Credit Acceptance (CACC) Incurs Q1 Loss as Provisions Jump

Credit Acceptance Corporation CACC incurred first-quarter 2020 loss of $4.61 per share against the Zacks Consensus Estimate of earnings of $4.15. The company had recorded earnings of $8.65 per share in the prior-year quarter. Notably, the figure includes certain non-recurring items.

The results were adversely impacted by a significant increase in provisions and higher operating expenses. However, an improvement in revenues was a tailwind.

Excluding non-recurring items, net income (non-GAAP basis) was $175.7 million or $9.66 per share, up from $153.6 million or $8.08 per share in the prior-year quarter.

GAAP Revenues & Expenses Rise

Total revenues were $389.1 million, up 10% year over year. This increase was largely driven by a rise in finance charges. Also, the figure beat the Zacks Consensus Estimate of $339.4 million.

Operating expenses of $147.2 million rose 10.7% from the prior-year quarter. Increase in sales and marketing costs, general and administrative costs, as well as interest expenses largely attributed to the rise.

As of Mar 31, 2020, net loans receivable amounted to $6.6 billion, down 1% from the prior quarter. Total assets were $7.3 billion as of the same date, which declined 2% sequentially. Also, total stockholders’ equity was $2 billion, down 16.5% from the prior quarter.

Credit Quality Deteriorates

Provision for credit losses surged substantially from the year-ago quarter to $354.7 million. The rise was mainly due to the adoption of CECL on Jan 1, 2020 and the impact of a reduction in expected future cash flows from its loan portfolio.

Allowance for credit losses at first quarter-end was $3.2 billion, up significantly year over year.

Our Viewpoint

Credit Acceptance is well poised for revenue growth, given the persistent rise in consumer loans. However, persistently increasing expenses and deteriorating asset quality are key near-term concerns.

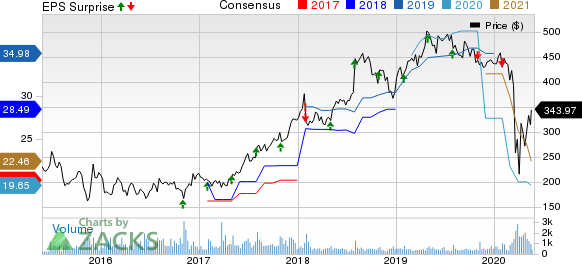

Credit Acceptance Corporation Price, Consensus and EPS Surprise

Credit Acceptance Corporation price-consensus-eps-surprise-chart | Credit Acceptance Corporation Quote

Currently, Credit Acceptance carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Consumer Loan Stocks

Zacks #4 (Sell) Ranked Ally Financial’s ALLY first-quarter 2020 adjusted loss was 44 cents per share against the Zacks Consensus Estimate of earnings of 71 cents. The year-ago quarterly earnings were recorded at 80 cents per share.

Sallie Mae SLM, also a #4 Ranked stock, reported first-quarter 2020 core earnings of 79 cents per share, lagging the Zacks Consensus Estimate of 88 cents. However, the figure compared favorably with 34 cents reported in the prior-year quarter.

Zacks #3 Ranked Capital One’s COF first-quarter 2020 adjusted loss was $3.02 per share against the Zacks Consensus Estimate of earnings of $2.56. The year-ago quarterly earnings were $2.90 per share.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SLM Corporation (SLM) : Free Stock Analysis Report

Capital One Financial Corporation (COF) : Free Stock Analysis Report

Credit Acceptance Corporation (CACC) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance