Crude Oil Price Update – Increasing Downside Momentum Targets $37.50

U.S. West Texas Intermediate crude oil futures are trading lower on Friday and poised to close lower for the week as inventories rose and record-breaking new coronavirus cases in the United States stoked concern about the pace of economic recovery and fuel demand.

Meanwhile, the International Energy Agency (IEA) bumped up its 2020 oil demand forecast on Friday, but warned that the spread of COVID-19 posed a risk to the outlook.

At 10:35 GMT, August WTI crude oil is trading $38.66, down $0.96 or -2.42%.

“While the oil market has undoubtedly made progress…the large, and in some countries, accelerating number of COVID-19 cases is a disturbing reminder that the pandemic is not under control,” the IEA said.

Prices also dropped after Libya National Oil Corporation announced it had lifted its force majeure on all oil exports after a half-year blockade by eastern forces.

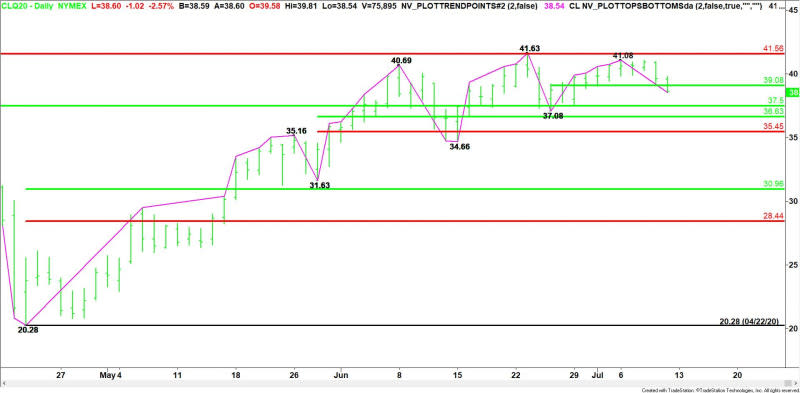

Daily Swing Chart Technical Analysis

The main trend is up according to the daily swing chart. A trade through $41.08 will change the main trend to up. Taking out the main top at $41.63 will reaffirm the uptrend. The main trend will change to down on a trade through $37.08.

The minor range is $37.08 to $41.08. Its 50% level at $39.08 is likely to control the direction of the market today.

The longer-term 50% level at $37.50 and the short-term retracement zone at $36.63 to $35.45 are also potential downside targets and support areas.

On the upside, the longer-term Fibonacci level at $41.56 remains resistance.

Daily Swing Chart Technical Forecast

Based on the early price action and the current price at $38.66, the direction of the August WTI crude oil market on Friday is likely to be determined by trader reaction to the 50% level at $39.08.

Bearish Scenario

A sustained move under $39.08 will indicate the presence of sellers. If this move creates enough downside momentum, then look for the selling to possibly extend into the 50% level at $37.50 and the main bottom at $37.08. Since the main trend is up, look for buyers to come in on a test of this area.

The main trend will change to down on a trade through $37.08. This could trigger a break into the 50% level at $36.63. The market will start to open up to the downside under this level with potential targets coming in at $35.45 and $34.66.

Bullish Scenario

Overtaking and sustaining a rally over $39.08 will signal the presence of buyers. This could lead to a quick test of a minor pivot at $39.81. This is the last potential resistance before a series of resistance levels at $41.08, $41.56 and $41.63.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance