CREDIT SUISSE: The UK is 'flirting with recession' and it could begin by the end of the year

REUTERS/Yiannis Kourtoglou

LONDON — Britain is "flirting with recession" and could see its economy start to contract within six months, according to a new note from Swiss banking giant Credit Suisse circulated to clients on Wednesday.

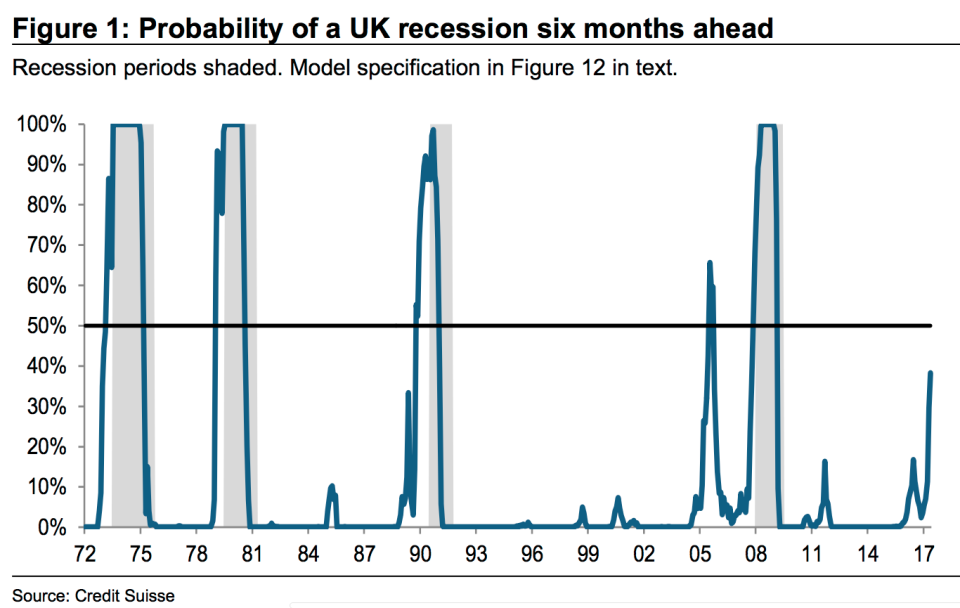

Analysts Sonali Punhani, Peter Foley, and Neville Hill argue that while a recession is not hugely likely and does not represent the bank's central scenario, there is as much as a 38% chance that a technical recession could be on the cards.

Britain's economy grew just 0.2% in the first quarter of the year, and most current forecasts are for growth to be around that level in the second quarter as well.

That, Credit Suisse's team says, is a troubling sign.

"Quarterly growth that is only narrowly in positive territory raises the prospect of a technical recession. That is not our central scenario, but the risks are increasing, and the volatile political backdrop and unpredictable Brexit negotiations have increased the uncertainty of our forecasts."

A technical recession occurs when an economy contracts for two consecutive quarters. If the UK's GDP were to shrink 0.1% in both the third and fourth quarters of 2017 that would be considered a technical recession.

However, in the hypothetical (and highly unlikely) scenario that the economy shrunk 1.1% in Q3, grew 0.1% in Q4, and then contracted a further 1% in Q1 of 2018, that would not strictly count as a technical recession.

Credit Suisse was one of the numerous banks to forecast a recession in the aftermath of the vote for Brexit, but acknowledges in its new research that it made errors in its modelling.

"It is worth noting that we forecasted a recession in the UK in the aftermath of the EU referendum last year. The recession didn’t materialize as consumer spending held up better than expected, albeit only thanks to a massive drop in the saving rate," the analysts write.

However, many of the negatives around the economy that could end up causing a recession persist in "haunting" Britain, they argue.

Here are Punhani, Foley, and Hill again (emphasis ours):

"The reasons for expecting a recession after the EU referendum continue to haunt the UK economy and the fundamentals have become weaker over the last few months. We expected a recession post the referendum to be driven by a halt in business investment as firms react to the uncertainty triggered by the vote; and a squeeze in consumer spending as a consequence of currency depreciation and higher inflation. These drivers are materializing now (later than we initially expected) and are likely to worsen as political uncertainty continues post the election and at the onset of Brexit negotiations."

Consequently, the chance of a recession is more than a third, they say. That could get even higher in the event that the Bank of England hikes interest rates before the end of the year, although that seems unlikely given Tuesday's inflation figures showing an unexpected fall in how fast the price of goods rose during June.

"We have estimated a number of models that put the chances of a recession in the UK in the next six months in a 25%-38% range," the trio write.

"Importantly, we estimate that a 25 bps hike by the BoE would increase the probability of a recession by around 5%."

Here's that prediction in chart form:

Credit Suisse

NOW WATCH: HENRY BLODGET: This chart explains everything that's wrong with the economy today

See Also:

SEE ALSO: Inflation suffers a surprise fall in June, dropping from its highest level since the Brexit vote

Yahoo Finance

Yahoo Finance