Crypto market sentiment declines as Bitcoin continues to consolidate

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

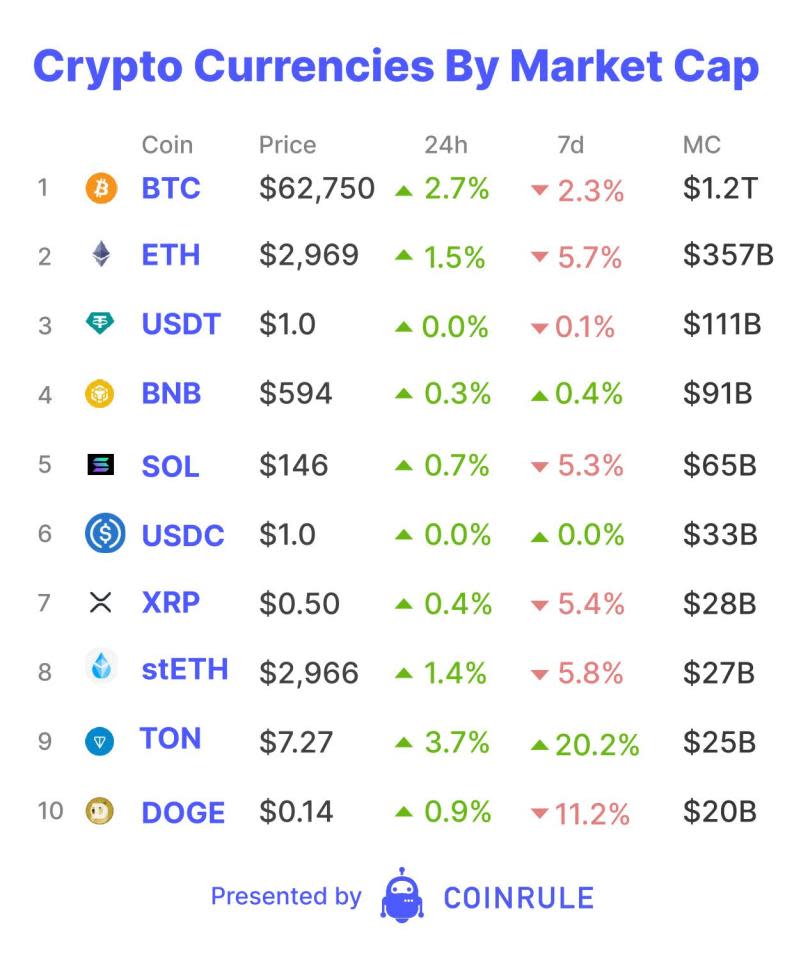

It has been two months since Bitcoin’s latest all-time high. After rising over 370% in 16 months, Bitcoin is taking a well-deserved breather. Before this period of consolidation, discussions suggested that this cycle might be “left-truncated” and could end much earlier than previous ones. The idea particularly gained traction as Bitcoin surpassed its previous all-time highs before the halving. Now, it seems the excitement of the previous run has faded with market sentiment also declining.

One way to measure crypto sentiment is by measuring the level of social media activity. Kaito AI’s sentiment analytics uses mentions of crypto-related words on social media to measure market sentiment and activity. Their data shows a steady decline in market sentiment from its peak in late February, after steadily climbing from the start of 2023. According to the data, current sentiment is at a similar level to that of October 2023. This was when rumours of the Bitcoin ETFs were heating up, with Bitcoin in the $30,000 range.

Google Trends data also shows decreasing interest in the market. Even during March, with Bitcoin reaching new highs, interest in the search term “cryptocurrency” was at 46% of its highs across the past five years. Interest is now sitting at 19%, also at similar levels to October 2023. Onchain activity also reflects this trend. According to DefiLlama, last week, decentralised exchange volumes dropped nearly 19% to around $29.5 billion. This is the lowest weekly volume since mid-February.

Another metric used to measure market sentiment is Alternative’s Crypto Fear and Greed Index. This indicator uses a combination of Google Trends data, market volume, volatility, and social media sentiment. Currently, this is also indicating the market has reined in its greed, with a value of 57 out of 100. These are similar levels to late January when Bitcoin was around $40,000. Understandably, the period of new all-time highs for Bitcoin in March caused peak greed for this cycle so far, with values around 90.

Crypto participants should welcome this period of consolidation. Forming stronger levels of sustained demand will likely enable this bull cycle to continue for longer and higher. Warren Buffet once said “The time to get interested is when no one else is.” Buffet also said “The stock market is a device for transferring money from the impatient to the patient.” Due to crypto’s fast paced nature, a bit of patience in this market goes even further than in stocks.