CrossFirst Bankshares Inc (CFB) Posts Q1 Earnings, Aligns with Analyst EPS Projections

Net Income: Reported at $18.2 million, consistent with analyst estimates.

Earnings Per Share (EPS): Delivered $0.36 per diluted share, aligning with analyst projections.

Revenue: Operating revenue reached $62.2 million, slightly below the estimated $63.28 million.

Net Interest Margin: Reported at 3.20% on a fully tax equivalent basis.

Asset Quality: Non-performing assets decreased to 0.27% of total assets.

Loan Growth: Loans increased by 2% compared to the previous quarter.

Deposit Growth: Deposits saw a 1% increase from the prior quarter.

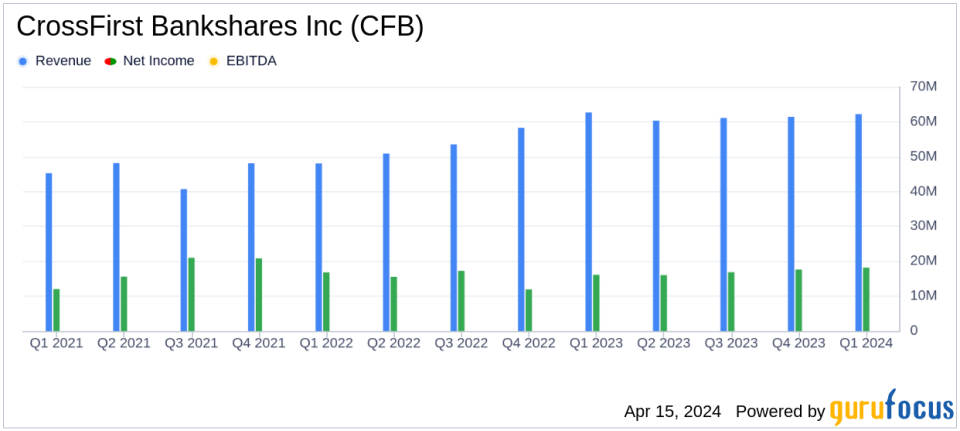

CrossFirst Bankshares Inc (NASDAQ:CFB) released its 8-K filing on April 15, 2024, announcing its financial results for the first quarter of 2024. The bank holding company, which provides a range of banking and financial services including loans and treasury services, reported a net income of $18.2 million, or $0.36 per diluted common share, aligning with analyst expectations for EPS but falling slightly short on revenue estimates.

Financial Performance and Challenges

According to the report, CrossFirst experienced a solid first quarter with organic loan and deposit growth, stable credit quality, and an increase in earnings. The company's operating revenue was $62.2 million, just below the analyst expectation of $63.28 million. The net interest margin on a fully tax equivalent basis was 3.20%, reflecting a competitive interest rate environment.

President and CEO Mike Maddox highlighted the company's successful execution of its strategy to serve clients and drive shareholder return. However, challenges such as pricing pressure on interest-bearing deposits and a reduction in average non-interest-bearing deposits were noted. These factors could potentially impact future profitability if not managed effectively.

Financial Achievements

CFB's financial achievements this quarter are significant for the banking industry, which relies heavily on interest income and loan growth. The bank's ability to increase loans by 2% compared to the previous quarter and manage a stable asset quality, with non-performing assets decreasing to 0.27% of total assets, indicates a strong credit environment and prudent risk management.

Income Statement and Balance Sheet Metrics

The income statement revealed an increase in non-interest income and a decrease in non-interest expense compared to the first quarter of the previous year. The balance sheet showed an increase in total assets, primarily due to loan growth, which included loans acquired from a recent acquisition. Deposits also showed robust growth, a key indicator of the bank's ability to attract and retain customers.

CrossFirst had a solid first quarter with strong organic loan and deposit growth, stable credit quality, expansion of non-interest income, and an increase in earnings, said Mike Maddox, President and CEO of CrossFirst Bankshares, Inc.

Analysis of Company Performance

CFB's performance in the first quarter of 2024 demonstrates alignment with analyst projections for EPS, reflecting the company's ability to meet market expectations. The slight shortfall in revenue compared to estimates may be a point of focus for investors, but the bank's overall financial health appears robust, with solid loan and deposit growth and effective management of asset quality.

The bank's strategic focus on dynamic markets and operational leverage has contributed to its positive performance. However, the competitive landscape and interest rate environment will continue to be critical factors influencing the bank's future earnings potential.

For more detailed information on CrossFirst Bankshares Inc's financial results, including the full income statement and balance sheet metrics, please refer to the full 8-K filing.

Stay tuned to GuruFocus.com for the latest financial news and expert analysis on CrossFirst Bankshares Inc and other value investment opportunities.

Explore the complete 8-K earnings release (here) from CrossFirst Bankshares Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance