS) of $1.12, closely matching the estimated $1.13, and an adjusted EPS of $1.22. Crane Co also announced a strategic acquisition and an upward revision of its full-year EPS forecast. The details of these financial outcomes can be accessed through Crane Co's recent 8-K filing.

Crane Co, a diversified industrial firm, operates through three segments: Aerospace & Electronics, Process Flow Technologies, and Engineered Materials. In 2023, the company generated approximately $2.1 billion in revenue, showcasing its significant role in manufacturing products ranging from aerospace components to engineered materials.

Financial Highlights and Strategic Developments

The first quarter of 2024 saw Crane Co achieving a net sales increase of 10% year-over-year, reaching $565 million, which surpasses the estimated $546.39 million. This growth was driven by a 5% increase in core sales and contributions from recent acquisitions. The company's operating profit also saw a robust increase, rising 15% to $89 million.

Crane Co's strategic maneuvers include the acquisition of CryoWorks, Inc. for approximately $61 million, a move poised to enhance its Process Flow Technologies segment, particularly in the hydrogen market. This acquisition aligns with Crane's growth initiatives and is expected to close by April 30, 2024.

Segment Performance and Market Challenges

The Aerospace & Electronics segment reported a significant 25% increase in sales, benefiting largely from the Vian acquisition and organic growth. However, the Process Flow Technologies and Engineered Materials segments faced some challenges. The former experienced a slight decline in core sales due to ongoing weakness in the European Chemical markets, while the latter saw a 12% decrease in sales, attributed to lower volumes.

Despite these challenges, Crane Co's overall financial health appears robust, with the company raising its full-year adjusted EPS guidance to $4.75-$5.05, up from the previous range of $4.55-$4.85. This adjustment reflects confidence in the company's operational strategies and market position.

Operational and Financial Metrics

Crane Co's balance sheet remains strong with a cash balance of $219 million and total debt of $357 million as of March 31, 2024. The company's cash flow activities reflect typical seasonal patterns, with a reported free cash flow of negative $89 million for the quarter.

The firm continues to focus on strategic acquisitions and internal growth initiatives to bolster its market presence across its segments. With a solid track record of successful acquisitions, Crane Co is well-positioned to leverage its financial stability for future growth opportunities.

Outlook and Investor Confidence

Max Mitchell, Chairman, President, and CEO of Crane Co, expressed strong confidence in the company's trajectory, citing robust order and backlog growth as key indicators of sustained performance. The company's proactive management of supply chain issues and strategic acquisitions are expected to drive continued success.

Investors and stakeholders are likely to find reassurance in Crane Co's steady financial performance and strategic direction, underscored by the alignment of Q1 results with analyst estimates and the optimistic full-year earnings guidance.

For more detailed information and to follow Crane Co's progress, including upcoming financial reports and strategic initiatives, visit www.craneco.com.

Explore the complete 8-K earnings release (here) from Crane Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance