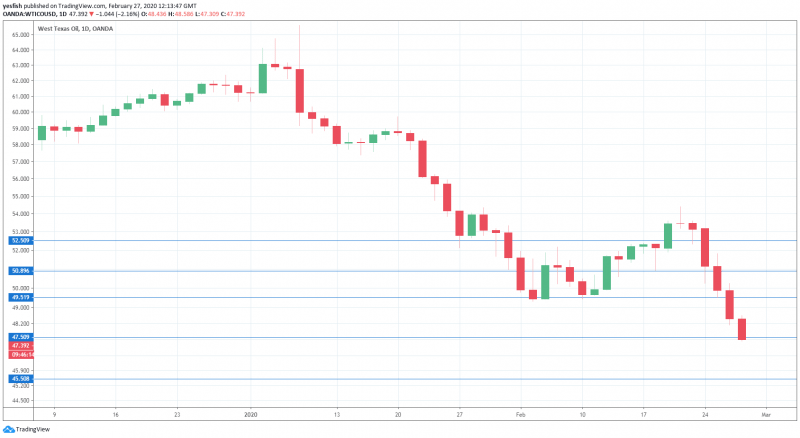

Crude Daily Forecast – Crude Slips Below $48 on Demand Concerns

Crude prices have fallen for a fifth straight day. Currently, U.S. crude oil is trading at $47.40, down $1.03 or 2.1% on the day. Brent crude oil is trading at $52.14, down $1.22 or 2.27%.

Crude Sags as Coronavirus Spreads

It has been a dismal week for crude, which has plummeted 10.8 percent. Investor risk apprehension continues to rise as the coronavirus outbreak has spread to Western Europe. Italy has reported 11 fatalities, while France confirmed its second victim on Wednesday. Spain, Austria and Switzerland have also reported coronavirus cases. It appears to be only a case of time before the virus reaches the United States.

The coronavirus is taking a toll on the global economy, with the disruption to supply chains and the plunge in the global tourism industry. The drop in economic activity has also weighed on the demand for crude, dragging prices lower. Crude fell to a daily low of 47.35 on Thursday, its lowest level since January 2018. With analysts warning that things could worsen before they improve, oil prices will likely remain under downward pressure.

EIA Shows Unexpectedly Small Surplus

The U.S. Department of Energy crude inventory report indicated a small surplus of 0.5 million barrels. This was well below the forecast of 2.3 million barrels. This reading was almost a repeat of the gain of 0.4 million a week earlier. Although the surplus was smaller than expected, the reading failed to stem crude’s slide.

Technical Analysis

WTI/USD continues to fall and break below support levels this week. The pair tested 47.50 earlier on Thursday and this line remains fluid. Below, there is support at 45.50. On the upside, there is resistance at 49.50, followed by resistance at 52.50.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance