CrowdStrike's (CRWD) Q4 Earnings & Revenues Beat Estimates

CrowdStrike CRWD reported fourth-quarter fiscal 2020 non-GAAP loss of 2 cents per share, which surpassed the Zacks Consensus Estimate by 75%. Moreover, the loss was narrower than the prior-year quarter’s loss of 60 cents per share.

The company’s revenues of $152.1 million surged 89% year over year. Moreover, the figure beat the Zacks Consensus Estimate of $136 million.

The top line was primarily driven by a growing customer base. Increase in demand for the Security Cloud platform was a positive.

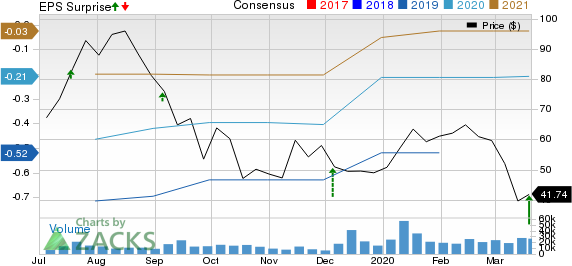

CrowdStrike Holdings Inc. Price, Consensus and EPS Surprise

CrowdStrike Holdings Inc. price-consensus-eps-surprise-chart | CrowdStrike Holdings Inc. Quote

Quarterly Details

Subscription revenues jumped a whopping 90% year over year to $138.5 million. A 116% increase in subscription customers drove the impressive growth of this segment.

Revenues from professional services rose 77.5% year over year to $13.6 million.

The company added $99 million to its net new Average Run Rate (ARR) year over year, achieving $600 million.

Geographically, the United States contributed 73% of revenues, 14% came from Europe, the Middle East and Africa markets, 9% from Asia-Pacific and 4% from other markets.

Notably, the disintegration of Symantec led several of its customers to shift to CrowdStrike during the quarter.

Margins

Additionally, CrowdStrike’s non-GAAP gross margin expanded 600 basis points (bps) on a year-over-year basis to 73%.

Non-GAAP operating margin expanded 31 bps.

Balance Sheet

CrowdStrike exited the fiscal fourth quarter with cash, cash equivalents and marketable securities of approximately $912.1 million compared with $191.6 million at the end of the prior-year quarter.

The company’s balance sheet does not have any long-term debt.

It generated cash flow from operations of $66.1 million compared with $15.8million in the prior-year quarter. Free cash flow came in at $50.7 million.

Guidance

For first-quarter fiscal 2021, CrowdStrike anticipates revenues between $164.3 million and $167.6 million. Non-GAAP net loss per share is estimated to be 7-6 cents.

For fiscal 2021, the company estimates revenues between $723.33 million and $733.5 million.

Non-GAAP loss per share is estimated in a band of 14-10 cents.

Zacks Rank & Other Stocks to Consider

CrowdStrike currently sports a Zacks Rank #1 (Strong Buy).

A few other similar-ranked stocks in the broader technology sector are HP Inc. HPQ, Microsoft Corporation MSFT and Comtech Telecommunications Corp. CMTL. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for HP, Microsoft and Comtech is currently pegged at 2%, 13.22% and 5%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

HP Inc. (HPQ) : Free Stock Analysis Report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

CrowdStrike Holdings Inc. (CRWD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance