Crane (CR) Beats on Q1 Earnings, Alters GAAP EPS View

Crane Co. CR kept its earnings beat streak alive in the first quarter of 2022, thus delivering better-than-expected results for the fifth consecutive quarter. The quarterly earnings surpassed the Zacks Consensus Estimate by 7.7%. Sales surprise is 0.7%.

Adjusted earnings were $1.81 per share, surpassing the Zacks Consensus Estimate of $1.68. The bottom line expanded 9% from the year-ago quarter’s figure of $1.66. Sales growth and margin expansion drove the quarterly performance.

Revenue Details

In the quarter, Crane’s net sales were $801 million, reflecting growth of 3% from the year-ago quarter’s reading. Results reflect the strength in Crane’s core businesses.

The quarterly net sales surpassed the Zacks Consensus Estimate of $796 million.

Crane reports net sales under three segments, namely Process Flow Technologies, Payment & Merchandising Technologies, and Aerospace & Electronics.

The segmental information is briefly discussed below:

Revenues from Process Flow Technologies (representing 38.8% of the quarter’s total revenues) were $311 million, reflecting growth of 8% from the year-ago quarter’s tally. Results benefited from a gain of 10% in organic sales. However, movements in foreign currencies had an adverse impact of 2% on sales The segment’s order backlog was $372.4 million in the reported quarter, reflecting sequential growth of 4.1%.

Revenues from Payment & Merchandising Technologies (representing 41.6% of the quarter’s total revenues) totaled $333 million, decreasing 1% year over year due to a 3% downward movement in foreign currencies. Organic sales grew 1% from the year-ago quarter’s figure. The order backlog at the end of the reported quarter was $429 million, down 2.1% sequentially.

Revenues from the Aerospace & Electronics segment (representing 19.6% of the quarter’s total revenues) were $157 million, increasing 2% year over year. The order backlog at the end of the quarter was $508.4 million, up 10.6%, sequentially.

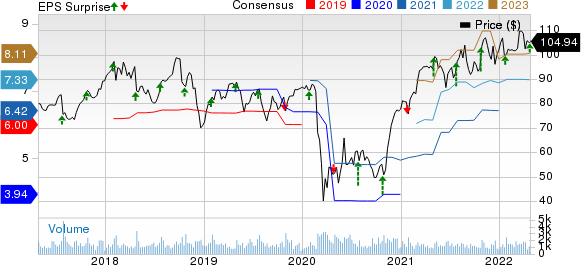

Crane Co. Price, Consensus and EPS Surprise

Crane Co. price-consensus-eps-surprise-chart | Crane Co. Quote

Margin Profile

In the first quarter, Crane’s cost of sales of $473.8 million reflected a 0.7% increase from the year-ago quarter’s number. The metric represented 59.1% of net sales compared with 60.4% in the year-ago quarter. Selling, general and administrative expenses increased 14.6% to 193.7 million. The same represented 24.2% of net sales compared with 21.7% in the year-ago quarter.

Adjusted operating income in the first quarter increased 10% year over year to $141 million, while margin expanded 110 basis points to 17.6%. Operating results gained from a favorable mix and higher volumes. Interest expenses, net, in the reported quarter were $11.1 million, down 18.4% year over year.

Balance Sheet and Cash Flow

Exiting the first quarter, Crane had cash and cash equivalents of $307.2 million, down 35.8% from $478.6 million at the end of the fourth quarter of 2021. The long-term debt balance was $842.7 million, compared with the previous quarter’s $842.4 million.

In the first three months of 2022, Crane made no repayment of commercial paper (maturity >90 days).

In the first three months of 2022, CR used net cash of $49.3 million from operating activities, compared with $47.6 million generated in the year-ago-period. Capital expenditure was $12.5 million, higher than $4.7 million spent in the previous year. Free cash outflow was $61.8 million, compared with 42.9 million free cash flow generated in the year ago period.

Shareholder-Friendly Policy

In first-quarter 2022, Crane used $26.7 million for paying out dividends, up 6.8% from the year-ago quarter’s level. Share reacquisitions in the quarter amounted to $175.8 million. It is worth noting that CR completed the previously announced share repurchase program worth $300 million in April 2022.

Concurrent with the earnings release, Crane announced a dividend of 47 cents per share for the second quarter of 2022. CR will pay out the dividend on Jun 8, 2022, to its shareholders of record as of May 31, 2022.

2022 Outlook

Crane adjusted its full-year GAAP earnings from continued operations to $6.35-$6.75 from the earlier issued projection of $6.85-$7.25. Management anticipates adjusted earnings per share of $7.00-$7.40 (excluding special items) for the year.

CR expects an operating cash flow of $410-$450 million and a capital expenditure of $60 million for 2022. Free cash flow is projected to be $350-$390 million.

Zacks Rank & Stocks to Consider

With a market capitalization of $5.9 billion, Crane currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks are discussed below:

Griffon Corporation GFF presently sports a Zacks Rank #1 (Strong Buy). GFF’s earnings surprise in the last four quarters was 56.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, GFF’s earnings estimates have increased 9% for fiscal 2022 (ending September 2022). The stock has declined 17.1% in the past three months.

Donaldson Company, Inc. DCI presently carries a Zacks Rank #2. DCI delivered a trailing four-quarter earnings surprise of 4.2%, on average.

Earnings estimates for DCI have increased 0.7% for fiscal 2022 (ending July 2022) in the past 60 days. Its shares have decreased 5.9% in the past three months.

Ferguson plc FERG is presently Zacks #2 Ranked. FERG’s earnings surprise in the last four quarters was 14.2%, on average.

In the past 60 days, the stock’s earnings estimates have increased 7% for fiscal 2022 (ending July 2022). The same has declined 14.7% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Donaldson Company, Inc. (DCI) : Free Stock Analysis Report

Crane Co. (CR) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

Wolseley PLC (FERG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance