Credit Suisse (CS) Settles Lawsuit With Lehman for $385M

Credit Suisse Group CS has reached a $385 million settlement with the Lehman Brothers Holdings’ bankruptcy estate over terminated derivatives transactions. The settlement is subject to court’s approval.

The Zurich-based lender expects the settlement to impact its strategic resolution unit by about $70 million, which it considers immaterial to its financial position. Also, Credit Suisse noted that the process of winding down its strategic resolution unit is ongoing and would be completed by the end of 2018.

Brief on the Spat Between Both Companies

Credit Suisse had filed a $1.2 billion worth lawsuit against Lehman almost a decade ago in order to claim the losses it incurred due to the early termination of derivatives trading of Lehman products when the latter went bankrupt.

Before its collapse in 2008, Lehman was one of the largest investment banks in the United States. Following the lawsuit, in 2013, it had alleged Credit Suisse of having increased the claims by nearly $1 billion in order to profit from bankruptcy at the expense of other creditors.

Over the years, Lehman also addressed cases of Wall Street biggies like JPMorgan Chase and Citigroup involving billions of dollars in allegedly "phantom losses" designed to ensure that they recover 100% of the derivatives claim. Credit Suisse was the last major party that Lehman settled with.

Recently, Credit Suisse entered a non-prosecution agreement with the Department of Justice in order to put to rest investigations on its hiring practices in the Asia-Pacific region between 2007 and 2013.

Though the bank has not been accused of any criminal activities, it is required to make a small penalty payment of $47 million to the regulator, which is not likely to have a material impact on its financials.

Credit Suisse has been through a lot of restructuring lately and has finally reached the final leg. The bank remains on track to achieve adjusted operating expenses of below $4.8 billion in 2018. These efforts to improve its financials encourage us.

However, persistent legal hassles continue to hurt the bank’s reputation. Also, it incurred an annual loss in 2017 due to a one-time charge related to the U.S. tax reform. Investors at Credit Suisse have reached the end of their patience and another annual loss might not be in its CEO’s favor.

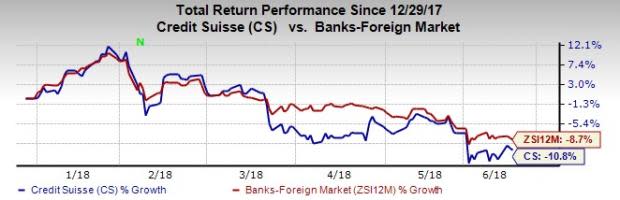

Shares of Credit Suisse have lost 10.8% so far this year compared with 8.7% decline of the industry.

Currently, the stock carries a Zacks Rank #4 (Sell).

A few better-ranked stocks from the same space are Banco de Chile BCH, Banco Santander-Chile BSAC and Bank of Montreal BMO. Each of these currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Banco de Chile have gained 27.4% over the past 12 months. Its Zacks Consensus Estimate for the current-year earnings has moved up 1% over the last 60 days.

Banco Santander-Chile’s shares have gained 30.8% in the past year. Its Zacks Consensus Estimate for the current year has remained stable over the last 60 days.

Bank of Montreal’s shares have gained 16.1% over the past 12 months. Its Zacks Consensus Estimate for the current fiscal’s earnings has climbed 1.5% over the last 60 days.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Credit Suisse Group (CS) : Free Stock Analysis Report

Bank Of Montreal (BMO) : Free Stock Analysis Report

Banco De Chile (BCH) : Free Stock Analysis Report

Banco Santander Chile (BSAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance